- Italy

- /

- Commercial Services

- /

- BIT:FILA

Here's Why I Think F.I.L.A. - Fabbrica Italiana Lapis ed Affini (BIT:FILA) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like F.I.L.A. - Fabbrica Italiana Lapis ed Affini (BIT:FILA). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for F.I.L.A. - Fabbrica Italiana Lapis ed Affini

How Quickly Is F.I.L.A. - Fabbrica Italiana Lapis ed Affini Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years F.I.L.A. - Fabbrica Italiana Lapis ed Affini grew its EPS by 5.5% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. F.I.L.A. - Fabbrica Italiana Lapis ed Affini's EBIT margins have actually improved by 2.1 percentage points in the last year, to reach 13%, but, on the flip side, revenue was down 12%. That falls short of ideal.

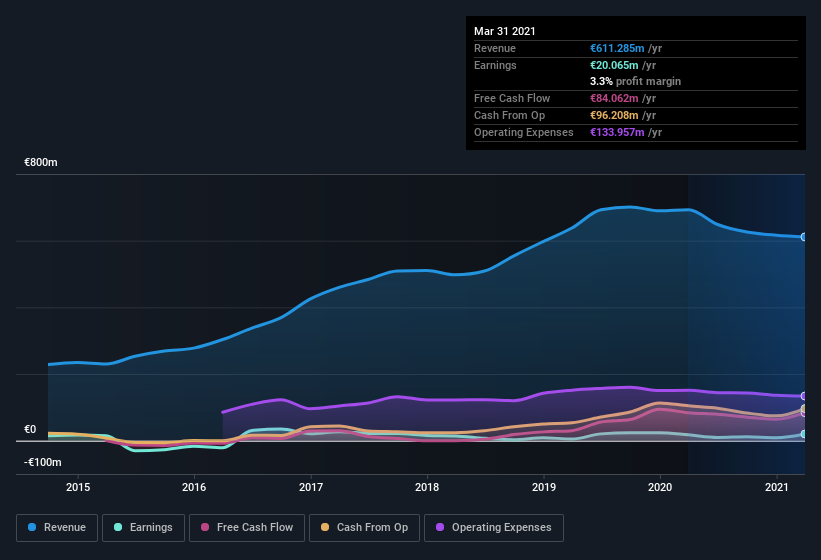

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for F.I.L.A. - Fabbrica Italiana Lapis ed Affini's future profits.

Are F.I.L.A. - Fabbrica Italiana Lapis ed Affini Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that F.I.L.A. - Fabbrica Italiana Lapis ed Affini insiders own a significant number of shares certainly appeals to me. In fact, they own 53% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling €296m. Now that's what I call some serious skin in the game!

Should You Add F.I.L.A. - Fabbrica Italiana Lapis ed Affini To Your Watchlist?

One important encouraging feature of F.I.L.A. - Fabbrica Italiana Lapis ed Affini is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You still need to take note of risks, for example - F.I.L.A. - Fabbrica Italiana Lapis ed Affini has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Although F.I.L.A. - Fabbrica Italiana Lapis ed Affini certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade F.I.L.A. - Fabbrica Italiana Lapis ed Affini, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:FILA

F.I.L.A. - Fabbrica Italiana Lapis ed Affini

F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives