The 19% return delivered to B.F's (BIT:BFG) shareholders actually lagged YoY earnings growth

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, B.F. S.p.A. (BIT:BFG) shareholders have seen the share price rise 16% over three years, well in excess of the market decline (22%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 9.1% in the last year, including dividends.

The past week has proven to be lucrative for B.F investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for B.F

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

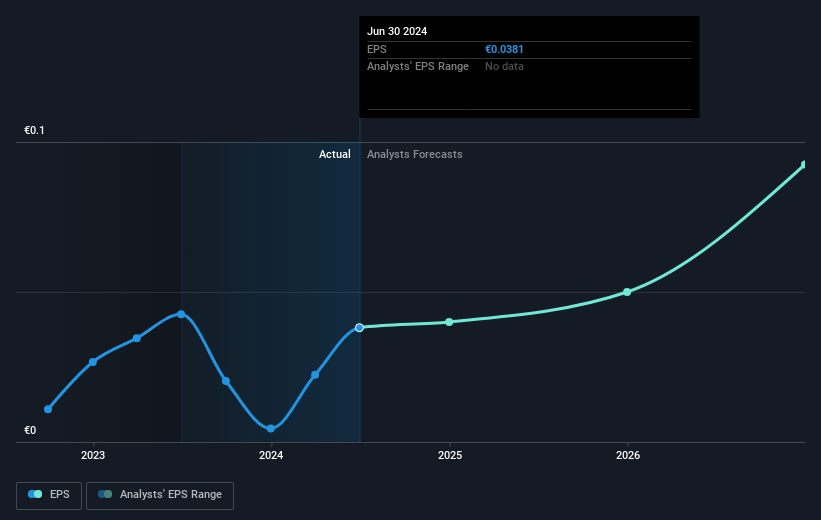

During three years of share price growth, B.F achieved compound earnings per share growth of 222% per year. The average annual share price increase of 5% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. Having said that, the market is still optimistic, given the P/E ratio of 97.84.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that B.F has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of B.F, it has a TSR of 19% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

B.F provided a TSR of 9.1% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade It is possible that returns will improve along with the business fundamentals. Is B.F cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if B.F might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BFG

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion