- Taiwan

- /

- Semiconductors

- /

- TWSE:2493

3 Solid Dividend Stocks Yielding Up To 5.9%

Reviewed by Simply Wall St

As global markets edge toward record highs, driven by a surge in U.S. stock indexes and positive developments in Europe and China, investors are keenly observing how inflationary pressures might influence future interest rate policies. Amid this backdrop of economic fluctuations, dividend stocks remain an attractive option for those seeking steady income streams; their appeal is heightened by the current market conditions where stability and consistent returns are prized.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

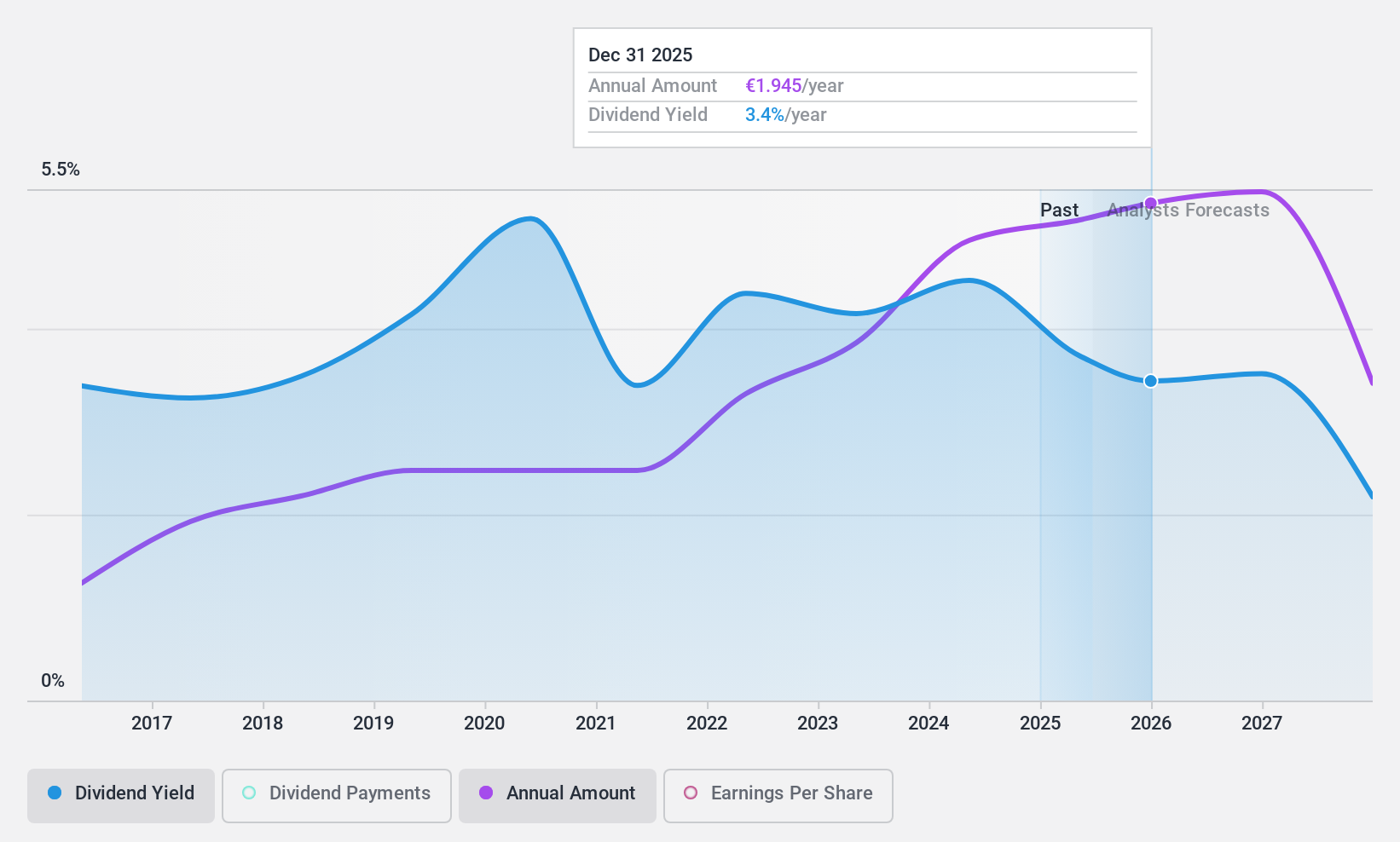

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and related tools in Italy, Europe, and internationally with a market cap of €734.89 million.

Operations: Cembre S.p.A.'s revenue primarily comes from its Electric Connectors and Related Tools segment, generating €224.89 million.

Dividend Yield: 4.1%

Cembre's dividend payments have shown reliability and stability over the past decade, with consistent growth and little volatility. However, the current payout ratio of 80% indicates that dividends are covered by earnings but not well supported by free cash flows, as evidenced by a high cash payout ratio of 148%. The dividend yield of 4.11% is below the top quartile in Italy's market. Earnings are projected to grow at nearly 8% annually, potentially enhancing future coverage.

- Dive into the specifics of Cembre here with our thorough dividend report.

- Our valuation report unveils the possibility Cembre's shares may be trading at a premium.

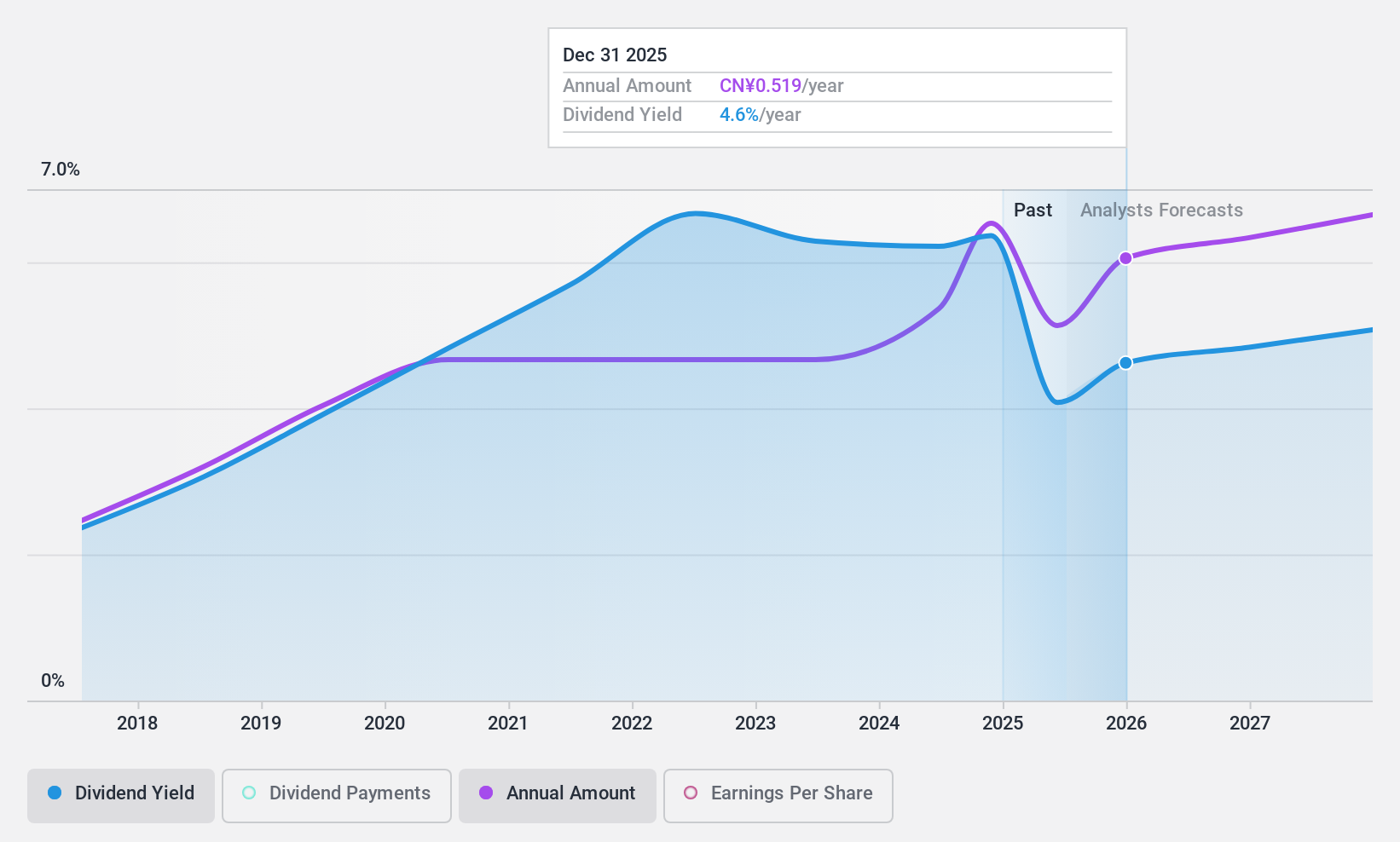

Bank of Shanghai (SHSE:601229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. offers a range of personal and corporate banking products and services mainly in Mainland China, with a market cap of approximately CN¥133.83 billion.

Operations: Bank of Shanghai Co., Ltd. generates revenue through its diverse offerings in personal and corporate banking services across Mainland China.

Dividend Yield: 5.9%

Bank of Shanghai's dividend yield of 5.94% ranks in the top 25% within China's market, supported by a stable payout ratio of 47.8%, indicating strong coverage by earnings. Although dividends have been paid for only eight years, they have grown consistently with minimal volatility. Recent inclusion in the SSE 180 and Shanghai Stock Exchange 180 Value Indexes may enhance visibility among investors seeking reliable dividend stocks trading at significant discounts to estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Bank of Shanghai.

- Our valuation report here indicates Bank of Shanghai may be overvalued.

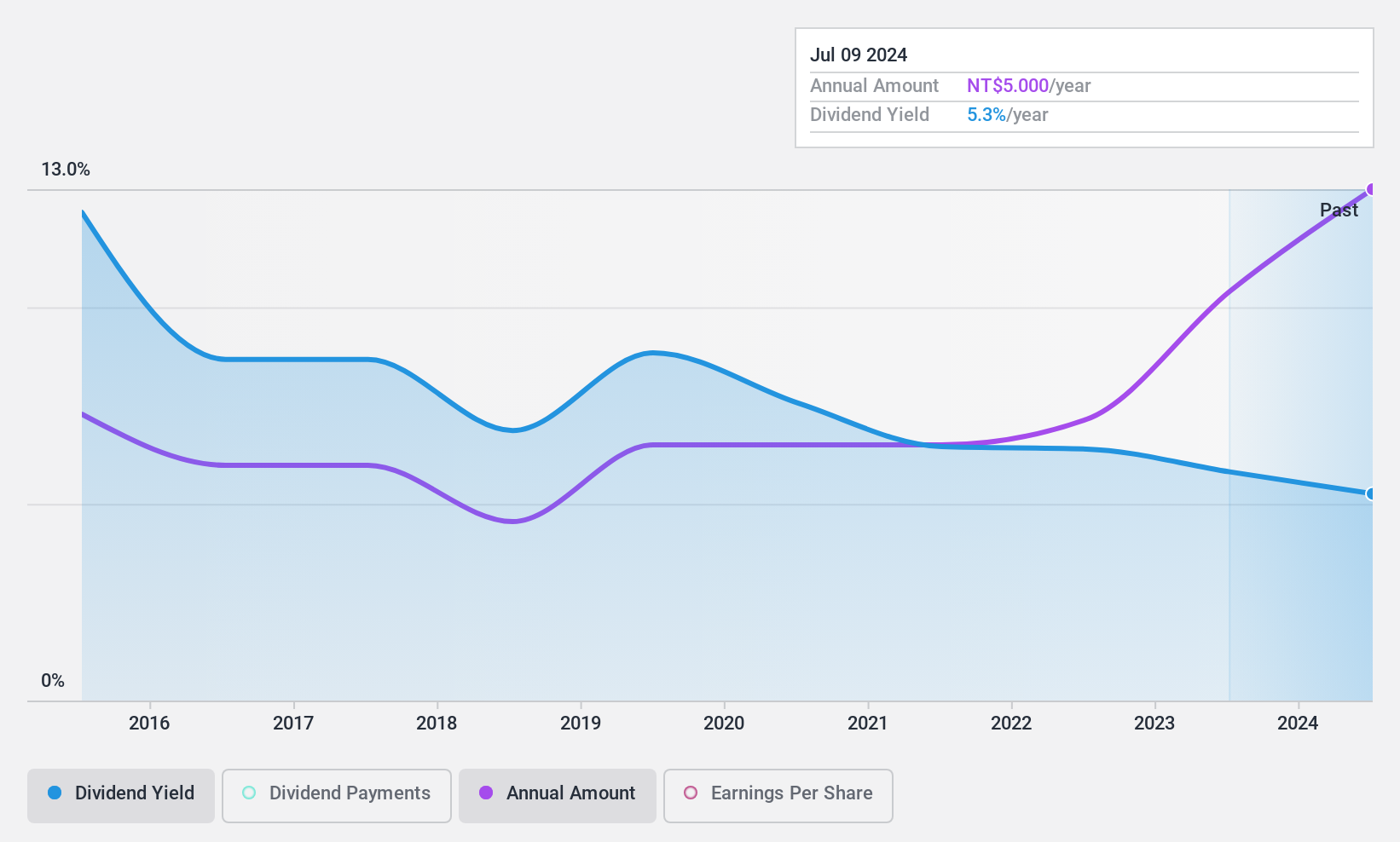

Ampoc Far-East (TWSE:2493)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ampoc Far-East Co., Ltd. and its subsidiaries focus on researching, manufacturing, and selling equipment and materials for the electrical industry across Taiwan, China, and Hong Kong, with a market cap of NT$11.50 billion.

Operations: Ampoc Far-East Co., Ltd.'s revenue segments include NT$2.12 billion from Zhongchi - Machine Equipment, NT$1.12 billion from Taipei - Consumable Materials, NT$741.17 million from Others - Machine Equipment, NT$320.49 million from Others - Consumable Materials, and NT$109.15 million from Zhongchi - Consumable Materials.

Dividend Yield: 5%

Ampoc Far-East's dividend yield of 4.98% places it among the top 25% in Taiwan, with coverage by earnings and cash flows at payout ratios of 85.1% and 82.9%, respectively. Despite trading at a notable discount to estimated fair value, its dividend history is marked by volatility over the past decade, indicating unreliability despite growth in payments during this period.

- Click here to discover the nuances of Ampoc Far-East with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Ampoc Far-East is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1984 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2493

Ampoc Far-East

Researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives