Brunello Cucinelli (BIT:BC): Exploring Valuation After Management Rebuts Short Seller Claims and Reports Strong Q3 Growth

Reviewed by Kshitija Bhandaru

Brunello Cucinelli (BIT:BC) responded directly to allegations from short seller Morpheus Research, stating that an internal review revealed no breaches of EU Russian sanctions. Meanwhile, Berenberg highlighted impressive Q3 2025 revenue gains despite recent scrutiny.

See our latest analysis for Brunello Cucinelli.

Even with the recent spotlight on short-seller critiques and sanction concerns, Brunello Cucinelli’s share price has retreated 14.6% year-to-date. However, the three- and five-year total shareholder returns of 62.6% and 240.4% reflect the brand’s strong long-term momentum, hinting at underlying investor confidence that persists beyond short-term volatility.

If you’re looking to widen your perspective after the week’s headlines, this could be the perfect time to explore fast growing stocks with high insider ownership.

With a sizable discount to analyst price targets and strong recent growth, is Brunello Cucinelli undervalued after its share price pullback, or is the market already reflecting the company’s robust future prospects?

Most Popular Narrative: 17.9% Undervalued

With Brunello Cucinelli last closing at €89.90, the most widely tracked narrative suggests a fair value of €109.50. This points to a compelling margin between the market price and what analysts believe the business is worth. This narrative sets a notably higher bar for the company’s future and provides a lens into the bullish foundation underlying current market optimism.

The company is capitalizing on increasing demand for authenticity and "quiet luxury," with a firm focus on artisanal quality and exclusivity in both product and brand experience, supporting pricing power and the ability to sustain high gross margins.

What’s fueling this sizable valuation gap? Only those who dive in will uncover the aggressive growth assumptions and the future profit multiple usually reserved for industry icons. The narrative’s foundation rests on more than just recent sales figures. Find out what ambitious financial projections make this price target possible.

Result: Fair Value of €109.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and Brunello Cucinelli’s increased financial debt could put pressure on future margins if luxury demand cools or top-line growth slows unexpectedly.

Find out about the key risks to this Brunello Cucinelli narrative.

Another View: Market Ratios Signal Caution

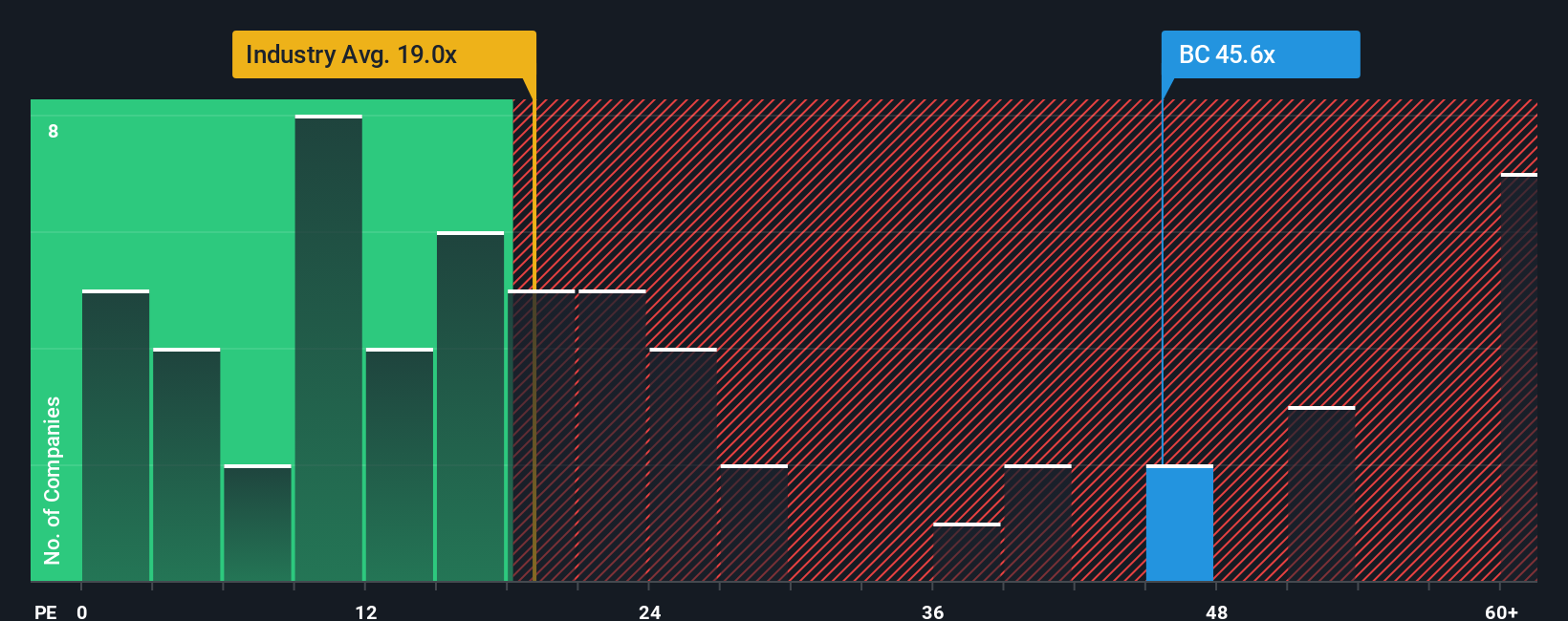

While the analyst narrative points to Brunello Cucinelli being undervalued, our market ratios tell a more cautious story. The company trades at 46.3 times its earnings, which is more than double both the peer average (19.4x) and what our fair ratio suggests (22.6x). This means Brunello Cucinelli could be priced for perfection, making the gap between market valuation and fundamentals a potential risk if future growth disappoints. Does the current price leave little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brunello Cucinelli Narrative

If you see things differently or want to shape your own view, you can craft a personalized outlook based on the data in just a few minutes. Do it your way.

A great starting point for your Brunello Cucinelli research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your strategy and get ahead. These powerful screeners reveal top stocks you might be overlooking. See which opportunities you should act on now.

- Uncover high-potential returns by checking out these 3596 penny stocks with strong financials that stand out for financial strength and real growth prospects.

- Capture tomorrow’s tech trends by examining these 24 AI penny stocks powering the next wave of artificial intelligence innovation.

- Strengthen your portfolio with these 18 dividend stocks with yields > 3% to secure yields above 3% from the market’s most reliable dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion