- Italy

- /

- Auto Components

- /

- BIT:CIR

COFIDE - Gruppo De Benedetti (BIT:COF) Use Of Debt Could Be Considered Risky

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that COFIDE - Gruppo De Benedetti S.p.A. (BIT:COF) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for COFIDE - Gruppo De Benedetti

What Is COFIDE - Gruppo De Benedetti's Net Debt?

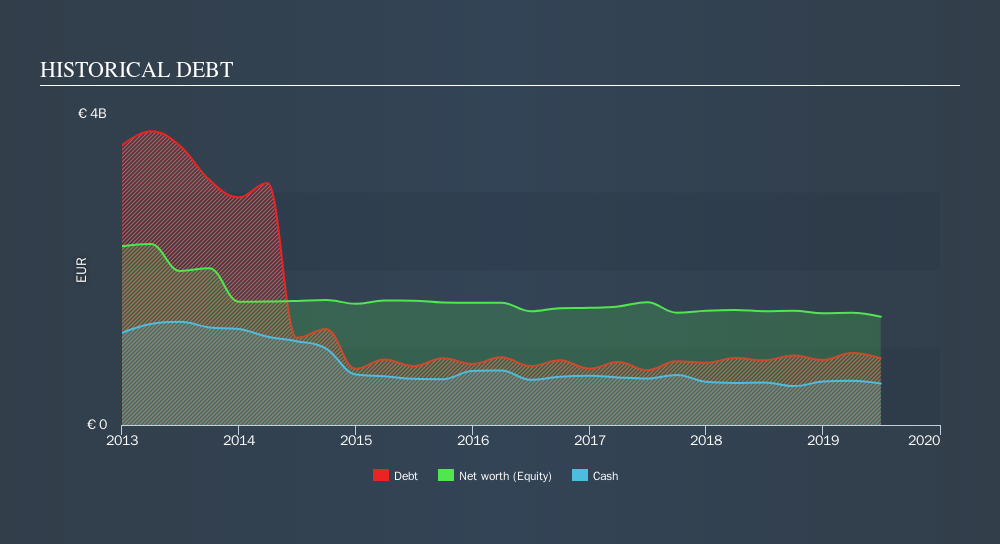

The image below, which you can click on for greater detail, shows that COFIDE - Gruppo De Benedetti had debt of €857.9m at the end of June 2019, a reduction from €905.9m over a year. On the flip side, it has €533.0m in cash leading to net debt of about €324.9m.

How Healthy Is COFIDE - Gruppo De Benedetti's Balance Sheet?

According to the last reported balance sheet, COFIDE - Gruppo De Benedetti had liabilities of €1.19b due within 12 months, and liabilities of €1.39b due beyond 12 months. On the other hand, it had cash of €533.0m and €561.8m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €1.49b.

The deficiency here weighs heavily on the €310.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, COFIDE - Gruppo De Benedetti would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though COFIDE - Gruppo De Benedetti's debt is only 1.7, its interest cover is really very low at 1.8. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. Importantly, COFIDE - Gruppo De Benedetti's EBIT fell a jaw-dropping 63% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since COFIDE - Gruppo De Benedetti will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, COFIDE - Gruppo De Benedetti actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, COFIDE - Gruppo De Benedetti's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Considering all the factors previously mentioned, we think that COFIDE - Gruppo De Benedetti really is carrying too much debt. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check COFIDE - Gruppo De Benedetti's dividend history, without delay!

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:CIR

CIR. - Compagnie Industriali Riunite

Through its subsidiaries, primarily operates in the automotive components and healthcare sectors in Italy, rest of European countries, North America, South America, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives