- Italy

- /

- Diversified Financial

- /

- BIT:NEXI

Nexi (BIT:NEXI): Assessing Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

The recent moves in Nexi (BIT:NEXI) shares have caught the eye of investors wondering what might be behind the volatility. With no single event or announcement driving the action, it is natural to wonder whether the market is simply recalibrating its views on the company’s prospects. Is this just noise, or a sign that something bigger is brewing for the payments giant?

If we zoom out, Nexi’s track record has been marked by some turbulence. Over the past year, the stock has fallen by 20%, retracing much of its prior momentum. Shorter-term performance has been mixed as well, with a slide of 16% in the past month following steady but modest gains earlier in the quarter. Recent developments have included swings in sentiment around European fintech and some quarterly numbers that were met with cautious optimism but also skepticism due to revenue headwinds.

After a year of price pressure and shifting expectations, is the market undervaluing Nexi, or are investors already pricing in muted growth for the future?

Most Popular Narrative: 32% Undervalued

According to the most widely followed narrative, Nexi may be significantly undervalued relative to its fair value estimate, based on an analysis of future earnings, profit margins, and sector risk factors. The consensus among analysts points to a price target well above current trading levels.

Accelerating migration from cash to digital payments continues to fuel Nexi's core transaction volumes, especially in Italy and Central Europe, supporting robust long-term revenue growth and offsetting short-term headwinds from bank contract renegotiations. E-commerce and mobile commerce penetration remains a key growth engine for Nexi, with customer base expansion of 5% across geographies and successful cross-selling of value-added digital services. This is driving higher take rates and supporting net margin expansion.

Curious how Nexi could unlock substantial upside? The secret sauce in the narrative is a bold mix of rising margins, accelerated customer gains, and optimistic long-term earnings benchmarks. Could this be a blueprint for breakout value, or are there hidden hurdles backing these projections? The answer lies in a powerful, numbers-driven argument that has analysts calling for a big move higher.

Result: Fair Value of €6.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent contract losses in Italy or delays in integrating recent acquisitions could quickly undermine this positive outlook for Nexi’s recovery.

Find out about the key risks to this Nexi narrative.Another View: What Do Market Comparisons Reveal?

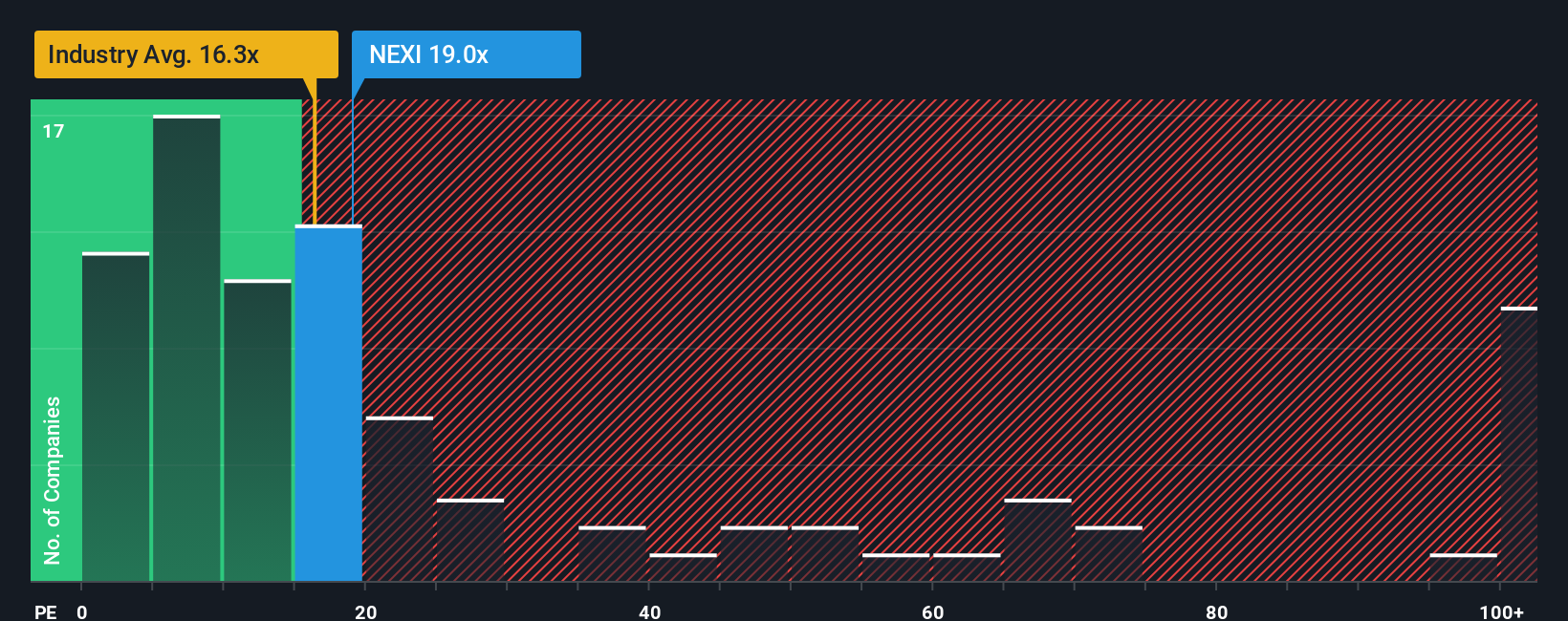

While analyst models see value ahead, comparing Nexi’s share price against companies in its industry tells a different story. This method suggests Nexi might actually be expensive right now. Could the truth lie somewhere in between?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Nexi to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Nexi Narrative

If you see things differently, or enjoy digging into the numbers yourself, uncover your own story from the data in just a few minutes. Do it your way.

A great starting point for your Nexi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on new opportunities. Don’t let the next big winner slip by. Take your research further and unlock fresh options tailored to your goals.

- Spot resilient income streams by checking out the latest high-yielding opportunities with dividend stocks with yields > 3% on your radar.

- Uncover tomorrow’s technology leaders by harnessing artificial intelligence innovation with the power of AI penny stocks at your fingertips.

- Tap into companies trading below fair value by exploring potential gems through our dedicated tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NEXI

Nexi

Provides electronic money and payment services to banks, small and medium-sized enterprises, large international corporations, institutions, and public administrations in Italy, Nordics and Baltics, Germany, Austria, Switzerland, Poland, Southeast Europe, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives