Investors Who Bought Salvatore Ferragamo (BIT:SFER) Shares A Year Ago Are Now Up 48%

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. Of course, the aim of the game is to pick stocks that do better than an index fund. Salvatore Ferragamo S.p.A. (BIT:SFER) has done well over the last year, with the stock price up 48% beating the market return of 48% (not including dividends). On the other hand, longer term shareholders have had a tougher run, with the stock falling 25% in three years.

Check out our latest analysis for Salvatore Ferragamo

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Salvatore Ferragamo saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Unfortunately Salvatore Ferragamo's fell 33% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

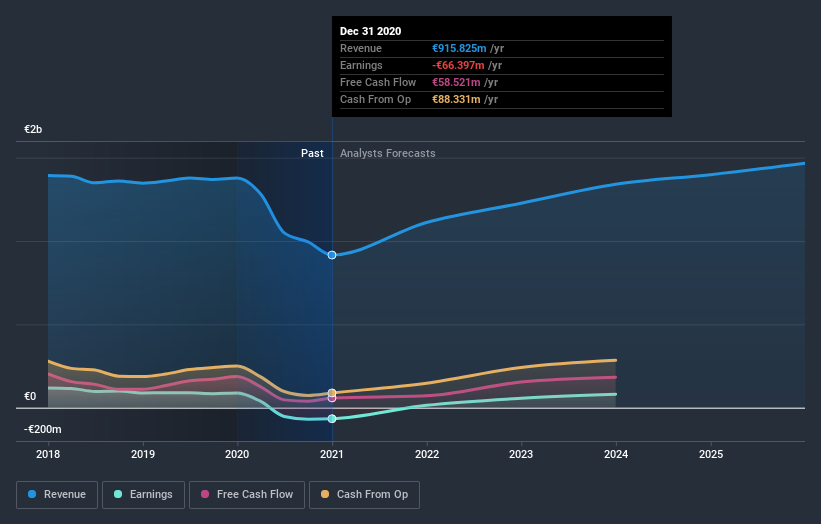

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Salvatore Ferragamo is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Salvatore Ferragamo will earn in the future (free analyst consensus estimates)

A Different Perspective

Salvatore Ferragamo provided a TSR of 48% over the year (including dividends). That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 3% over the last five years. While 'turnarounds seldom turn' there are green shoots for Salvatore Ferragamo. It's always interesting to track share price performance over the longer term. But to understand Salvatore Ferragamo better, we need to consider many other factors. For example, we've discovered 1 warning sign for Salvatore Ferragamo that you should be aware of before investing here.

We will like Salvatore Ferragamo better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you’re looking to trade Salvatore Ferragamo, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Salvatore Ferragamo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:SFER

Salvatore Ferragamo

Through its subsidiaries, creates, produces, and sells luxury goods for men and women in Europe, North America, Japan, the Asia Pacific, and Central and South America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives