- Italy

- /

- Oil and Gas

- /

- BIT:GSP

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid a backdrop of fluctuating economic indicators and trade tensions, the European market has shown resilience, with major indices like the STOXX Europe 600 Index posting gains despite challenges. As investors navigate these dynamic conditions, dividend stocks in Europe offer an appealing option for those seeking to enhance their portfolios through reliable income streams and potential capital appreciation.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.05% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.72% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.47% | ★★★★★★ |

| ERG (BIT:ERG) | 5.43% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.69% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.44% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

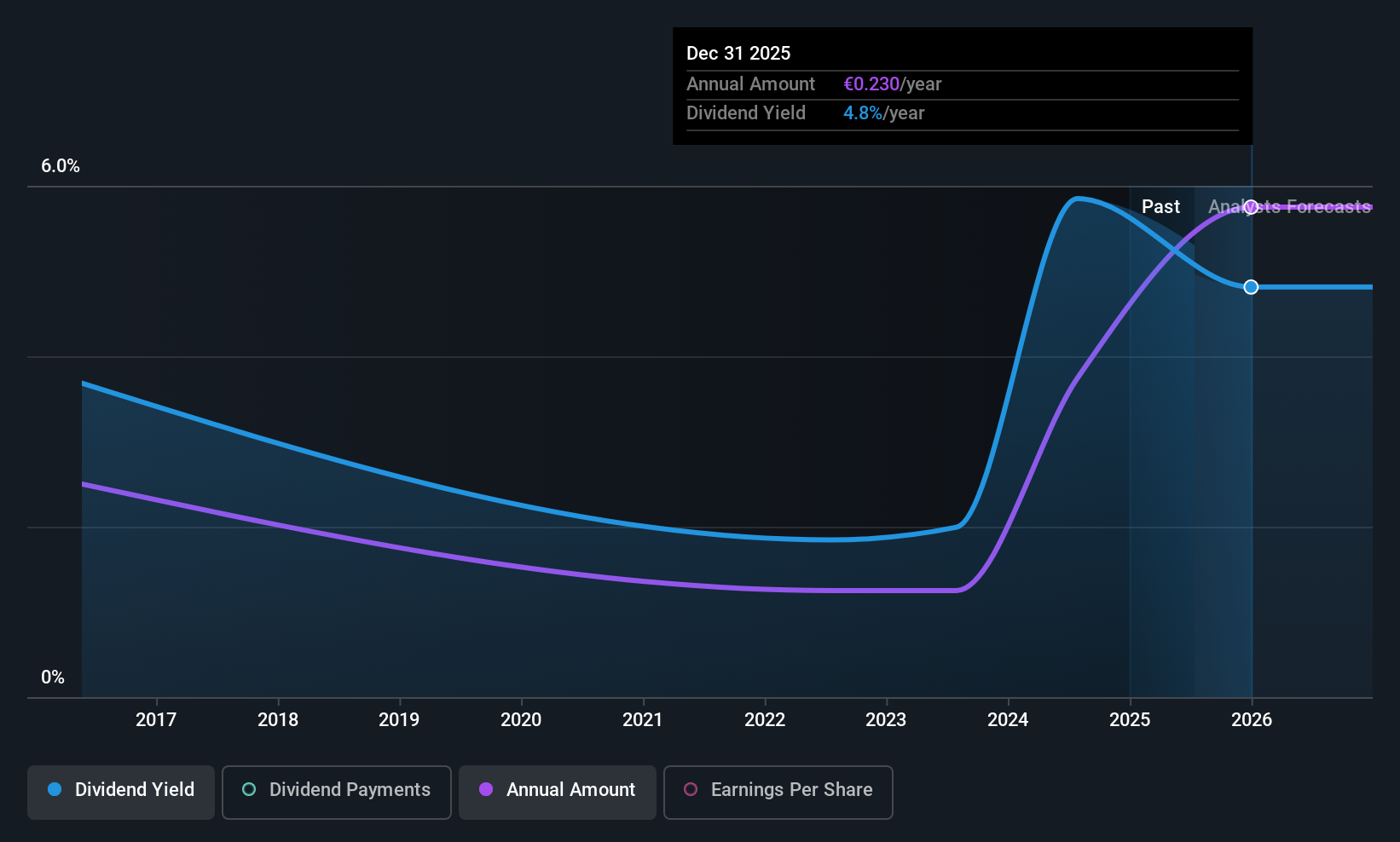

Gas Plus (BIT:GSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gas Plus S.p.A. is involved in the exploration and production of natural gas in Italy, with a market cap of €207.41 million.

Operations: Gas Plus S.p.A.'s revenue segments include Retail (€44.54 million), Network & Transportation (€17.63 million), Exploration & Production in Italy (€45.74 million), and Exploration & Production abroad (€38.35 million).

Dividend Yield: 4.2%

Gas Plus's dividends have been volatile and unreliable over the past decade, with a yield of 4.2%, lower than Italy's top dividend payers. Despite this, its payout ratios suggest sustainability, with earnings covering 69.5% and cash flows covering 26%. However, large one-off items affect financial results and profit margins have decreased significantly from the previous year. The stock trades at a notable discount to its estimated fair value but has experienced high share price volatility recently.

- Get an in-depth perspective on Gas Plus' performance by reading our dividend report here.

- Our valuation report here indicates Gas Plus may be overvalued.

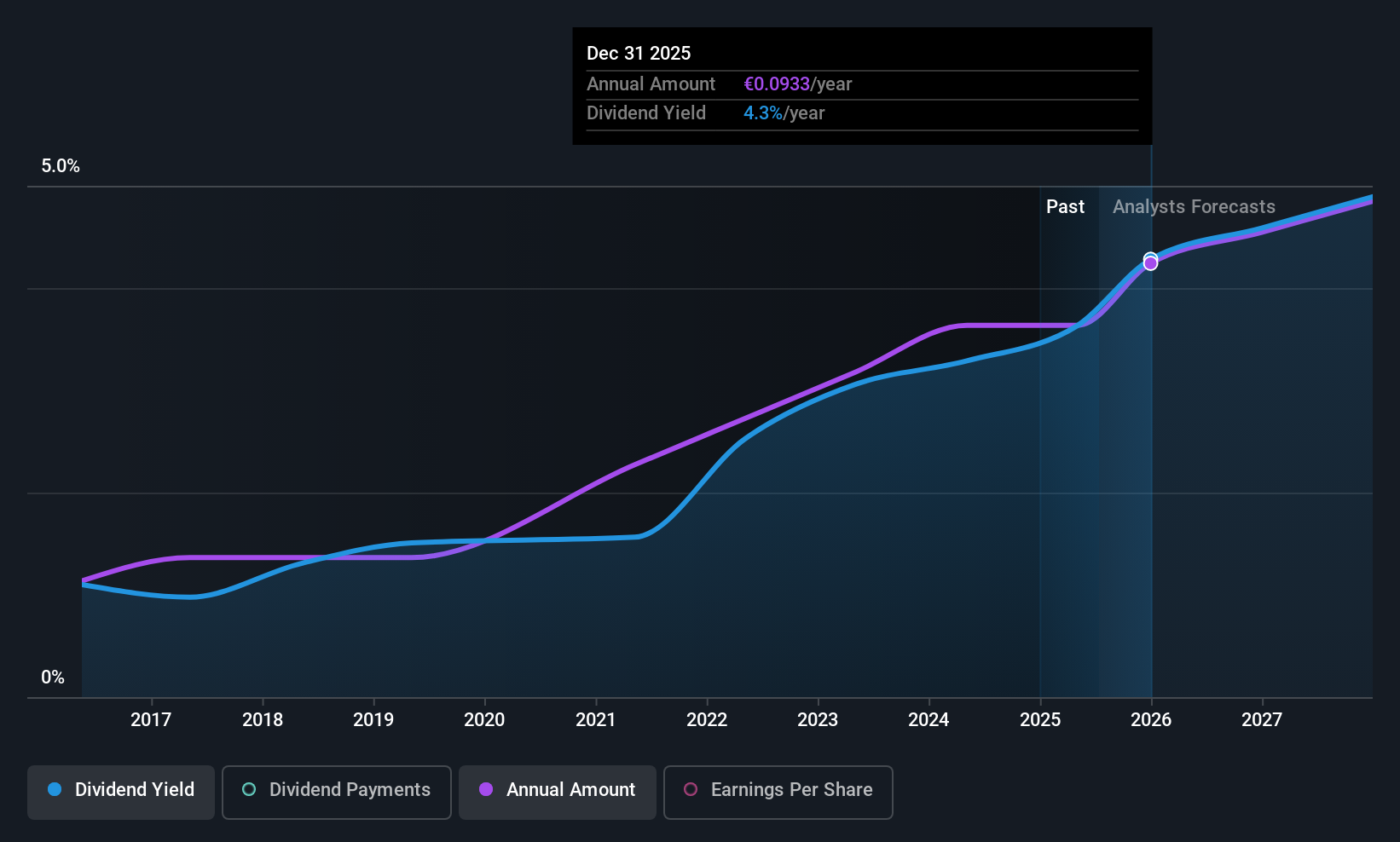

Deceuninck (ENXTBR:DECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deceuninck NV designs, manufactures, recycles, and distributes multi-material window, door, and building solutions across Europe, North America, Turkey, and internationally with a market cap of €300.98 million.

Operations: Deceuninck NV generates revenue through three primary segments: Outdoor Living (€26.70 million), Home Protection (€40.48 million), and Window and Door Systems (€759.81 million).

Dividend Yield: 3.7%

Deceuninck's dividend payments have been volatile and unreliable over the past decade, with a yield of 3.67%, lower than Belgium's top dividend payers. Despite this instability, its payout ratios indicate sustainability; earnings cover 79.7% and cash flows cover 32.8% of dividends. Recently, an annual dividend of €0.056 per share was affirmed for May 2025. The stock trades at a significant discount to its estimated fair value, with strong earnings growth forecasted at 32.84% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of Deceuninck.

- Our valuation report unveils the possibility Deceuninck's shares may be trading at a discount.

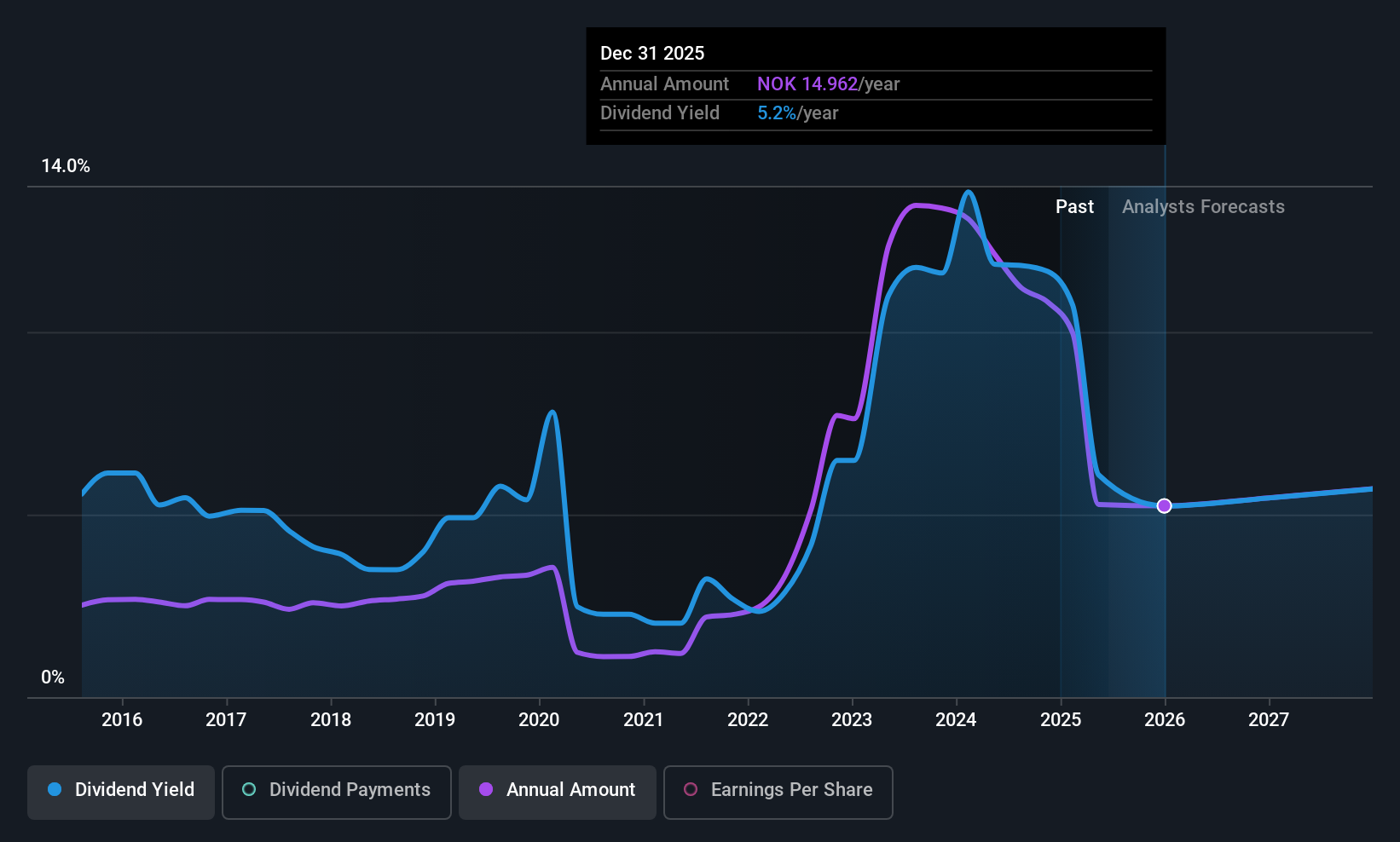

Equinor (OB:EQNR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Equinor ASA is an energy company involved in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy both in Norway and internationally, with a market cap of NOK670.53 billion.

Operations: Equinor's revenue is primarily derived from its Marketing, Midstream & Processing segment at $105.97 billion, followed by Exploration & Production Norway at $35.17 billion, Exploration & Production International (excluding USA) at $6.39 billion, Exploration & Production USA at $4.09 billion, and Renewables contributing $86 million.

Dividend Yield: 5.5%

Equinor's dividend yield is modest compared to Norway's top payers, yet its dividends are well covered by earnings and cash flows, with payout ratios of 45.4% and 49.9%, respectively. Despite a history of volatility, recent increases in dividend payments signal potential stability. The company's strategic investments in projects like Fram Sor enhance long-term prospects, while the Centrica partnership strengthens its market position. Equinor trades significantly below its estimated fair value, offering relative value for investors seeking dividend sustainability amidst growth initiatives.

- Delve into the full analysis dividend report here for a deeper understanding of Equinor.

- According our valuation report, there's an indication that Equinor's share price might be on the cheaper side.

Make It Happen

- Unlock our comprehensive list of 230 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GSP

Gas Plus

Engages in the exploration and production of natural gas in Italy.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives