- Italy

- /

- Oil and Gas

- /

- BIT:ENI

3 Top Dividend Stocks To Consider For Steady Income

Reviewed by Simply Wall St

As global markets navigate through a period of volatility marked by AI competition fears and fluctuating interest rates, investors are increasingly seeking stability amidst economic uncertainties. With U.S. stocks experiencing mixed performance and European indices buoyed by strong earnings and rate cuts, dividend stocks offer a potential avenue for steady income in such unpredictable times. A good dividend stock typically combines a reliable payout history with solid fundamentals, making it an attractive option for those looking to balance risk while generating income in the current market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

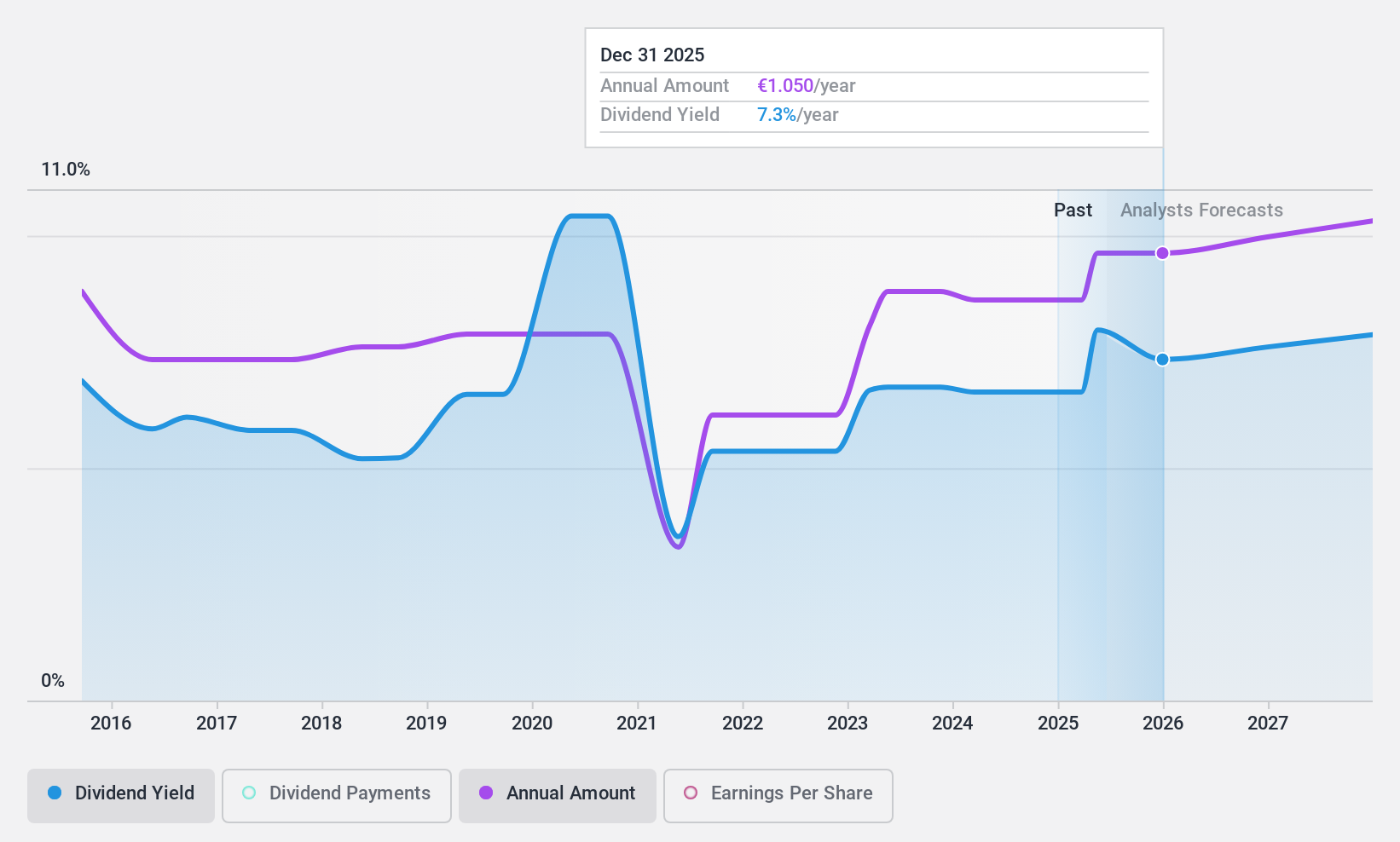

Eni (BIT:ENI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eni S.p.A. is an integrated energy company operating globally, with a market cap of €42.19 billion.

Operations: Eni S.p.A.'s revenue segments include Exploration & Production (€23.93 billion), Global Gas & LNG Portfolio (€15.71 billion), and Corporate and Other Activities (€2.07 billion).

Dividend Yield: 6.9%

Eni's dividend yield ranks in the top 25% of Italian market payers, yet its history of dividend payments has been volatile over the past decade. Despite this, Eni maintains a low payout ratio of 29.9%, indicating dividends are well-covered by earnings and cash flows. Recent fixed-income offerings totaling €1.49 billion may support financial flexibility but do not directly address dividend stability concerns. Earnings growth is projected at 16.46% annually, offering potential for future improvement in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Eni.

- Our expertly prepared valuation report Eni implies its share price may be too high.

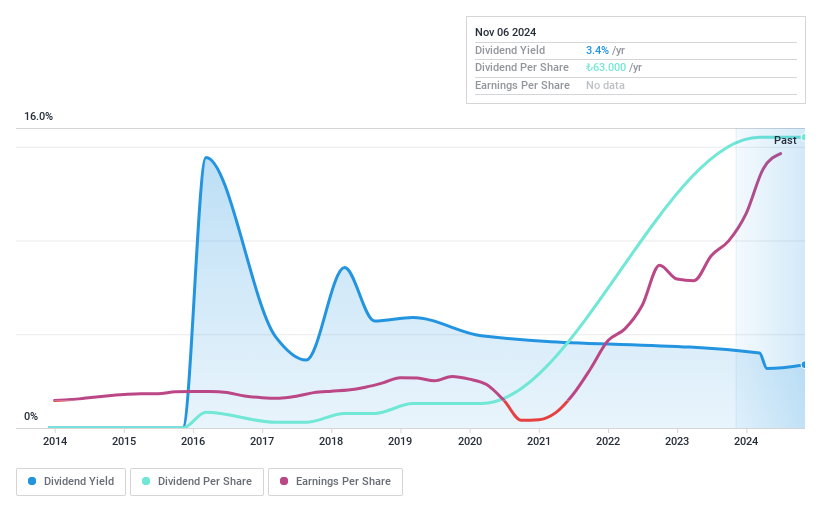

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to domestic and international airlines as well as private air cargo companies mainly in Turkey, with a market cap of TRY46.73 billion.

Operations: Çelebi Hava Servisi's revenue comprises TRY11.33 billion from airport ground services, including ground handling services, and TRY5.90 billion from cargo and warehouse services.

Dividend Yield: 3.3%

Çelebi Hava Servisi's dividend yield is among the top 25% in Turkey, with a payout ratio of 52.3%, indicating dividends are covered by earnings and cash flows. However, the company has a less stable dividend history over its nine-year payment period, marked by volatility exceeding 20%. Recent earnings growth of TRY 1.4 billion for Q3 suggests robust financial health that could support future dividends despite past instability concerns.

- Dive into the specifics of Çelebi Hava Servisi here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Çelebi Hava Servisi shares in the market.

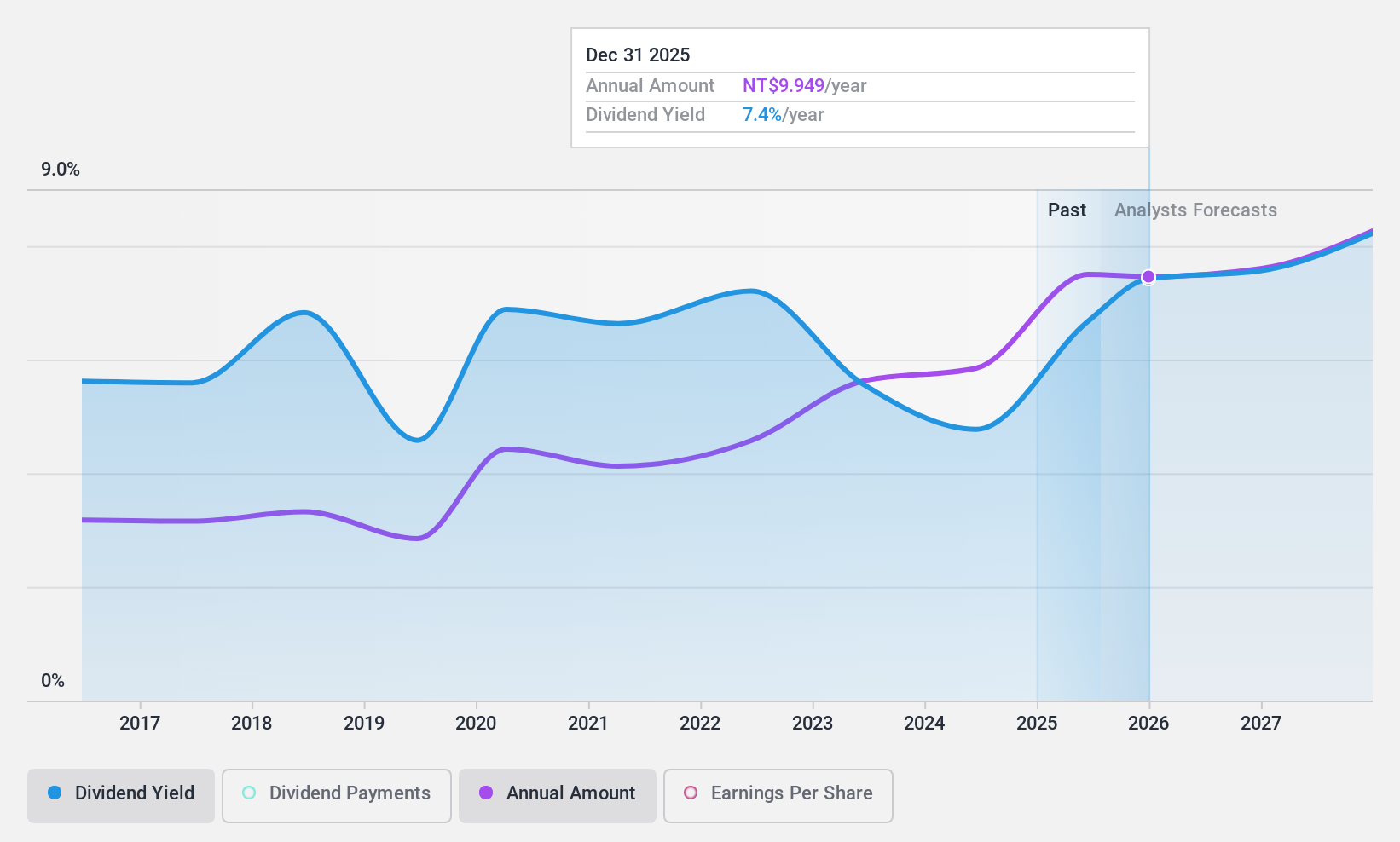

Chicony Electronics (TWSE:2385)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chicony Electronics Co., Ltd. manufactures and sells electronic parts and components both in Taiwan and internationally, with a market cap of NT$113.16 billion.

Operations: Chicony Electronics Co., Ltd. generates revenue from its Computer Peripherals segment, amounting to NT$99.67 billion.

Dividend Yield: 5%

Chicony Electronics offers a compelling dividend profile, with a 5.02% yield ranking in the top 25% of Taiwan's market. Its dividends are well-covered by earnings and cash flows, with payout ratios of 65.1% and 64.3%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and growing consistently. Recent earnings results show solid growth, with Q3 net income rising to TWD 2.40 billion from TWD 2.12 billion year-over-year, supporting its reliable dividend payments further.

- Click to explore a detailed breakdown of our findings in Chicony Electronics' dividend report.

- The analysis detailed in our Chicony Electronics valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1980 Top Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives