- Italy

- /

- Consumer Durables

- /

- BIT:RAD

Getting In Cheap On Radici Pietro Industries & Brands S.p.A. (BIT:RAD) Might Be Difficult

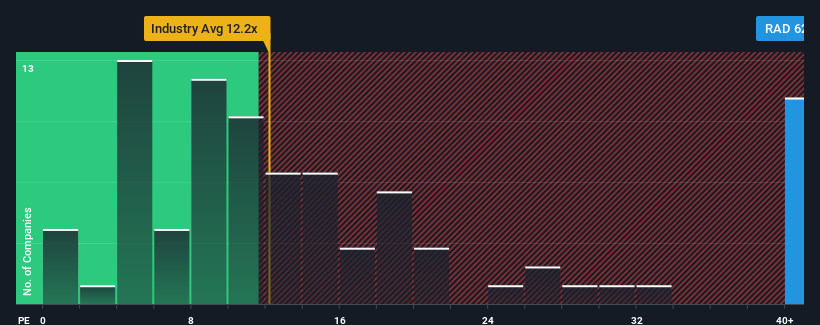

With a price-to-earnings (or "P/E") ratio of 62x Radici Pietro Industries & Brands S.p.A. (BIT:RAD) may be sending very bearish signals at the moment, given that almost half of all companies in Italy have P/E ratios under 14x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate Radici Pietro Industries & Brands' and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Radici Pietro Industries & Brands

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Radici Pietro Industries & Brands' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 96% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 117% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 11% each year, which is noticeably less attractive.

With this information, we can see why Radici Pietro Industries & Brands is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Radici Pietro Industries & Brands' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Radici Pietro Industries & Brands maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Radici Pietro Industries & Brands (at least 1 which is significant), and understanding them should be part of your investment process.

You might be able to find a better investment than Radici Pietro Industries & Brands. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:RAD

Radici Pietro Industries & Brands

Engages in the production and distribution of woven and non-woven textile coverings worldwide.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026