- Italy

- /

- Oil and Gas

- /

- BIT:DIS

These Analysts Think d'Amico International Shipping S.A.'s (BIT:DIS) Sales Are Under Threat

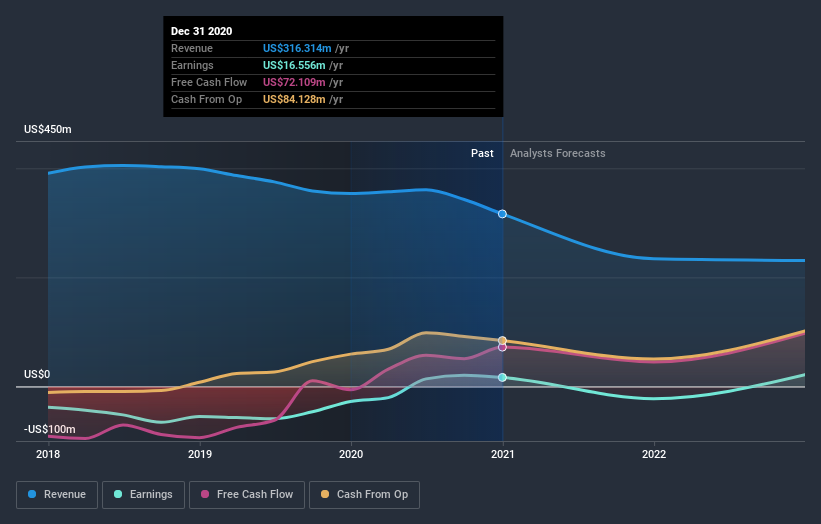

The analysts covering d'Amico International Shipping S.A. (BIT:DIS) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the downgrade, the consensus from two analysts covering d'Amico International Shipping is for revenues of US$219m in 2021, implying a sizeable 31% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$248m in 2021. The consensus view seems to have become more pessimistic on d'Amico International Shipping, noting the substantial drop in revenue estimates in this update.

See our latest analysis for d'Amico International Shipping

The consensus price target fell 7.3% to US$0.15, with the analysts clearly less optimistic about d'Amico International Shipping's valuation following this update. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values d'Amico International Shipping at US$0.15 per share, while the most bearish prices it at US$0.11. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One more thing stood out to us about these estimates, and it's the idea that d'Amico International Shipping's decline is expected to accelerate, with revenues forecast to fall at an annualised rate of 31% to the end of 2021. This tops off a historical decline of 2.0% a year over the past five years. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 9.5% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect d'Amico International Shipping to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of d'Amico International Shipping's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on d'Amico International Shipping after today.

Hungry for more information? At least one of d'Amico International Shipping's two analysts has provided estimates out to 2022, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade d'Amico International Shipping, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives