Getting In Cheap On Clabo S.p.A. (BIT:CLABO) Might Be Difficult

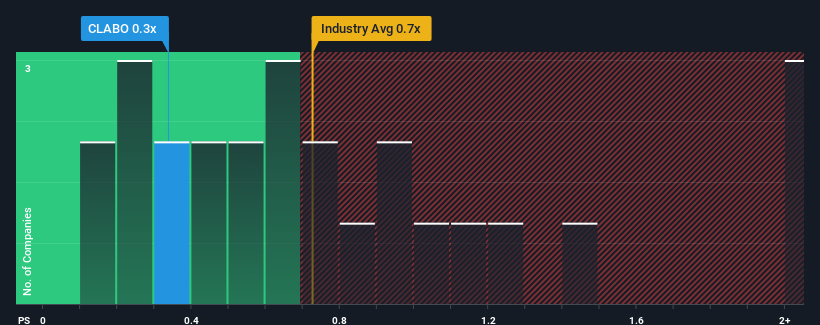

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Machinery industry in Italy, you could be forgiven for feeling indifferent about Clabo S.p.A.'s (BIT:CLABO) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Clabo

How Has Clabo Performed Recently?

Recent times have been advantageous for Clabo as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Clabo's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Clabo?

Clabo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 71% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 5.8% each year during the coming three years according to the lone analyst following the company. That's shaping up to be similar to the 4.3% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Clabo's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Clabo's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Clabo's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Machinery industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Clabo that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CLABO

Clabo

Designs, produces, and distributes refrigerated display cases and furniture for the food retail market worldwide.

Slightly overvalued with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026