Industrie De Nora S.p.A. (BIT:DNR) Shares May Have Slumped 29% But Getting In Cheap Is Still Unlikely

Industrie De Nora S.p.A. (BIT:DNR) shares have had a horrible month, losing 29% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

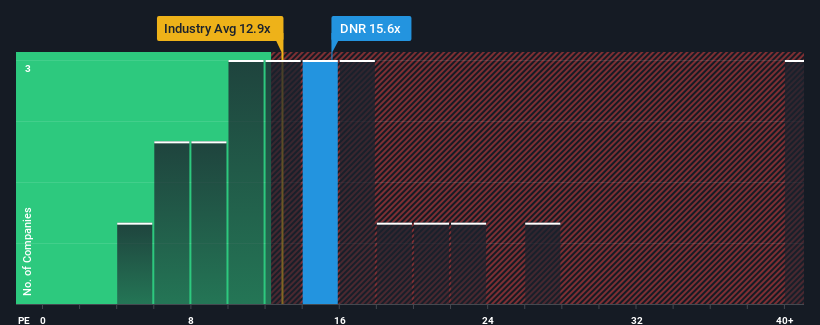

Even after such a large drop in price, it's still not a stretch to say that Industrie De Nora's price-to-earnings (or "P/E") ratio of 15.6x right now seems quite "middle-of-the-road" compared to the market in Italy, where the median P/E ratio is around 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Industrie De Nora's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Industrie De Nora

How Is Industrie De Nora's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Industrie De Nora's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 63%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 11% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 4.0% as estimated by the four analysts watching the company. With the market predicted to deliver 24% growth , that's a disappointing outcome.

With this information, we find it concerning that Industrie De Nora is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Industrie De Nora's P/E

Following Industrie De Nora's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Industrie De Nora currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Industrie De Nora is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DNR

Industrie De Nora

Through its subsidiaries, provides catalytic coatings and insoluble electrodes for electrochemical and industrial applications worldwide.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives