Fincantieri (BIT:FCT): Exploring Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Fincantieri (BIT:FCT) shares have experienced a sharp pullback over the past month. Recent price action has drawn the interest of market watchers. Investors are weighing the company’s performance as industry shifts continue.

See our latest analysis for Fincantieri.

Even with a slide of 23.7% in its 1-month share price, Fincantieri’s momentum still stands out. Year-to-date the share price is up a striking 145.3%, and its 1-year total shareholder return is 186.3%. Momentum has cooled recently as investors digest last quarter’s surge and watch for the next catalysts, but the longer-term trajectory remains firmly positive.

If you’re watching industrials for signs of dynamic growth stories, it’s the perfect moment to expand your search and discover See the full list for free.

The recent volatility raises a critical question. With a current price that sits well below analyst targets but a year of record gains behind it, could Fincantieri offer untapped value, or is future growth already built into the price?

Most Popular Narrative: 23.2% Undervalued

With a narrative fair value of €22.16 against the last close of €17.01, market sentiment may be missing out on what analysts see coming next in Fincantieri’s story. The analyst consensus highlights renewed optimism and raises pointed expectations for the company’s future, setting the scene for further debate among investors.

Robust global demand for advanced military vessels, driven by increased defense budgets and geopolitical tensions, is resulting in a record order backlog and new contract opportunities in both Europe and APAC. This positions Fincantieri for sustained revenue growth and greater earnings visibility through 2036.

Want to unpack what’s behind this bullish call? The narrative is built on powerful long-term growth assumptions, rising margins, and a future profit multiple that rivals top-tier peers. Curious what bold projections justify this valuation leap? Get a closer look at the blockbuster expectations driving the fair value above today’s price.

Result: Fair Value of €22.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Fincantieri’s reliance on cruise and defense markets, along with the complexity of long-cycle contracts, could challenge its growth outlook if trends shift.

Find out about the key risks to this Fincantieri narrative.

Another View: High Market Multiple Casts Doubt

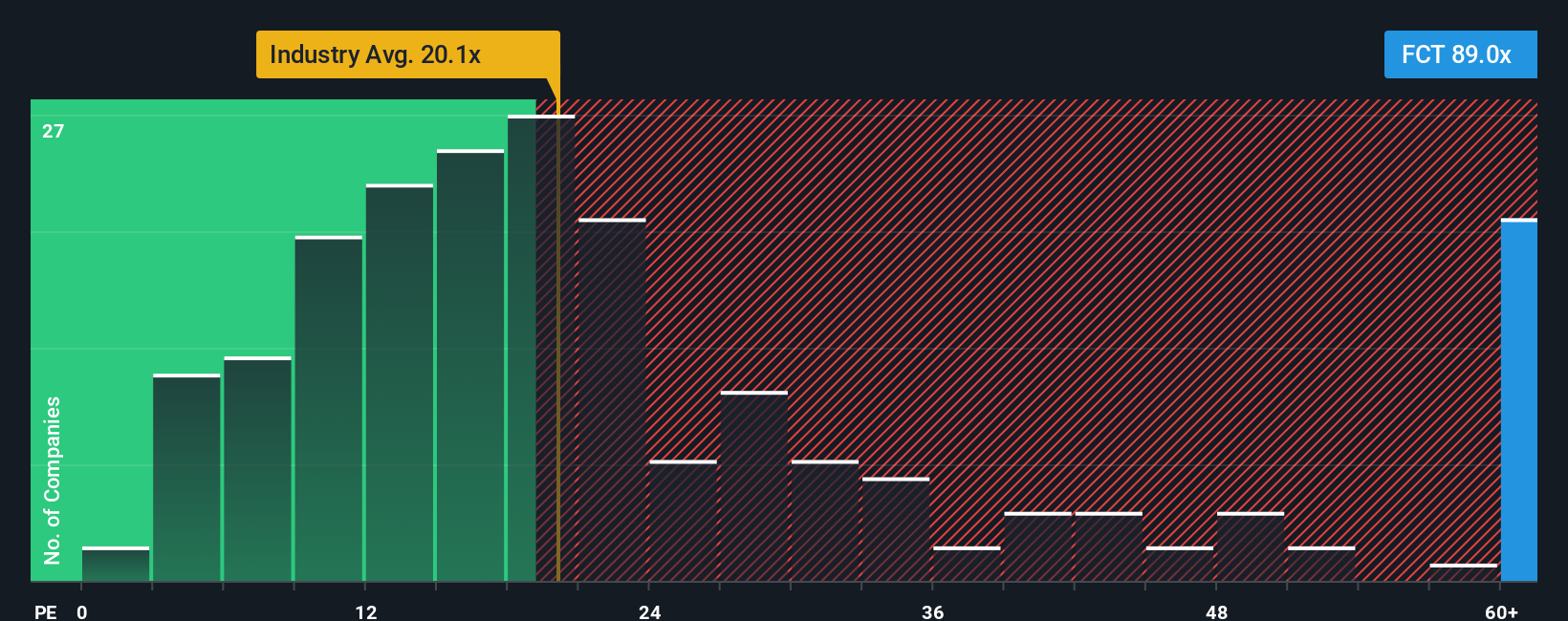

Looking from another angle, Fincantieri’s shares trade at a price-to-earnings ratio of 57.6x. This level is considerably higher than both the European Machinery sector average of 20x and the peer average of 16.6x. Even compared to a fair ratio of 34.3x, the premium is striking, hinting at higher expectations that may not be easily met. Is this a sign of sustained optimism or could the share price be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fincantieri Narrative

If you see things differently or want to dig deeper into the numbers, it’s easy to shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Fincantieri research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one exciting story. Make your next smart move by checking out these unique stock opportunities. Fresh strategies could boost your returns and set you ahead of the crowd.

- Uncover rare value plays with real upside in these 920 undervalued stocks based on cash flows and see which companies could be trading well below their true worth.

- Kickstart your portfolio’s next growth phase by browsing these 25 AI penny stocks fueled by innovation in artificial intelligence and advanced automation.

- Accelerate your search for steady income streams with these 15 dividend stocks with yields > 3%, featuring robust yields that can power your dividends forward year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FCT

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.