- Italy

- /

- Construction

- /

- BIT:NXT

Undiscovered European Gems with Strong Potential for September 2025

Reviewed by Simply Wall St

As European markets navigate a period of cautious optimism, with the pan-European STOXX Europe 600 Index remaining steady amid interest rate assessments and trade uncertainties, investors are keenly observing key economic indicators such as the eurozone's business activity reaching a 16-month high. In this environment, identifying promising stocks requires focusing on companies that demonstrate resilience and adaptability to evolving market conditions, offering potential growth opportunities in an otherwise stable landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Next Geosolutions Europe SpA offers marine geoscience and offshore construction support services across Europe, Asia, and North America, with a market cap of €573.60 million.

Operations: With a market cap of €573.60 million, the primary revenue stream for Next Geosolutions Europe SpA is engineering services, generating €215.59 million.

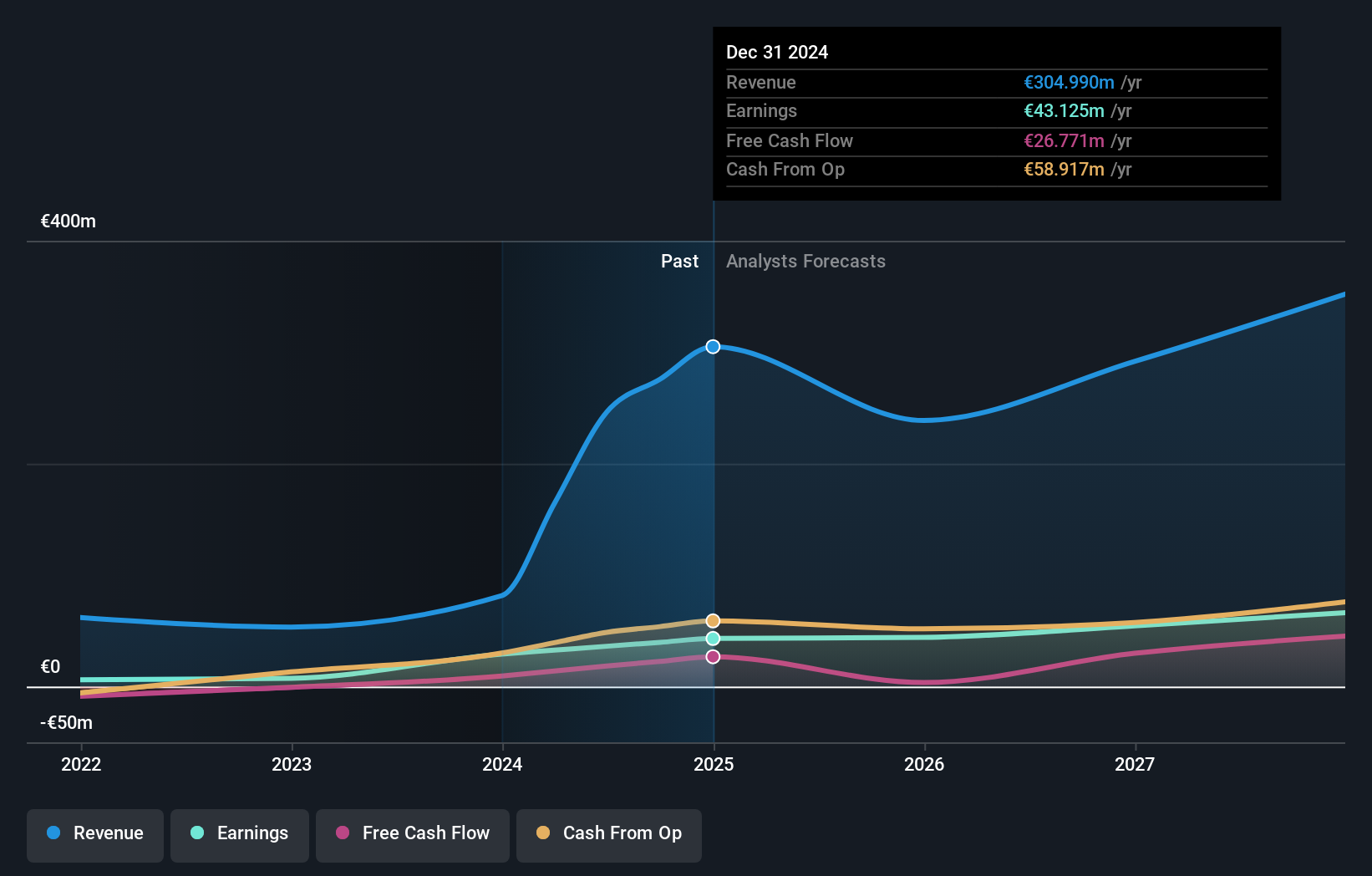

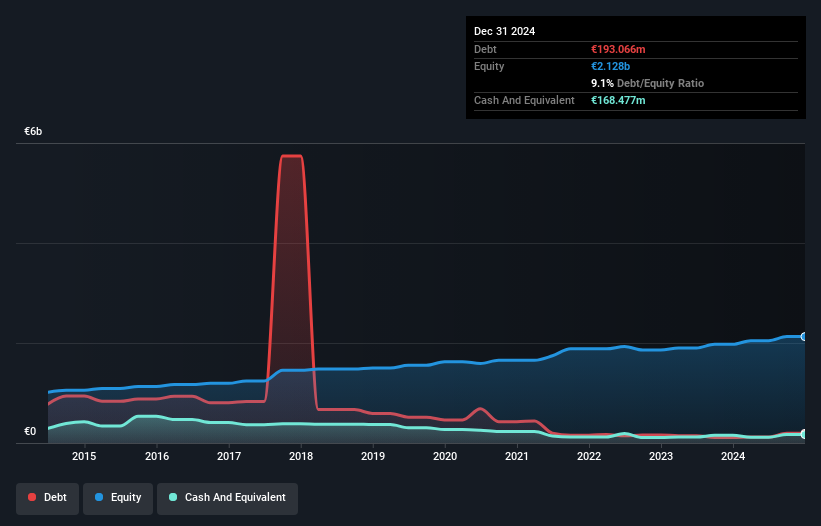

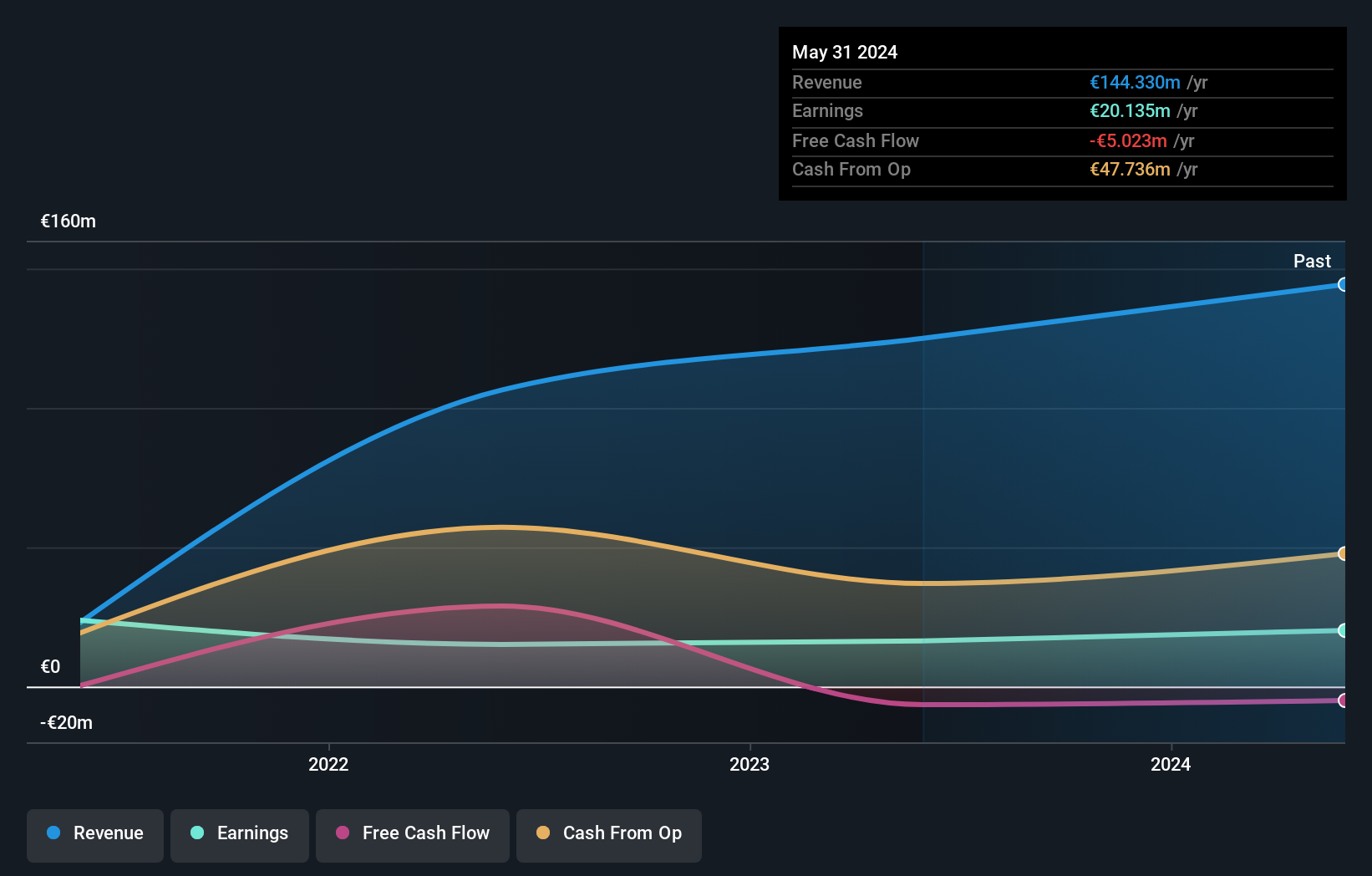

Next Geosolutions Europe, a smaller player in its sector, reported half-year sales of €103.7 million, down from €190.8 million the previous year, but revenue rose to €114.3 million from €104.1 million. Net income improved to €25.4 million compared to last year's €21.1 million, showcasing solid earnings growth of 39% annually over five years and a forecasted 21% annual increase moving forward. The company holds more cash than total debt and trades at 38% below estimated fair value while maintaining positive free cash flow despite high share price volatility recently observed in the market.

- Delve into the full analysis health report here for a deeper understanding of Next Geosolutions Europe.

Evaluate Next Geosolutions Europe's historical performance by accessing our past performance report.

Caisse Régionale de Crédit Agricole du Morbihan (ENXTPA:CMO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole du Morbihan offers a range of banking products and services to diverse clients including individuals, professionals, farmers, and local authorities in France, with a market capitalization of €597.89 million.

Operations: CMO generates its revenue primarily from retail banking, with this segment contributing €229.80 million. The company has a market capitalization of €597.89 million.

Crédit Agricole du Morbihan stands out with its robust financial health, boasting total assets of €13.8 billion and equity of €2.2 billion. The bank's liabilities are primarily low risk, with 96% funded by customer deposits, reducing external borrowing risks. Its price-to-earnings ratio at 8.6x is notably below the French market average of 16x, indicating potential undervaluation. Earnings have surged by 26%, significantly outperforming the broader banking sector's -0.3%. With a sufficient allowance for bad loans at 105% and non-performing loans at just 1.8%, this institution seems well-prepared to manage credit risks effectively.

Compagnie Du Mont-Blanc (ENXTPA:MLCMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Du Mont-Blanc operates as a ski lift company in France, with a market capitalization of €233.86 million.

Operations: Compagnie Du Mont-Blanc generates revenue primarily from its Sports Lift segment, contributing €143.40 million, while its Restaurants and Stores segment adds €4.73 million.

With a price-to-earnings ratio of 11.6x, Compagnie Du Mont-Blanc (MLCMB) trades below the French market average of 16x, suggesting it might be undervalued. The company's net debt to equity ratio stands at a satisfactory 17.1%, reflecting prudent financial management. Over the past year, MLCMB's earnings surged by 23.2%, significantly outpacing the hospitality industry's growth rate of just 1.9%. This robust performance is supported by high-quality earnings and well-covered interest payments with an EBIT coverage of ten times, indicating strong operational efficiency despite recent challenges in free cash flow and capital expenditures reaching €52.76 million this year.

Where To Now?

- Click this link to deep-dive into the 331 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next Geosolutions Europe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:NXT

Next Geosolutions Europe

Provides marine geoscience and offshore construction support services in Europe, Asia, and North America.

Undervalued with high growth potential.

Market Insights

Community Narratives