- Italy

- /

- Oil and Gas

- /

- BIT:GSP

Three Top Dividend Stocks For Steady Income

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cut and ongoing economic uncertainties, investors are increasingly seeking stable income sources amid fluctuating indices. In this environment, dividend stocks can offer a reliable stream of income, providing potential stability through regular payouts even as broader market conditions remain unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Gas Plus (BIT:GSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gas Plus S.p.A. is involved in the exploration and production of natural gas in Italy, with a market capitalization of €111.55 million.

Operations: Gas Plus S.p.A.'s revenue segments include Retail (€41.35 million), Network & Transportation (€22.25 million), Exploration & Production in Italy (€48.19 million), and Exploration & Production abroad (€37.88 million).

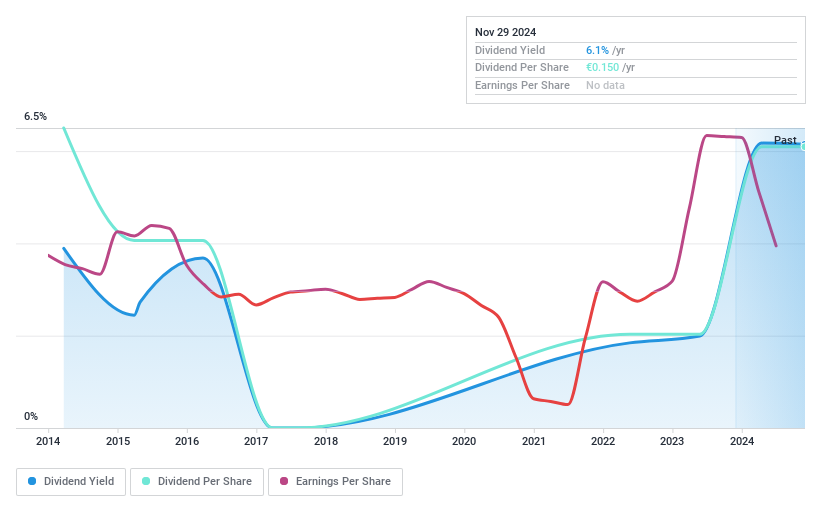

Dividend Yield: 5.9%

Gas Plus offers a compelling dividend yield of 5.86%, ranking in the top 25% in the Italian market. Its dividends are well-covered by both earnings and cash flows, with payout ratios at 44.7% and 43.7%, respectively, suggesting sustainability from current profits and cash generation. However, investors should note that Gas Plus has experienced volatility in its dividend payments over the past decade, indicating an unreliable track record despite recent coverage strength.

- Unlock comprehensive insights into our analysis of Gas Plus stock in this dividend report.

- Our valuation report here indicates Gas Plus may be overvalued.

Kobe Steel (TSE:5406)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kobe Steel, Ltd. operates in the materials, machinery, and electric power sectors globally with a market capitalization of ¥596.92 billion.

Operations: Kobe Steel, Ltd.'s revenue segments include Welding at ¥93.92 million, Machinery at ¥251.38 million, Engineering at ¥160.78 million, Electric Power at ¥276.79 million, Steel & Aluminum at ¥1.09 billion, Advanced Materials at ¥309.12 million, and Construction Machinery at ¥408.93 million.

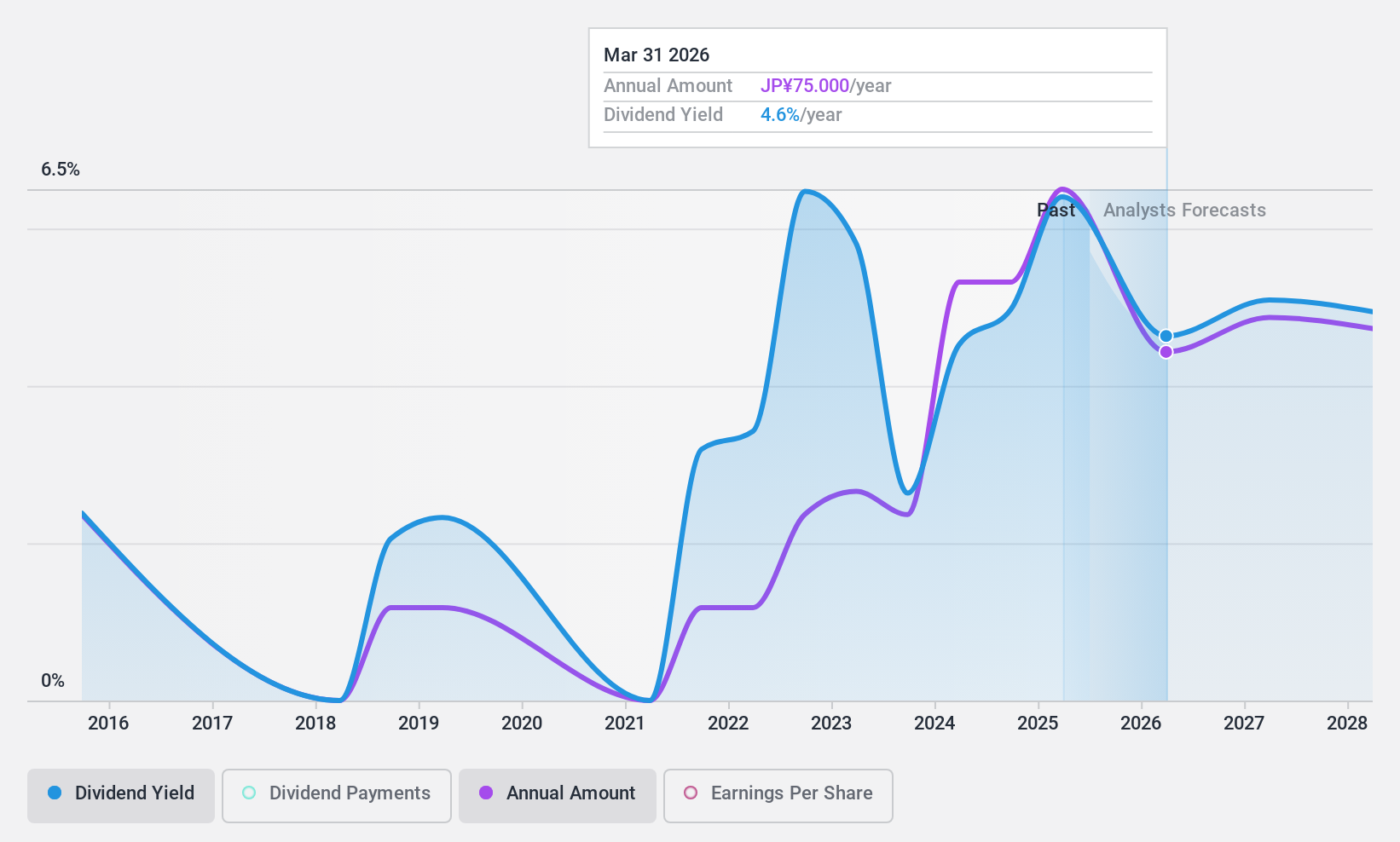

Dividend Yield: 6%

Kobe Steel's dividend yield of 5.95% places it among the top 25% in Japan, yet its sustainability is questionable due to a lack of free cash flow coverage. Despite a low payout ratio of 41.4%, dividends have been volatile over the past decade, reflecting an unreliable history. Recent ¥30 billion fixed-income offerings may impact financial stability, while current earnings guidance suggests potential challenges in maintaining consistent dividend payments moving forward.

- Click here to discover the nuances of Kobe Steel with our detailed analytical dividend report.

- Our valuation report here indicates Kobe Steel may be undervalued.

EVN (WBAG:EVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EVN AG offers energy and environmental services to private customers, businesses, and municipalities, with a market cap of €3.80 billion.

Operations: EVN AG's revenue segments include Energy (€799.80 million), Networks (€643.70 million), Production (€426 million), Environment (€428.70 million), and South East Europe (€1.34 billion).

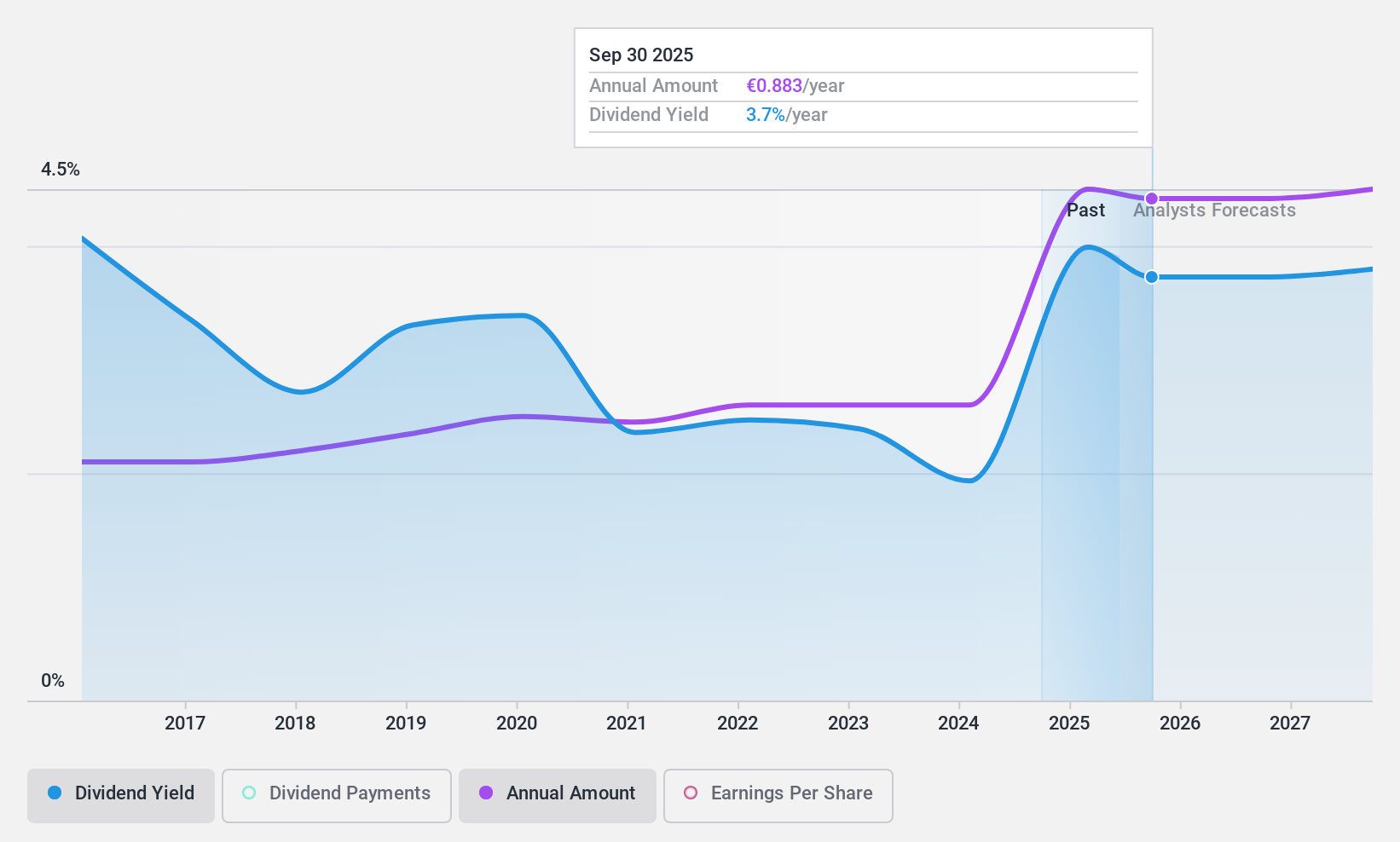

Dividend Yield: 4.2%

EVN's dividend payments have been reliable and stable over the past decade, supported by a low payout ratio of 34% and cash payout ratio of 38.7%, ensuring sustainability. However, its yield of 4.23% is below the top quartile in Austria. Despite recent declines in revenue to €3.26 billion and net income to €471.7 million, EVN remains undervalued by 27.1% compared to its estimated fair value, with analysts expecting a potential price increase of 62.9%.

- Dive into the specifics of EVN here with our thorough dividend report.

- Our expertly prepared valuation report EVN implies its share price may be lower than expected.

Taking Advantage

- Explore the 1953 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GSP

Gas Plus

Engages in the exploration and production of natural gas in Italy.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives