Undiscovered Gems Three Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by record highs in U.S. indices and robust economic indicators, smaller-cap stocks have been gaining traction, outpacing their larger counterparts amid broad-based gains. This environment presents a fertile ground for investors seeking opportunities in promising yet under-the-radar stocks that could benefit from ongoing economic growth and stabilizing interest rates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

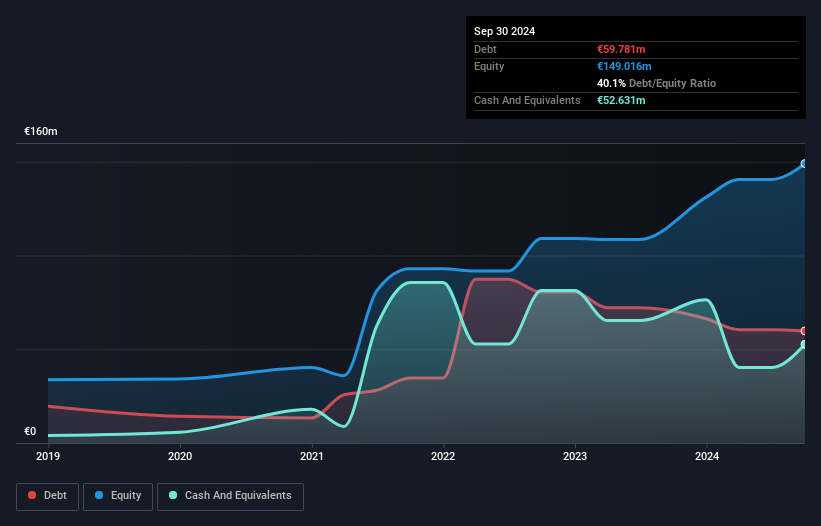

Italian Sea Group (BIT:TISG)

Simply Wall St Value Rating: ★★★★★★

Overview: The Italian Sea Group S.p.A. operates in the luxury yachting industry with a market capitalization of €386.37 million.

Operations: Italian Sea Group generates revenue primarily from shipbuilding (€347.59 million) and refit services (€43.97 million). The shipbuilding segment is the dominant contributor to its revenue streams.

Italian Sea Group, a promising player in the luxury yacht industry, has shown impressive financial performance. For the first half of 2024, sales reached €189.83 million compared to €162.5 million last year, while net income surged to €29.01 million from €13.59 million. The company boasts a robust earnings growth of 52.9%, outpacing the leisure industry's 11.3% growth rate and maintaining an EBIT interest coverage of 8.9 times its debt obligations, indicating strong financial health and operational efficiency with a satisfactory net debt to equity ratio of 12.8%. Trading at nearly half its estimated fair value suggests potential upside for investors seeking undervalued opportunities in niche markets like luxury yachting.

- Dive into the specifics of Italian Sea Group here with our thorough health report.

Gain insights into Italian Sea Group's past trends and performance with our Past report.

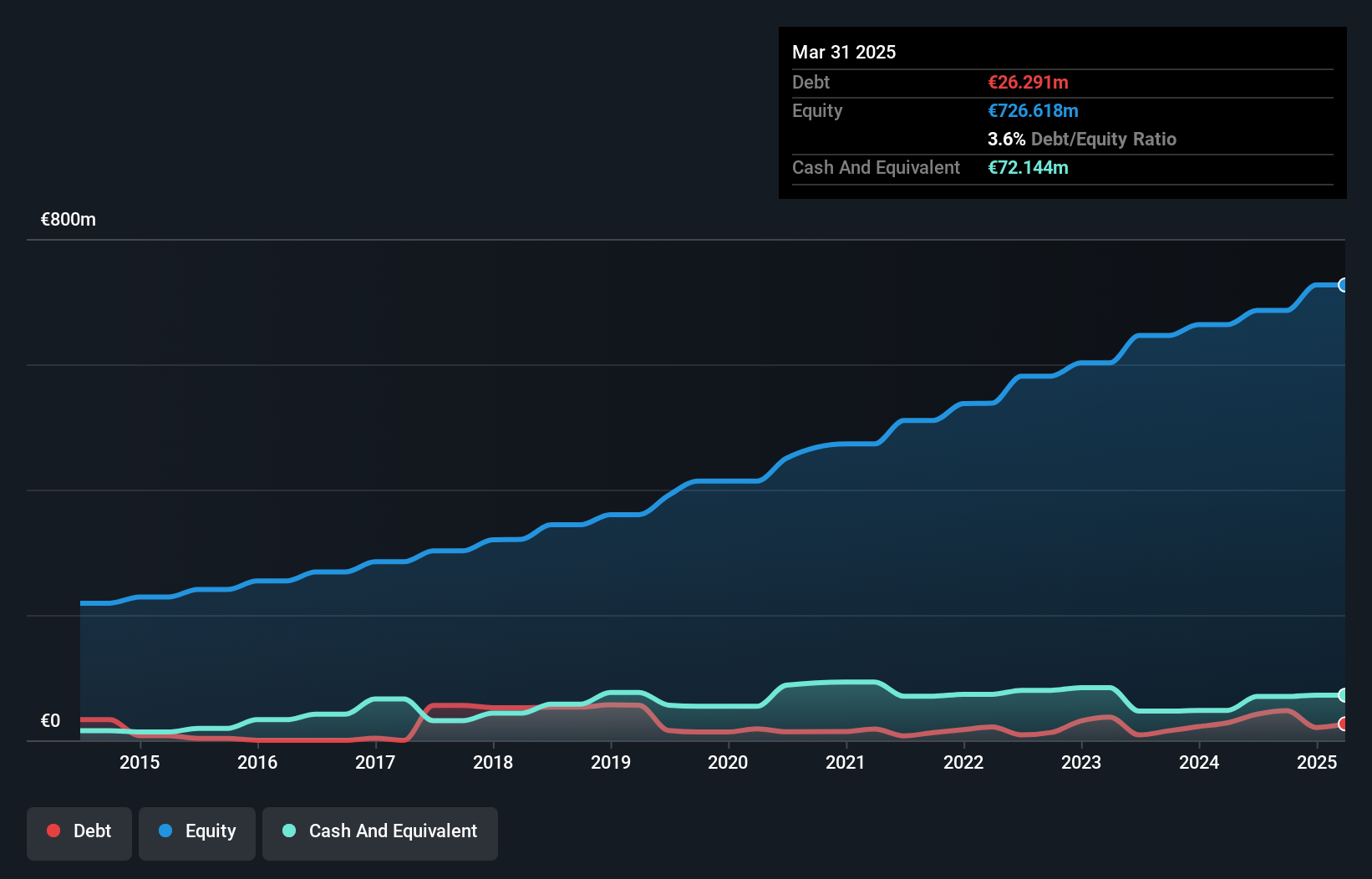

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Faes Farma, S.A. is a company that engages in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials globally with a market capitalization of €1.09 billion.

Operations: The primary revenue stream for Faes Farma comes from its Pharmaceutical Products segment, generating €448.08 million, with additional revenue from the Nutrition and Animal Health segment at €52.36 million.

Faes Farma, a nimble player in the pharmaceuticals sector, is trading at 29.8% below its estimated fair value, offering potential for investors seeking undervalued opportunities. The company's financial health appears robust with cash surpassing total debt and interest payments comfortably covered by EBIT at 211 times. Over the last five years, earnings have grown annually by 8.3%, though recent growth of 8.8% slightly lagged behind the industry's 8.9%. Despite an increased debt-to-equity ratio from 3.2% to 6.9%, Faes Farma's high-quality earnings and solid sales growth to €379 million indicate a strong operational footing amidst forecasted challenges ahead.

- Click to explore a detailed breakdown of our findings in Faes Farma's health report.

Explore historical data to track Faes Farma's performance over time in our Past section.

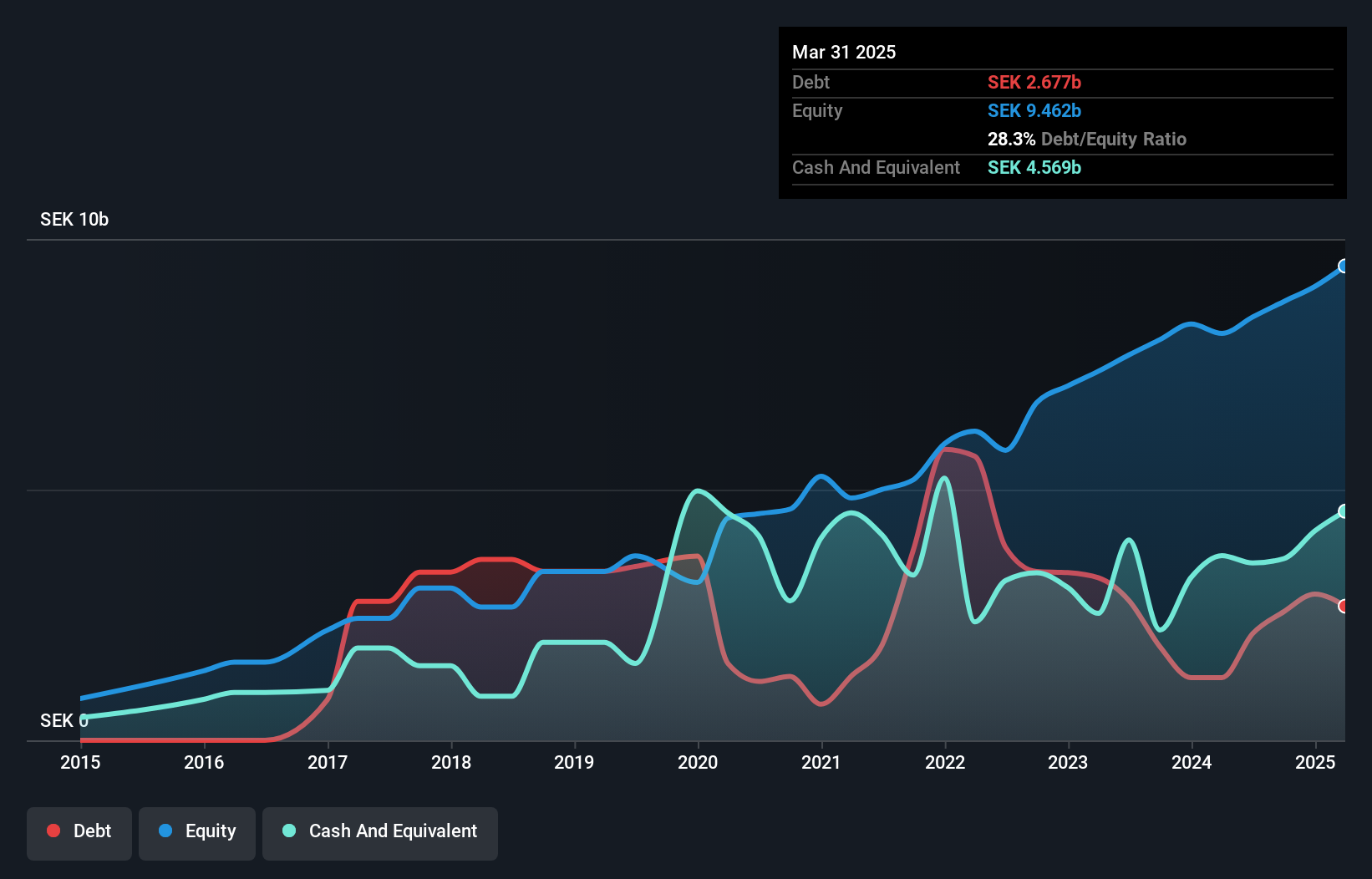

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Norion Bank AB (publ) offers financial solutions for corporate and private individuals, focusing on small and medium-sized companies across Sweden, Finland, Norway, and internationally, with a market cap of SEK7.80 billion.

Operations: Norion Bank generates revenue primarily from its Real Estate, Consumer, Corporate, and Payments segments, with Real Estate contributing SEK1.21 billion and Consumer adding SEK896 million. The bank's financial performance is influenced by these diverse revenue streams across different regions.

With total assets of SEK59.3 billion and equity at SEK8.8 billion, Norion Bank presents a compelling profile in the financial sector. The bank's earnings growth of 0.2% over the past year slightly outpaced the industry average, indicating a modest upward trajectory despite challenges like high bad loans at 21.8%. Trading significantly below its estimated fair value by 74.7%, it offers potential for value-seeking investors, though its low allowance for bad loans at 46% remains a concern. With customer deposits constituting 91% of liabilities, Norion benefits from stable funding sources while navigating its financial landscape effectively.

Seize The Opportunity

- Explore the 4634 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORION

Norion Bank

Provides financial solutions for corporate and private individuals with a focus on small and medium-sized companies in Sweden, Finland, Norway, and internationally.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives