- Italy

- /

- Aerospace & Defense

- /

- BIT:AVIO

Industry Analysts Just Made A Notable Upgrade To Their Avio S.p.A. (BIT:AVIO) Revenue Forecasts

Avio S.p.A. (BIT:AVIO) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts have sharply increased their revenue numbers, with a view that Avio will make substantially more sales than they'd previously expected.

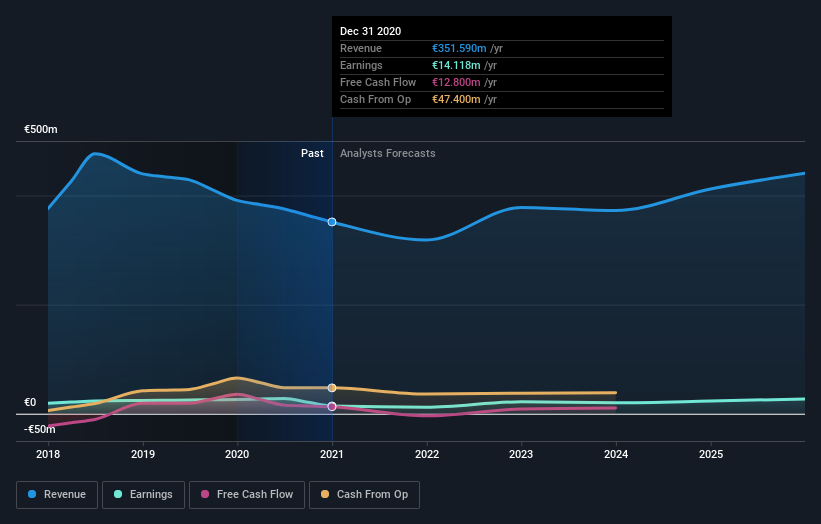

Following the upgrade, the consensus from five analysts covering Avio is for revenues of €319m in 2021, implying a not inconsiderable 9.4% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €283m in 2021. The consensus has definitely become more optimistic, showing a nice increase in revenue forecasts.

See our latest analysis for Avio

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. Over the past three years, revenues have declined around 6.0% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 12% decline in revenue until the end of 2021. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 7.8% annually. So while a broad number of companies are forecast to grow, unfortunately Avio is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Avio this year. They also expect company revenue to perform worse than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Avio.

Unanswered questions? We have analyst estimates for Avio going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Avio or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:AVIO

Avio

Through its subsidiaries, designs, develops, produces, and integrates space launchers in Italy and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.