Next Geosolutions Europe And 2 Other Undiscovered Gems To Consider In Europe

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index climbing 2.35% and major single-country indexes also posting gains, reflecting a broader optimism despite subdued inflation data suggesting stability around the ECB's target. As investors navigate this landscape, identifying promising small-cap stocks can be key to harnessing growth potential; companies like Next Geosolutions Europe exemplify the kind of innovative and under-the-radar opportunities that may thrive in such an environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Next Geosolutions Europe (BIT:NXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Next Geosolutions Europe SpA specializes in providing marine geoscience and offshore construction support services across Europe, Asia, and North America with a market capitalization of €597.60 million.

Operations: Next Geosolutions Europe SpA generates revenue primarily from engineering services, amounting to €215.35 million.

Next Geosolutions Europe, a nimble player in its field, showcases robust financial health with more cash than total debt and positive free cash flow. Despite a dip in sales to €103.7 million from €190.8 million year-over-year for the half-year ending June 2025, revenue climbed to €114.3 million from €104.1 million, and net income rose to €25.4 million from €21.1 million—highlighting resilience amid challenges. The price-to-earnings ratio of 12.6x undercuts the Italian market's average of 16.2x, suggesting good relative value alongside high-quality earnings and promising growth prospects at nearly 22% annually forecasted growth.

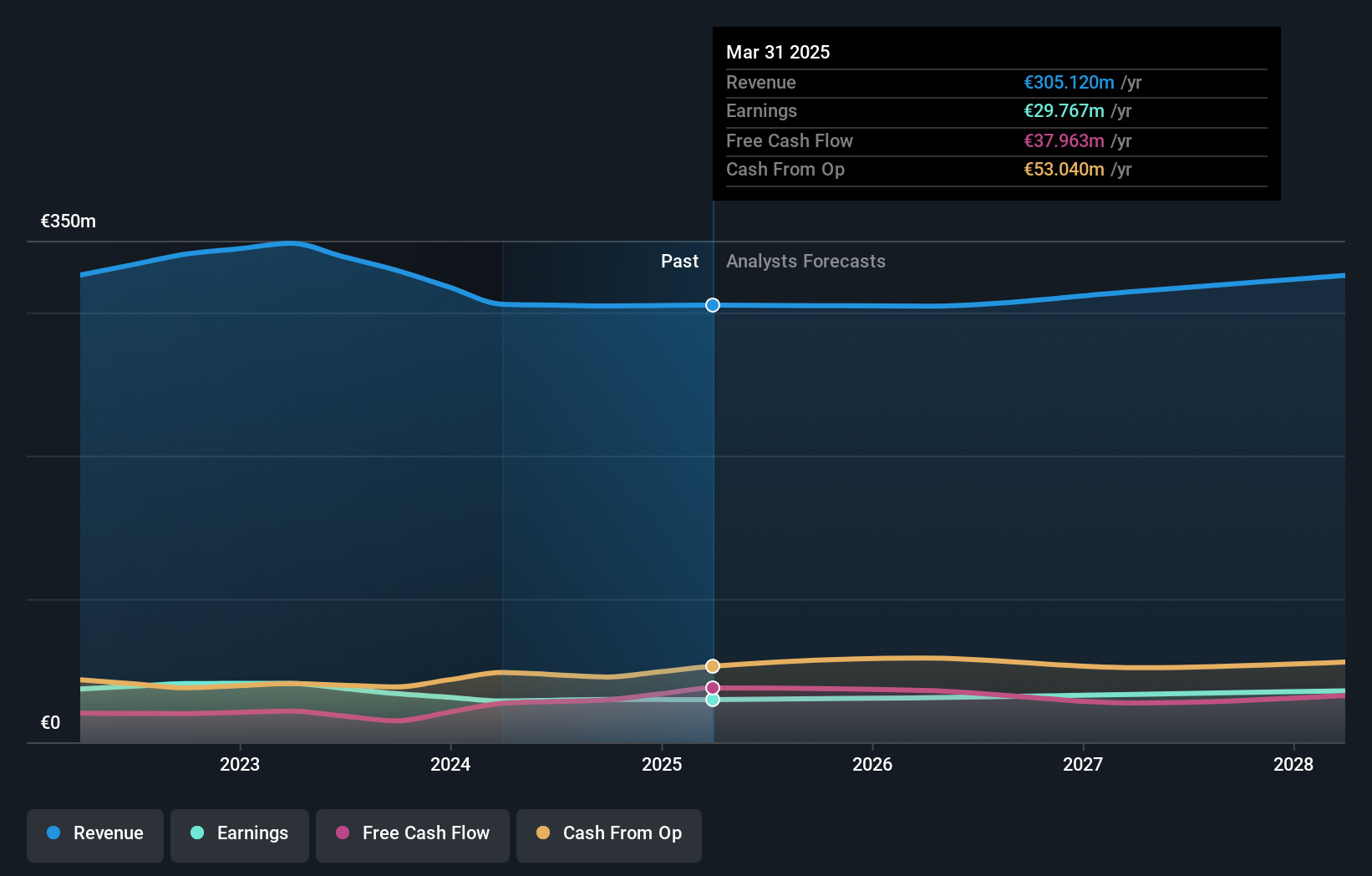

Oeneo (ENXTPA:SBT)

Simply Wall St Value Rating: ★★★★★★

Overview: Oeneo SA operates in the wine industry worldwide, with a market capitalization of approximately €595.73 million.

Operations: Oeneo generates revenue primarily from its Closures segment, contributing €222.47 million, and the Winemaking segment, which adds €82.65 million. The Closures segment is the major revenue driver for the company.

Oeneo, a notable player in the European market, has demonstrated solid financial health with its interest payments well covered by EBIT at 8.7 times. The company's net debt to equity ratio stands at a satisfactory 16%, indicating prudent financial management. Over the past year, Oeneo's earnings grew by 3.2%, outpacing the packaging industry's downturn of -18.7%. This growth trajectory is supported by high-quality earnings and positive free cash flow, which have been consistent over recent periods. With earnings forecasted to grow annually by 4.73%, Oeneo seems poised for continued stability and potential expansion in its niche market segment.

- Delve into the full analysis health report here for a deeper understanding of Oeneo.

Gain insights into Oeneo's historical performance by reviewing our past performance report.

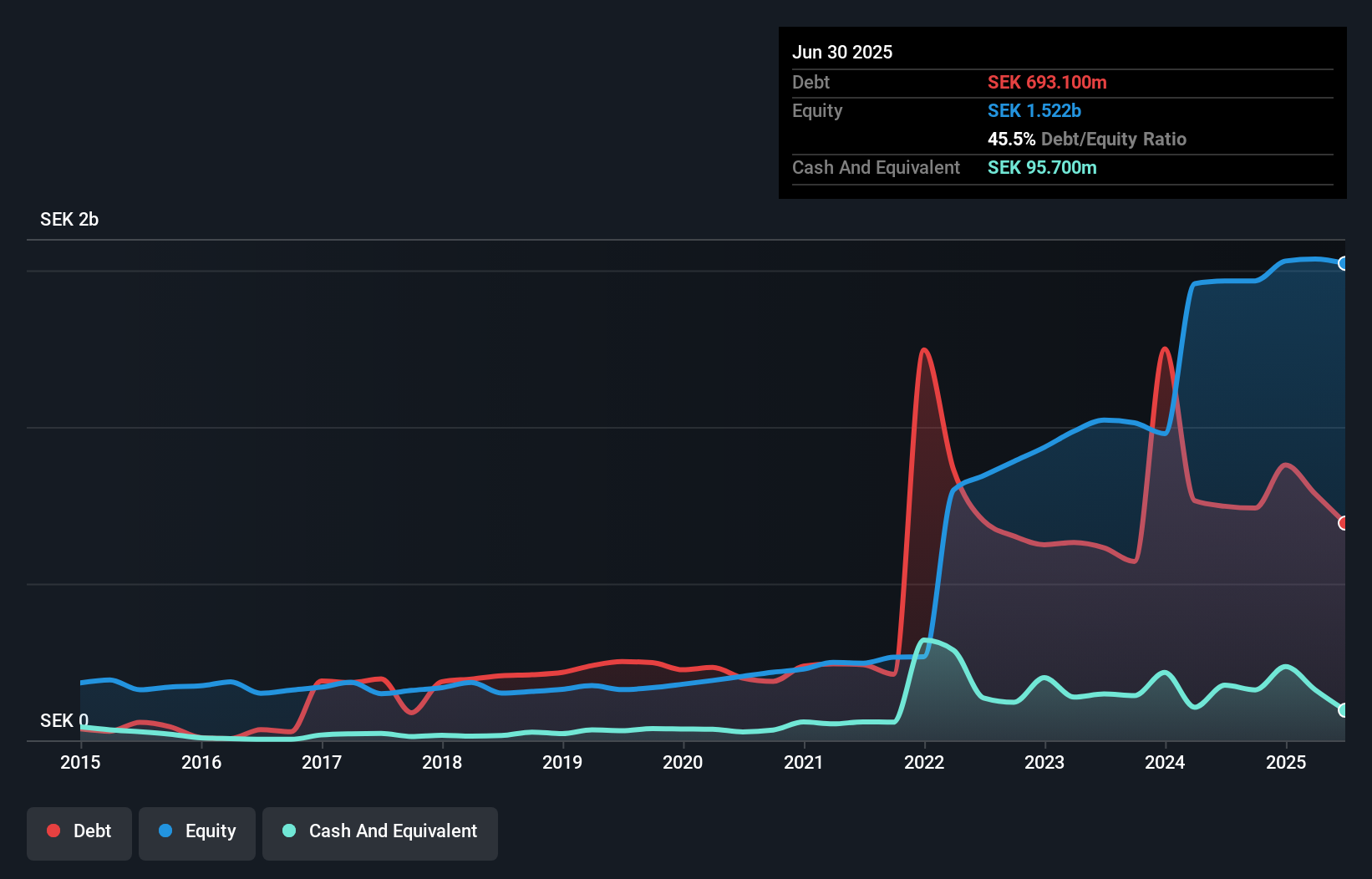

Svedbergs Group (OM:SVED B)

Simply Wall St Value Rating: ★★★★★★

Overview: Svedbergs Group AB (publ) is a company that focuses on the development, manufacturing, and marketing of bathroom products across the Nordic region, the United Kingdom, and the Netherlands, with a market capitalization of SEK3.41 billion.

Operations: Revenue streams for Svedbergs Group primarily include Roper Rhodes contributing SEK1.17 billion, followed by Thebalux at SEK412.10 million and Svedbergs at SEK399.30 million.

Svedbergs Group, a notable player in the building industry, has shown robust financial health with earnings surging 57.5% over the past year, significantly outpacing the sector's -1.7%. Trading at 31% below its estimated fair value, it presents an attractive opportunity for investors. The company's net debt to equity ratio stands at a satisfactory 33%, reflecting prudent financial management as it reduced from 86.7% over five years. Recent expansions in the UK market with a new distribution center underscore its commitment to growth and operational excellence, supported by high-quality earnings and strong interest coverage of 8.6x EBIT on debt payments.

- Get an in-depth perspective on Svedbergs Group's performance by reading our health report here.

Gain insights into Svedbergs Group's past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 310 more companies for you to explore.Click here to unveil our expertly curated list of 313 European Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SBT

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026