Newsflash: Fiera Milano SpA (BIT:FM) Analysts Have Been Trimming Their Revenue Forecasts

Market forces rained on the parade of Fiera Milano SpA (BIT:FM) shareholders today, when the analysts downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

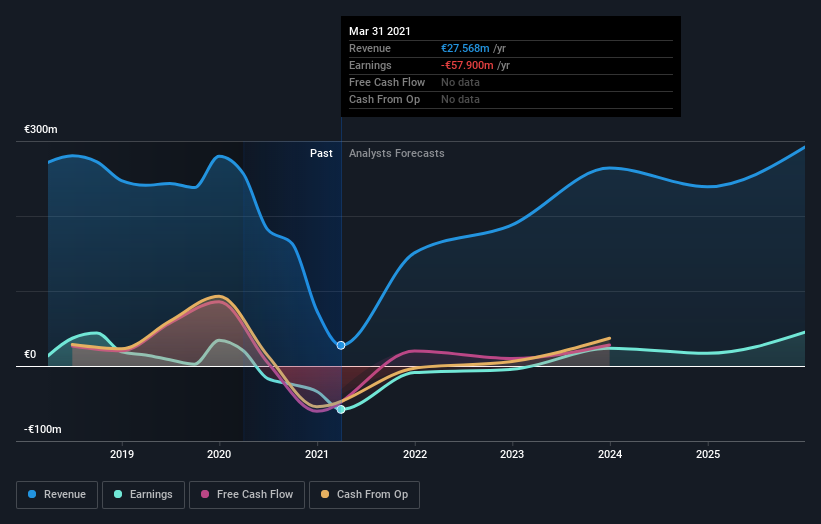

After the downgrade, the twin analysts covering Fiera Milano are now predicting revenues of €151m in 2021. If met, this would reflect a sizeable 447% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 75% to €0.12. However, before this estimates update, the consensus had been expecting revenues of €186m and €0.12 per share in losses. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to this year's revenue estimates, while at the same time holding losses per share steady.

See our latest analysis for Fiera Milano

Of course, another way to look at these forecasts is to place them into context against the industry itself. One thing stands out from these estimates, which is that Fiera Milano is forecast to grow faster in the future than it has in the past, with revenues expected to display 4x annualised growth until the end of 2021. If achieved, this would be a much better result than the 13% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 8.0% per year. Not only are Fiera Milano's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Fiera Milano going forwards.

After a downgrade like this one, it's pretty clear that previous forecasts were too optimistic. Worse, it's possible that the forecast future income could struggle to cover Fiera Milano'sdividend payments. You can learn more, and discover the 1 possible risk we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Fiera Milano, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:FM

Fiera Milano

Engages in hosting exhibitions, fairs, and other events in Italy and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives