Nunzio Chiolo is the CEO of Conafi S.p.A. (BIT:CNF), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Conafi

Comparing Conafi S.p.A.'s CEO Compensation With the industry

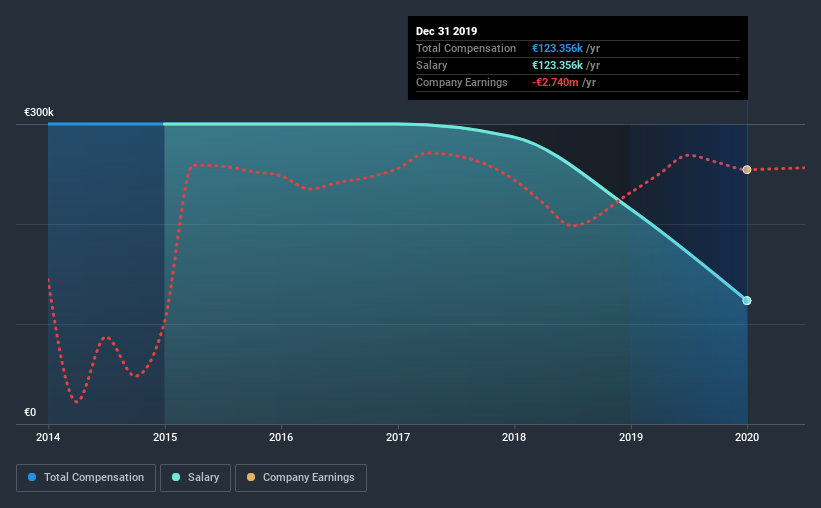

At the time of writing, our data shows that Conafi S.p.A. has a market capitalization of €9.6m, and reported total annual CEO compensation of €123k for the year to December 2019. That's a notable decrease of 43% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth €123k.

For comparison, other companies in the industry with market capitalizations below €167m, reported a median total CEO compensation of €327k. Accordingly, Conafi pays its CEO under the industry median. Moreover, Nunzio Chiolo also holds €6.2m worth of Conafi stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €123k | €215k | 100% |

| Other | - | - | - |

| Total Compensation | €123k | €215k | 100% |

On an industry level, roughly 81% of total compensation represents salary and 19% is other remuneration. On a company level, Conafi prefers to reward its CEO through a salary, opting not to pay Nunzio Chiolo through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Conafi S.p.A.'s Growth Numbers

Conafi S.p.A.'s earnings per share (EPS) grew 8.3% per year over the last three years. Its revenue is down 50% over the previous year.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Conafi S.p.A. Been A Good Investment?

Boasting a total shareholder return of 57% over three years, Conafi S.p.A. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Conafi pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, Conafi S.p.A. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In contrast, shareholder returns have been excellent over the past three years, and that’s certainly a promising trend to keep an eye on. So, considering these tasty returns, CEO compensation seems quite appropriate.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Conafi that you should be aware of before investing.

Important note: Conafi is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Conafi, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:CNF

Conafi

An investment holding company, engages in the provision of various loan products in Italy.

Flawless balance sheet low.

Market Insights

Community Narratives