- Italy

- /

- Construction

- /

- BIT:ICOP

Exploring Europe's Undiscovered Gems in August 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index climbs 2.11% on strong corporate earnings and hopes for geopolitical resolutions, investors are increasingly turning their attention to small-cap stocks that may have been overlooked in the broader market rally. In this environment, identifying companies with solid fundamentals and growth potential can uncover opportunities amidst Europe's dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

I.CO.P.. Società Benefit (BIT:ICOP)

Simply Wall St Value Rating: ★★★★★★

Overview: I.CO.P. S.p.A. Società Benefit operates in the construction and special engineering sector, serving both public and private clients in Italy and internationally, with a market cap of €566.45 million.

Operations: ICOP generates revenue primarily from its heavy construction segment, amounting to €110.92 million. The company's market cap is valued at €566.45 million.

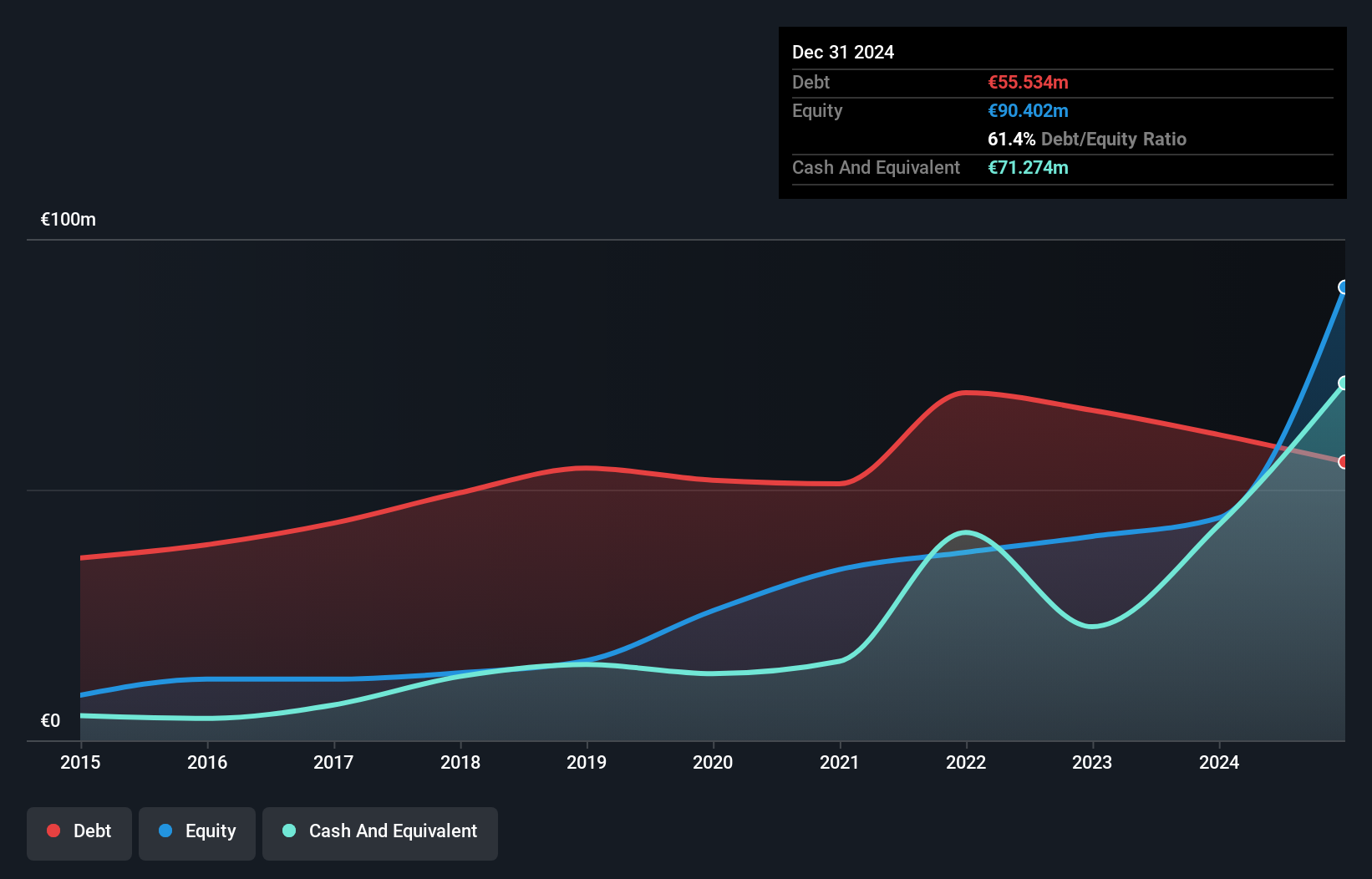

ICOP, a standout in the European market, showcases impressive financial health and growth potential. Over the past year, earnings skyrocketed by 254%, outpacing the Construction industry's 39%. The company's debt to equity ratio has impressively decreased from 201% to 61% over five years, highlighting prudent financial management. Interest payments are well-covered with EBIT at 12.5 times coverage. With high non-cash earnings and trading at a discount of approximately 26% below estimated fair value, ICOP seems poised for continued growth. However, its share price volatility in recent months might be a concern for risk-averse investors.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. is a financial institution that offers wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €740.62 million.

Operations: Renta 4 Banco generates revenue primarily through wealth management, brokerage, and corporate advisory services. The company's financial performance can be assessed by examining its net profit margin, which reflects the efficiency of its operations and profitability relative to total revenue.

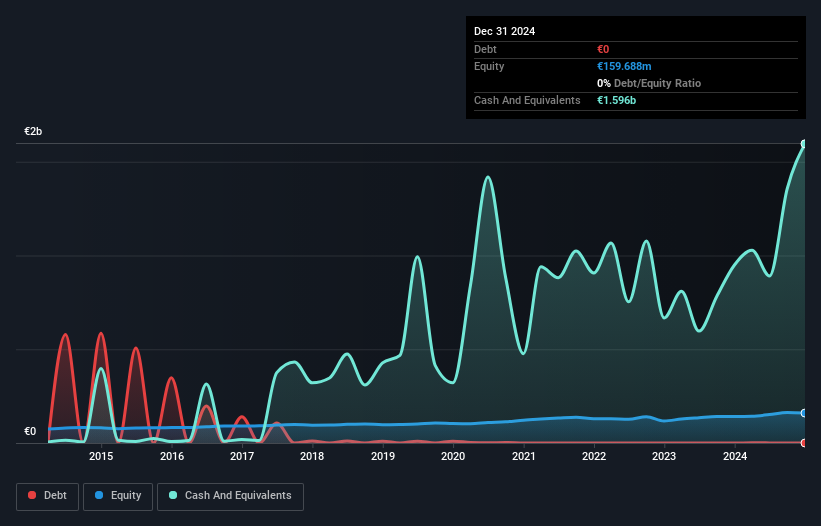

Renta 4 Banco, a nimble player in Europe's financial landscape, has demonstrated robust earnings growth of 33.1% over the past year, outpacing the Capital Markets industry average of 12.2%. The company reported a net income of €19.26 million for the first half of 2025, up from €15.18 million in the previous year, with basic earnings per share rising to €0.47 from €0.37. Notably debt-free now compared to five years ago when its debt-to-equity ratio was 0.8%, Renta 4 Banco also boasts high-quality earnings and positive free cash flow despite recent share price volatility.

- Click here to discover the nuances of Renta 4 Banco with our detailed analytical health report.

Gain insights into Renta 4 Banco's past trends and performance with our Past report.

Cosmo Pharmaceuticals (SWX:COPN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cosmo Pharmaceuticals N.V. specializes in developing and commercializing products for gastroenterology, dermatology, and healthtech on a global scale, with a market cap of CHF897.36 million.

Operations: Cosmo Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to €182.27 million. The company's market cap is CHF897.36 million.

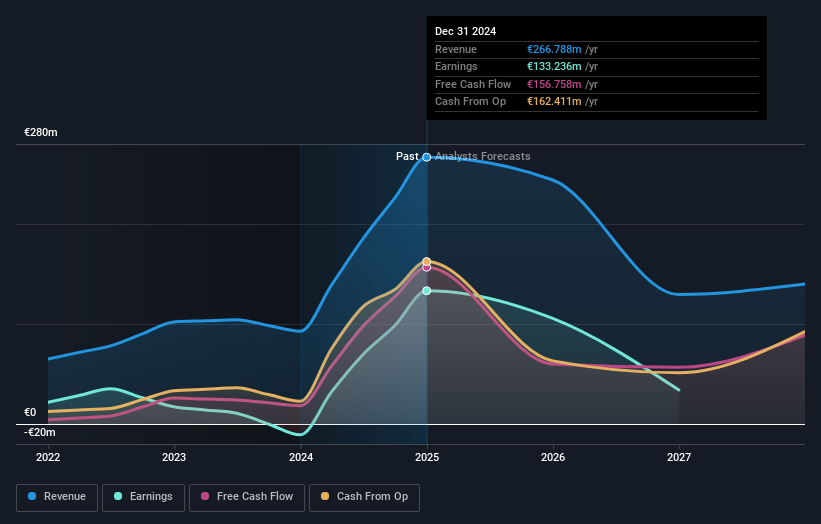

Cosmo Pharmaceuticals, a nimble player in the healthcare sector, is making waves with its innovative AI diagnostics and drug delivery platforms. The company has strategically partnered with Medtronic to boost growth prospects amid increasing global healthcare spending. Despite a recent net loss of EUR 2 million for H1 2025, compared to a net income of EUR 71.24 million the previous year, Cosmo remains focused on its core areas like gastroenterology and dermatology. With earnings projected to grow annually by 34%, it aims for profit margins rising from 32.9% to 42.6%. However, regulatory risks and high R&D costs pose challenges ahead.

Where To Now?

- Investigate our full lineup of 319 European Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOP

I.CO.P.. Società Benefit

Engages in providing construction and special engineering services to public and private clients in Italy and internationally.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives