- Italy

- /

- Professional Services

- /

- BIT:OJM

Earnings Tell The Story For Openjobmetis S.p.A. (BIT:OJM) As Its Stock Soars 38%

Openjobmetis S.p.A. (BIT:OJM) shareholders have had their patience rewarded with a 38% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 51%.

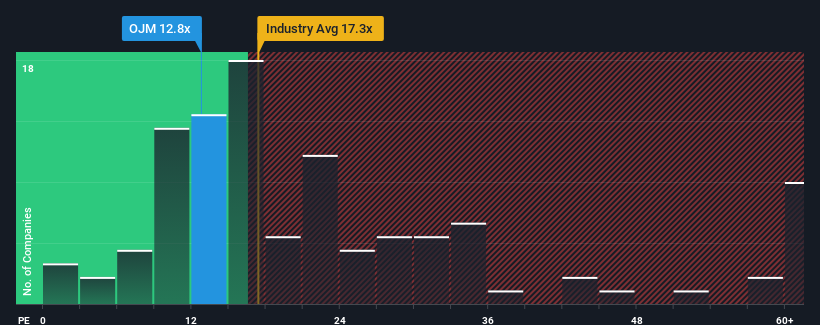

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Openjobmetis' P/E ratio of 12.8x, since the median price-to-earnings (or "P/E") ratio in Italy is also close to 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Openjobmetis could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Openjobmetis

Is There Some Growth For Openjobmetis?

There's an inherent assumption that a company should be matching the market for P/E ratios like Openjobmetis' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.9% last year. This was backed up an excellent period prior to see EPS up by 104% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 19% during the coming year according to the four analysts following the company. That's shaping up to be similar to the 18% growth forecast for the broader market.

With this information, we can see why Openjobmetis is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Openjobmetis' P/E

Openjobmetis' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Openjobmetis maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware Openjobmetis is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than Openjobmetis. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OJM

Undervalued with moderate growth potential.

Market Insights

Community Narratives