- Italy

- /

- Aerospace & Defense

- /

- BIT:OS

Investors Appear Satisfied With Officina Stellare S.p.A.'s (BIT:OS) Prospects As Shares Rocket 42%

Despite an already strong run, Officina Stellare S.p.A. (BIT:OS) shares have been powering on, with a gain of 42% in the last thirty days. The last month tops off a massive increase of 101% in the last year.

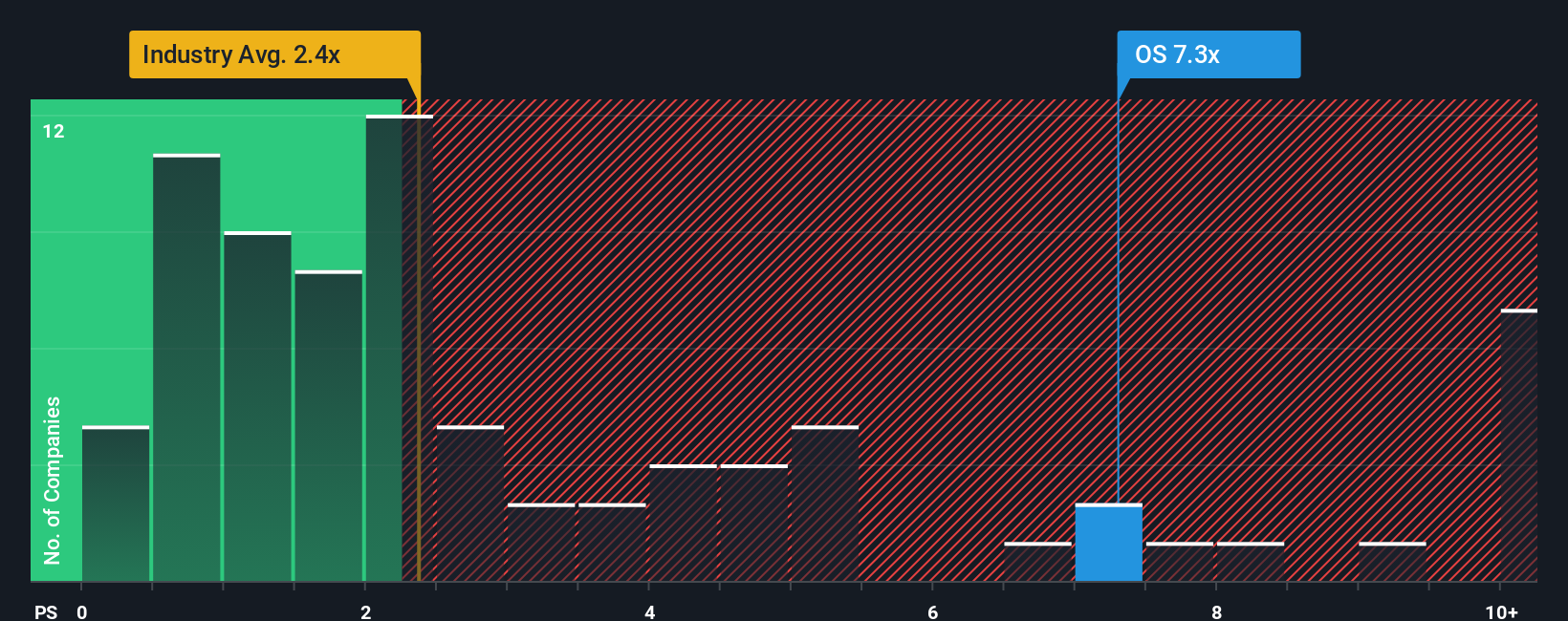

Since its price has surged higher, when almost half of the companies in Italy's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Officina Stellare as a stock not worth researching with its 7.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Officina Stellare

How Has Officina Stellare Performed Recently?

Officina Stellare has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Officina Stellare's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Officina Stellare's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. The latest three year period has also seen an excellent 160% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

In light of this, it's understandable that Officina Stellare's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Officina Stellare's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Officina Stellare revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Officina Stellare you should be aware of, and 2 of them are a bit concerning.

If these risks are making you reconsider your opinion on Officina Stellare, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OS

Officina Stellare

Designs, produces, and sells telescopes, and optical and aerospace instruments worldwide.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives