- Saudi Arabia

- /

- Food

- /

- SASE:6001

3 Stocks Including EuroGroup Laminations That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mix of rising consumer concerns and fluctuating indices, investors are increasingly focused on identifying opportunities that may be undervalued. In this environment, stocks like EuroGroup Laminations present potential interest for those seeking value investments amid shifting economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7288.65 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

| Merus Power Oyj (HLSE:MERUS) | €3.71 | €7.39 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.05 | US$129.48 | 49.8% |

We'll examine a selection from our screener results.

EuroGroup Laminations (BIT:EGLA)

Overview: EuroGroup Laminations S.p.A. designs, produces, and distributes motor cores for electric motors and generators across various regions including Europe, the Middle East, Africa, North America, Asia, and China; it has a market capitalization of approximately €455.13 million.

Operations: The company's revenue is derived from two primary segments: Industrial, contributing €311.06 million, and EV & Automotive, generating €529.81 million.

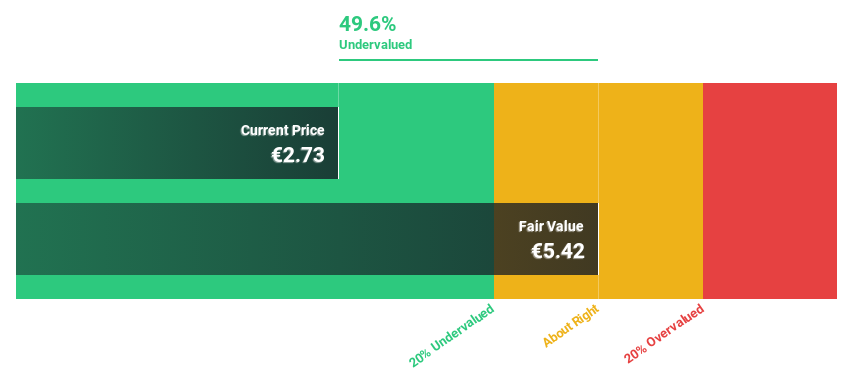

Estimated Discount To Fair Value: 48.3%

EuroGroup Laminations is trading at €2.8, significantly below its fair value estimate of €5.41, indicating it may be undervalued based on discounted cash flow analysis. Despite a decline in net income to €16.86 million for the first nine months of 2024 from €27.41 million a year ago, earnings are forecast to grow significantly at 43.1% annually over the next three years, outpacing the Italian market's growth rate and suggesting potential for future appreciation in stock value.

- Our earnings growth report unveils the potential for significant increases in EuroGroup Laminations' future results.

- Take a closer look at EuroGroup Laminations' balance sheet health here in our report.

Halwani Bros (SASE:6001)

Overview: Halwani Bros. Co. Ltd. is involved in the manufacturing, packaging, wholesaling, and retailing of food products in Saudi Arabia, Egypt, and internationally with a market cap of SAR1.88 billion.

Operations: The company generates revenue of SAR971.93 million from its operations in manufacturing, filling, wholesaling, and retail trading of food products.

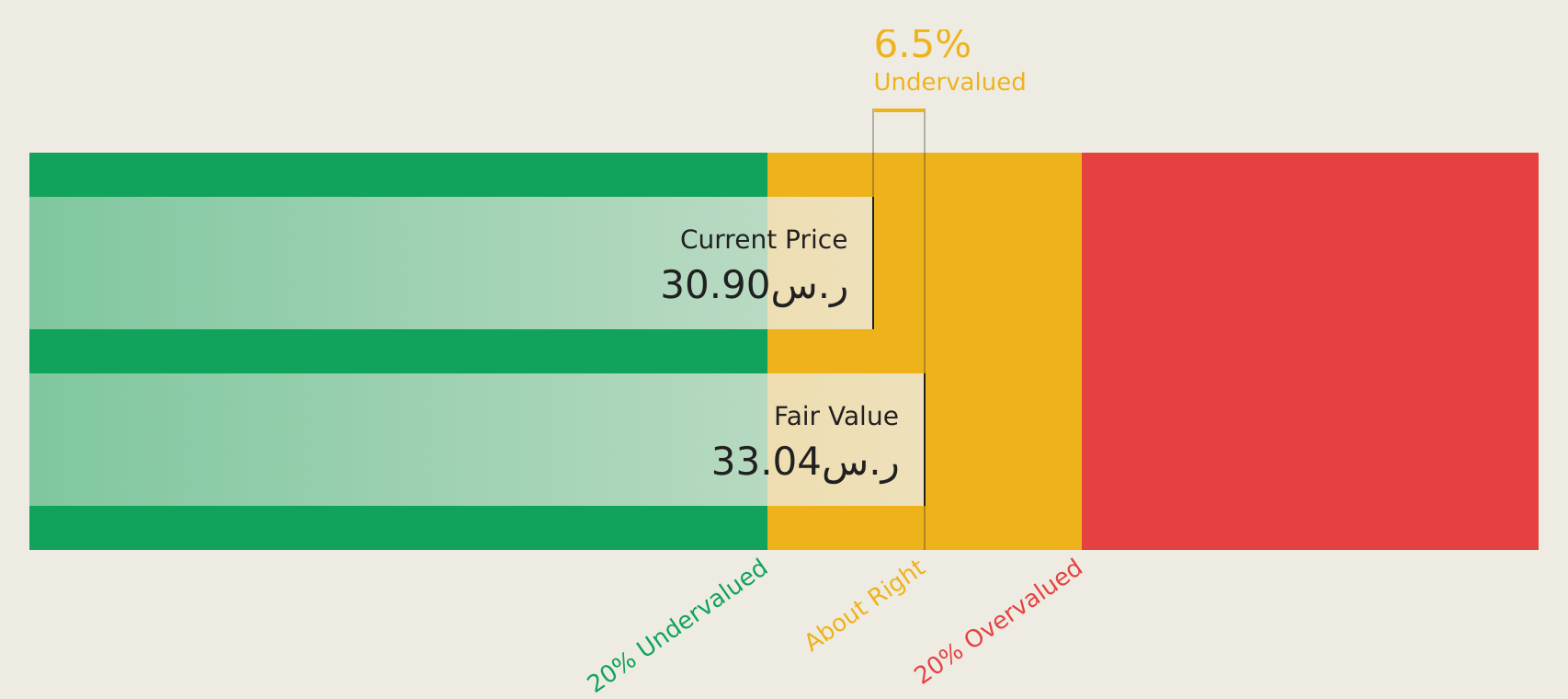

Estimated Discount To Fair Value: 13.4%

Halwani Bros. Co. Ltd., trading at SAR 53.3, is undervalued based on discounted cash flow analysis with an estimated fair value of SAR 61.53. The company reported third-quarter sales of SAR 248.55 million and net income of SAR 15.48 million, recovering from a net loss last year, with earnings per share improving to SAR 0.44 from a previous loss per share of SAR 1.2, highlighting its potential for future growth despite interest coverage concerns.

- In light of our recent growth report, it seems possible that Halwani Bros' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Halwani Bros stock in this financial health report.

Bora Pharmaceuticals (TWSE:6472)

Overview: Bora Pharmaceuticals Co., LTD. is engaged in the research, development, manufacturing, distribution, and sales of pharmaceuticals globally with a market cap of NT$77.20 billion.

Operations: The company's revenue is primarily generated from its Sales Operations Department, contributing NT$14.08 billion, followed by the CDMO Operations Department at NT$6.33 billion.

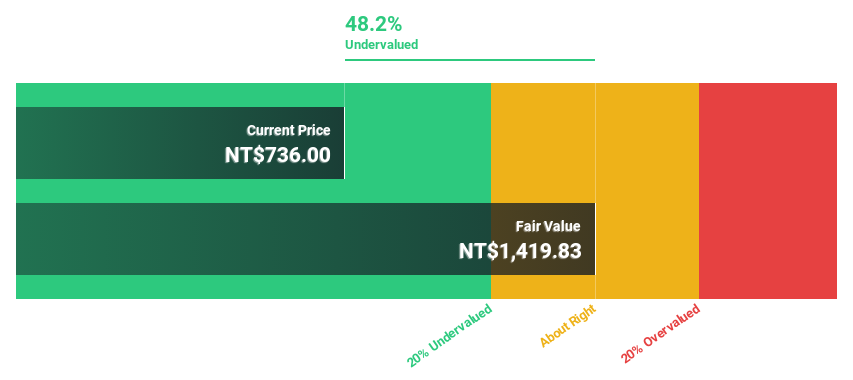

Estimated Discount To Fair Value: 47.1%

Bora Pharmaceuticals is trading at NT$751, significantly below its estimated fair value of NT$1,419.83. Recent earnings reports show strong growth with third-quarter sales reaching TWD 5.61 billion and net income doubling year-over-year to TWD 1.45 billion. Despite past shareholder dilution and large one-off items affecting results, the company's revenue is projected to grow at 22.5% annually, outpacing the Taiwan market's average growth rate of 12.2%.

- According our earnings growth report, there's an indication that Bora Pharmaceuticals might be ready to expand.

- Click to explore a detailed breakdown of our findings in Bora Pharmaceuticals' balance sheet health report.

Summing It All Up

- Click this link to deep-dive into the 889 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halwani Bros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:6001

Halwani Bros

Manufactures, packages, wholesales, and retails food products in the Kingdom of Saudi Arabia, Arab Republic of Egypt, and internationally.

High growth potential and fair value.

Market Insights

Community Narratives