We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Gruppo MutuiOnline S.p.A (BIT:MOL).

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Gruppo MutuiOnline

Gruppo MutuiOnline Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Executive Chairman, Marco Pescarmona, sold €584k worth of shares at a price of €12.46 per share. That means that an insider was selling shares at slightly below the current price (€28.60). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was 100% of Marco Pescarmona's stake.

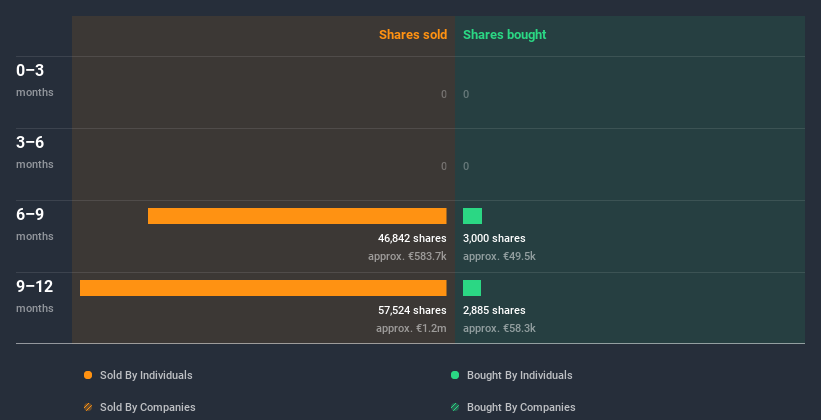

Over the last year, we can see that insiders have bought 5.89k shares worth €108k. But insiders sold 104.37k shares worth €1.8m. In total, Gruppo MutuiOnline insiders sold more than they bought over the last year. The average sell price was around €17.24. It's not too encouraging to see that insiders have sold at below the current price. Since insiders sell for many reasons, we wouldn't put too much weight on it. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Gruppo MutuiOnline insiders own about €14m worth of shares. That equates to 1.3% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About Gruppo MutuiOnline Insiders?

It doesn't really mean much that no insider has traded Gruppo MutuiOnline shares in the last quarter. Our analysis of Gruppo MutuiOnline insider transactions leaves us cautious. The modest level of insider ownership is, at least, some comfort. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Gruppo MutuiOnline. At Simply Wall St, we found 2 warning signs for Gruppo MutuiOnline that deserve your attention before buying any shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Gruppo MutuiOnline, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:MOL

Moltiply Group

A holding company that operates in the financial services industry.

High growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026