- Italy

- /

- Hospitality

- /

- BIT:IGV

Bullish: This Analyst Just Lifted Their iGrandiViaggi S.p.A. (BIT:IGV) Outlook For This Year

Shareholders in iGrandiViaggi S.p.A. (BIT:IGV) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

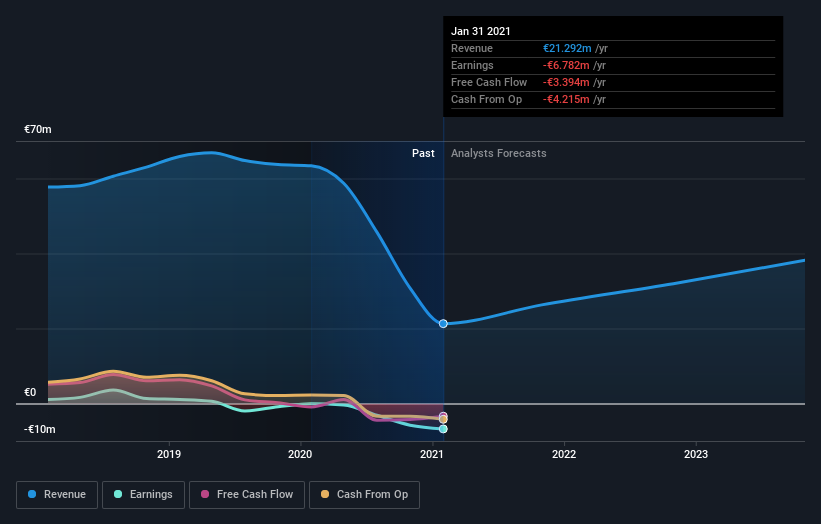

Following the upgrade, the most recent consensus for iGrandiViaggi from its single analyst is for revenues of €34m in 2021 which, if met, would be a sizeable 59% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 72% to €0.04. Yet prior to the latest estimates, the analyst had been forecasting revenues of €26m and losses of €0.10 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

View our latest analysis for iGrandiViaggi

The consensus price target rose 47% to €1.50, with the analyst encouraged by the higher revenue and lower forecast losses for this year.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the iGrandiViaggi's past performance and to peers in the same industry. For example, we noticed that iGrandiViaggi's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 59% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 6.4% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 17% annually. So it looks like iGrandiViaggi is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing here is that the analyst reduced their loss per share estimates for this year, reflecting increased optimism around iGrandiViaggi's prospects. Fortunately, the analyst also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at iGrandiViaggi.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade iGrandiViaggi, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:IGV

I Grandi Viaggi

Engages in the travel and tourism business in Italy, rest of Europe, and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.