How Investors May Respond To Brunello Cucinelli (BIT:BC) Clearing Sanctions Probe And Posting Record Growth

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Brunello Cucinelli’s management announced the completion of internal investigations, confirming that no breaches of EU Russian sanctions were identified following allegations made by short seller Morpheus Research.

- The company also reported its strongest organic revenue growth in seven quarters during the third quarter, highlighting resilience and operational credibility despite the backdrop of recent negative publicity.

- With management’s clear stance on compliance and robust revenue expansion, we'll explore how these developments influence Brunello Cucinelli’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Brunello Cucinelli Investment Narrative Recap

For shareholders, the core thesis behind Brunello Cucinelli rests on faith in the ongoing global appetite for authentic "quiet luxury" and the company’s ability to grow profitably, even as costs rise. The recent internal investigation and revenue growth update appear to have only a limited impact on the biggest near-term catalyst, sustained high single-digit sales growth, but do little to alleviate the key risk of rising debt and cost pressures if growth slows.

Among Brunello Cucinelli’s recent announcements, the confirmation of 10 percent projected revenue growth for 2025 and 2026 stands out, directly supporting optimism around near-term sales momentum and the company’s premium brand positioning highlighted in the latest quarterly results. Against the backdrop of dismissed sanctions concerns and strengthening top-line performance, the relevance of cost discipline and operational resilience is heightened.

But while recent headlines favored the company, investors should not overlook the growing financial risk as net debt...

Read the full narrative on Brunello Cucinelli (it's free!)

Brunello Cucinelli's outlook anticipates €1.8 billion in revenue and €195.6 million in earnings by 2028. This implies a 10.1% annual revenue growth rate and a €63.8 million increase in earnings from the current €131.8 million.

Uncover how Brunello Cucinelli's forecasts yield a €109.50 fair value, a 21% upside to its current price.

Exploring Other Perspectives

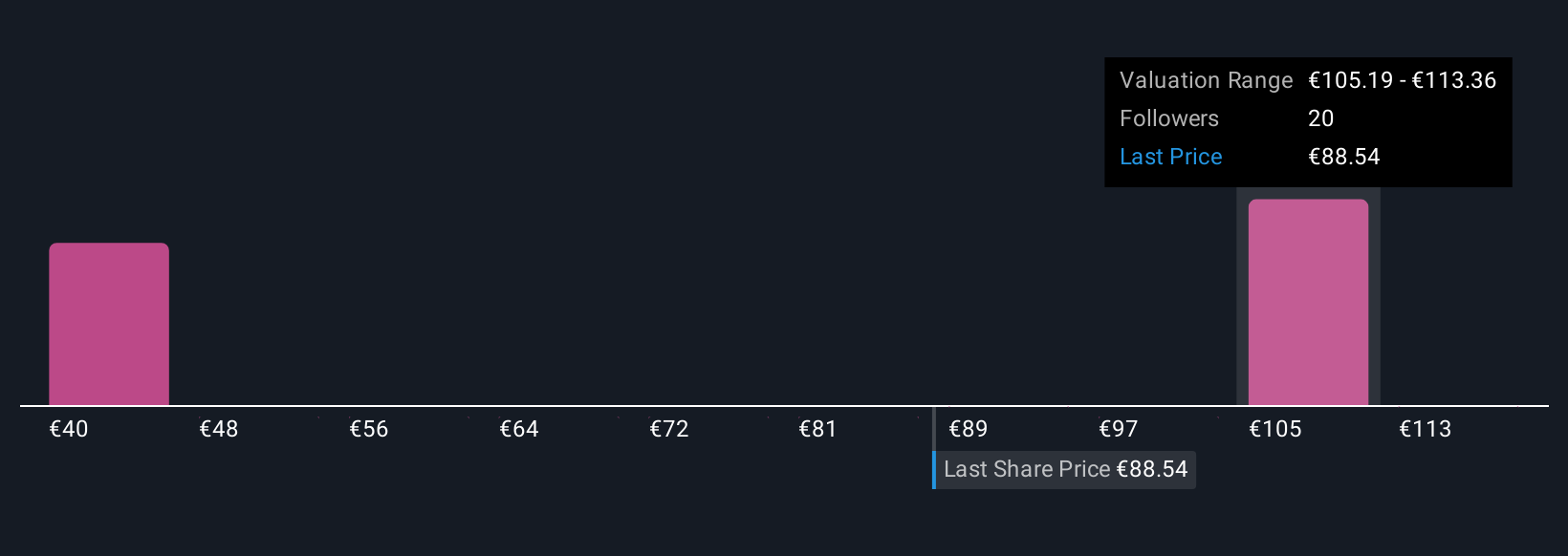

Simply Wall St Community members offered four fair value estimates for Brunello Cucinelli, ranging from €39.70 to €121.54. Even as consensus centers around strong revenue and earnings growth, you can see how widely views can differ on financial risk and earnings quality, explore these contrasting perspectives before making any firm judgments.

Explore 4 other fair value estimates on Brunello Cucinelli - why the stock might be worth as much as 34% more than the current price!

Build Your Own Brunello Cucinelli Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brunello Cucinelli research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brunello Cucinelli research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brunello Cucinelli's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion