Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Circle (BIT:CIRC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Circle

How Quickly Is Circle Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Circle's EPS has grown 33% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

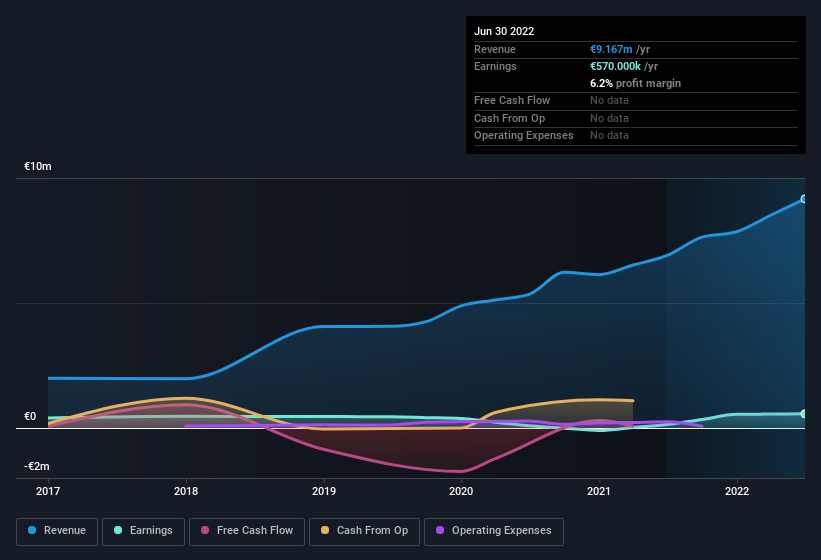

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Circle shareholders can take confidence from the fact that EBIT margins are up from 3.8% to 7.5%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Circle is no giant, with a market capitalisation of €17m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Circle Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Circle shares, in the last year. Add in the fact that Luca Abatello, the President of the Board & CEO of the company, paid €13k for shares at around €3.32 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Circle will reveal that insiders own a significant piece of the pie. Owning 50% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, Circle is a very small company, with a market cap of only €17m. That means insiders only have €8.7m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Circle Deserve A Spot On Your Watchlist?

For growth investors, Circle's raw rate of earnings growth is a beacon in the night. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Circle that you should be aware of.

The good news is that Circle is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CIRC

Circle

Provides management consultancy, IT, and software solutions for the port, maritime, and logistics sectors in Italy.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026