- Italy

- /

- Food and Staples Retail

- /

- BIT:TALEA

Pulling back 11% this week, Farmaè's BIT:FAR) three-year decline in earnings may be coming into investors focus

Farmaè S.p.A. (BIT:FAR) shareholders might be concerned after seeing the share price drop 19% in the last month. But don't let that distract from the very nice return generated over three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 54%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Farmaè

We don't think that Farmaè's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years Farmaè has grown its revenue at 35% annually. That's well above most pre-profit companies. While the compound gain of 16% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. So now might be the perfect time to put Farmaè on your radar. If the company is trending towards profitability then it could be very interesting.

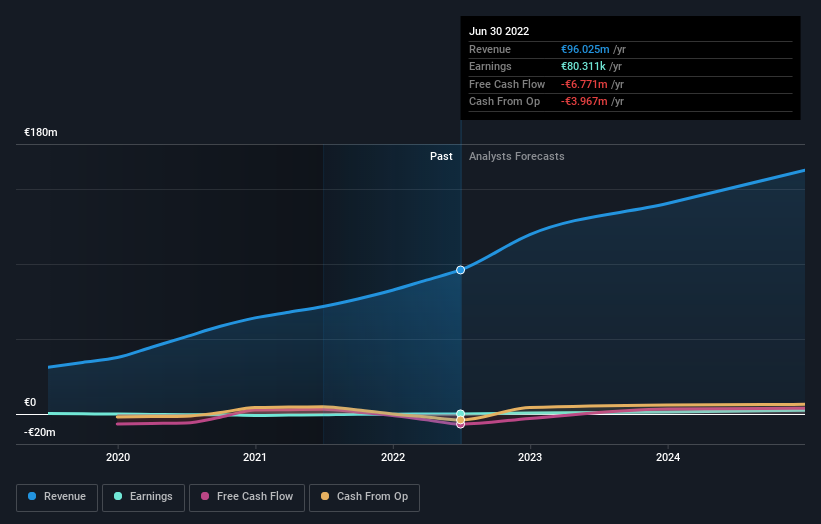

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Farmaè has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Farmaè in this interactive graph of future profit estimates.

A Different Perspective

The last twelve months weren't great for Farmaè shares, which performed worse than the market, costing holders 43%. The market shed around 0.05%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 16% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Farmaè better, we need to consider many other factors. For instance, we've identified 4 warning signs for Farmaè (2 can't be ignored) that you should be aware of.

We will like Farmaè better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Talea Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TALEA

Talea Group

Operates as an e-retailer of health, wellness, and beauty products in Italy.

Good value with reasonable growth potential.

Market Insights

Community Narratives