Should You Reassess Brunello Cucinelli After Shares Fall 14% in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with Brunello Cucinelli stock? You are definitely not alone. The luxury apparel maker is a favorite of both style mavens and market-watchers, but lately, it has been a bit of a roller coaster ride for shareholders. Just over the past year, the stock has dipped by 4.4%, with even sharper drops seen year-to-date, down 13.9%. Pull back the lens, however, and the story changes. Cucinelli has delivered an impressive 87.2% return over three years and a massive 240.9% over five years. Clearly, something about this company keeps drawing long-term investors back in.

These swings have come alongside broad shifts in the luxury sector. As global consumers face increased economic uncertainty, many are recalibrating risk tolerance in high-end stocks. This has caused some short-term jitters, but the overall upward momentum in recent years hints that the market still believes in Brunello Cucinelli’s potential. For those focused on fundamentals, a closer look at valuation metrics reveals that the company is currently considered undervalued in just 1 out of 6 standard checks, giving it a valuation score of 1. Not exactly a slam dunk, but it is a signal worth digging into.

If you are trying to make sense of all these numbers and headlines, you are in the right place. Up next, we will break down the main ways analysts assess stock valuation and show how these apply to Brunello Cucinelli. Stick around until the end, as there is an even smarter way to think about what the numbers say, and we will get to that as well.

Brunello Cucinelli scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Brunello Cucinelli Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate a company’s intrinsic value by projecting its expected future cash flows and discounting those amounts back to their value today. This process helps determine what the business is theoretically worth, based on how much cash it can generate over time rather than relying only on market sentiment or recent financials.

For Brunello Cucinelli, analysts calculate a current Free Cash Flow (FCF) of €98.2 million. Forecasts suggest the company's FCF will continue to expand, with projections reaching €349.4 million in 2035. These further-year figures are extrapolated by Simply Wall St after considering estimates up to 2027 from analysts. This steady increase signals optimism about the company’s long-term growth potential.

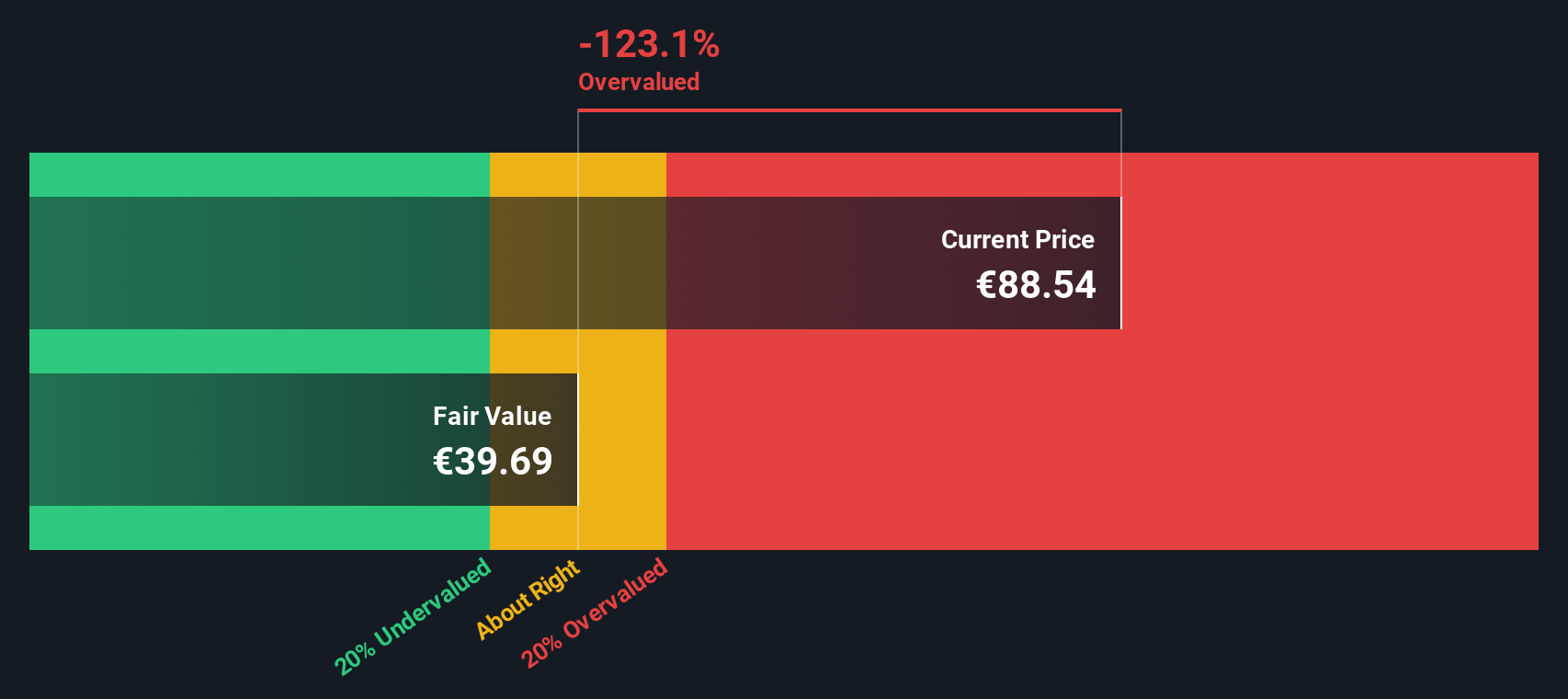

After discounting all projected cash flows back to their present value, the DCF model arrives at an intrinsic value of €39.63 per share. However, with the market pricing the stock significantly above this level, the implied discount is negative 128.9%. This indicates the stock is trading at a much higher value than what future cash flows suggest it should be worth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brunello Cucinelli may be overvalued by 128.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Brunello Cucinelli Price vs Earnings

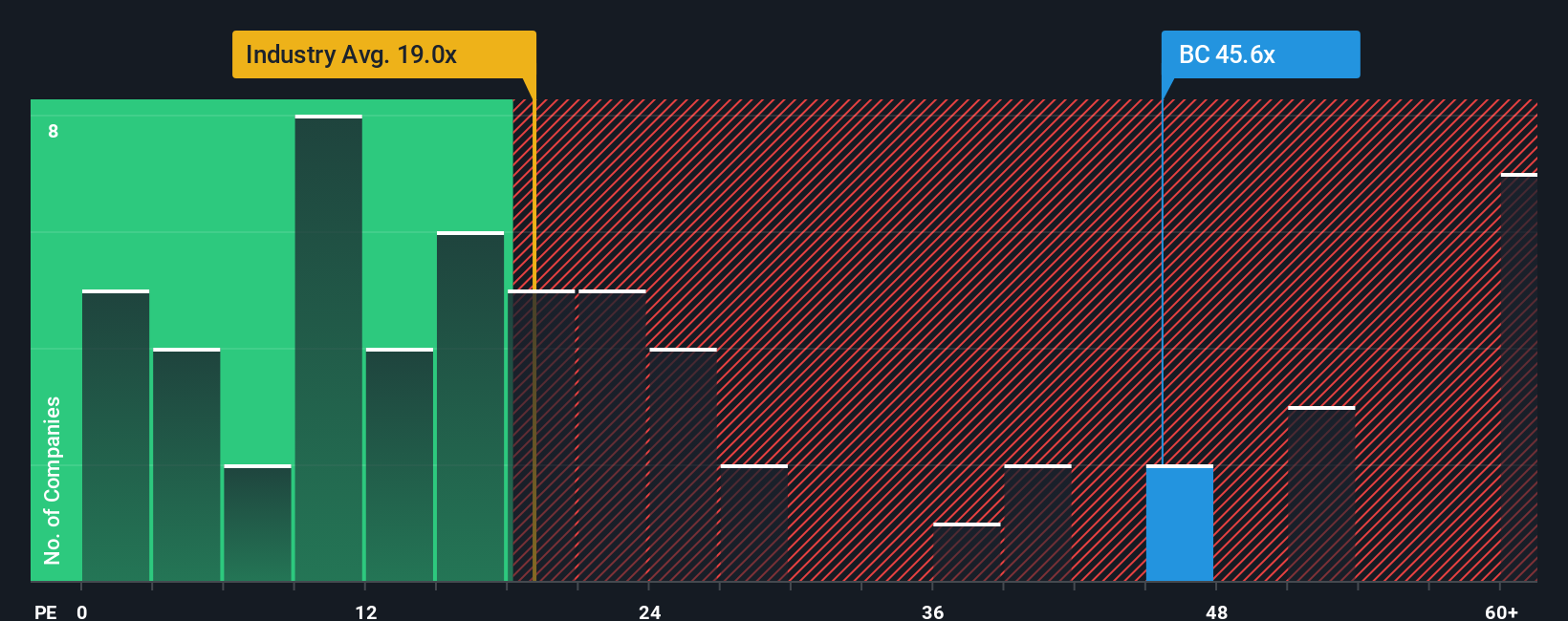

For established, profitable companies like Brunello Cucinelli, the Price-to-Earnings (PE) ratio is a popular way to assess valuation. The PE ratio gives investors a snapshot of how much they are paying for each euro of current earnings. Growth expectations and risk also play a big part here, as fast-growing or lower-risk companies typically command higher PE ratios, while slower growth or increased uncertainty tends to pull that number down.

Currently, Brunello Cucinelli trades on a PE ratio of 46.8x, which is significantly higher than the luxury industry's average of 18.7x and above its peer group’s typical 19.2x. At first glance, this large premium might raise eyebrows, suggesting the stock could be overvalued compared to its direct competition.

However, Simply Wall St’s proprietary "Fair Ratio" provides a more nuanced benchmark. The Fair Ratio, at 22.7x, blends in key factors like the company’s projected earnings growth, its profit margins, the specific characteristics of the luxury sector, as well as company size and risk. This holistic view offers deeper insight than a simple side-by-side with peers or industry averages.

Comparing the Fair Ratio to Brunello Cucinelli’s current PE, the stock still trades notably above what would be considered fair, even after accounting for its strengths and growth prospects. This suggests that, on an earnings basis, the stock appears overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brunello Cucinelli Narrative

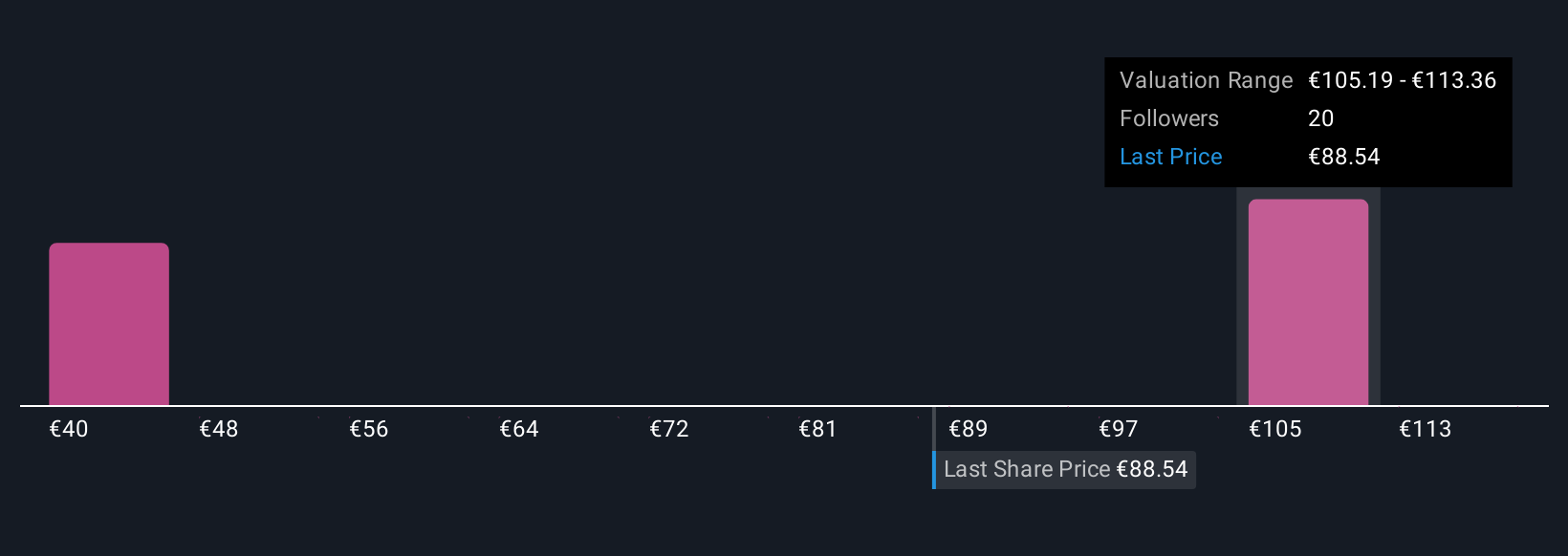

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your investment story, your perspective about Brunello Cucinelli’s business, combined with your assumptions about its future revenues, earnings, and profit margins. Narratives connect the dots between what you believe about the company, a financial forecast, and the fair value you estimate it deserves today.

With Narratives on Simply Wall St’s Community page, millions of investors can easily build and update their own view on Brunello Cucinelli using accessible tools. Narratives help you decide when to buy or sell by showing if your Fair Value is above or below the current share price, and they automatically adjust when news or earnings are released, keeping your perspective current.

For example, some investors see enduring global demand for “quiet luxury” and set Fair Values as high as €125 per share, while more cautious users focus on rising costs and set values as low as €68. Narratives highlight this range of opinion and give you clarity to compare, challenge, or build your own investment thesis. This approach makes decision making smarter and more personal than ever.

Do you think there's more to the story for Brunello Cucinelli? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)