There Is A Reason Centrale del Latte d'Italia S.p.A.'s (BIT:CLI) Price Is Undemanding

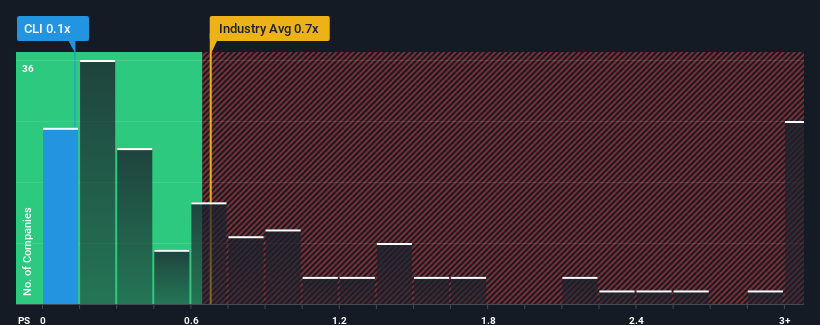

Centrale del Latte d'Italia S.p.A.'s (BIT:CLI) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in Italy have P/S ratios greater than 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Centrale del Latte d'Italia

What Does Centrale del Latte d'Italia's Recent Performance Look Like?

Recent times have been advantageous for Centrale del Latte d'Italia as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Centrale del Latte d'Italia will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Centrale del Latte d'Italia's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 79% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 0.4% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 2.9% growth forecast for the broader industry.

With this information, we can see why Centrale del Latte d'Italia is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Centrale del Latte d'Italia's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Centrale del Latte d'Italia maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for Centrale del Latte d'Italia (2 are concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CLI

Centrale del Latte d'Italia

Engages in the production, treatment, processing, and sale of milk, dairy, and food products in Italy, Germany, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.