Intesa Sanpaolo (BIT:ISP): Re-Evaluating Valuation Following Recent Share Price Stability

Reviewed by Simply Wall St

See our latest analysis for Intesa Sanpaolo.

Intesa Sanpaolo’s share price has built solid momentum this year, climbing steadily and delivering a 44.44% gain year-to-date. Over the longer haul, shareholders have enjoyed an impressive 53.35% total return in the past twelve months. This suggests confidence in the bank’s growth outlook and earnings resilience.

If you’re weighing where the next opportunity could come from, now is the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With impressive gains already logged, the real question is whether Intesa Sanpaolo’s current share price still underestimates its value, or if the market has fully priced in the bank’s growth prospects. Could this be a new buying opportunity?

Most Popular Narrative: 6.6% Undervalued

With Intesa Sanpaolo’s fair value estimated at €5.95, which is above the last close of €5.56, the narrative points to modest upside and renewed optimism after recent upgrades to forecasts.

Continued investment in digital transformation, including cloud migration, AI, and technology platforms, should lead to further operational cost reductions and improved customer reach. This is expected to support higher net margins and long-term bottom-line growth.

Want to see what’s fueling this bold fair value? The most watched narrative hinges on fresh growth strategies and a renewed push into technology. Curious about the headline profit assumptions and the projected margin moves that set this target? Dig into the narrative for all the surprising details that drive this valuation.

Result: Fair Value of €5.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on Italy’s economy and increasing competition from fintechs could present challenges to Intesa Sanpaolo’s long-term growth story.

Find out about the key risks to this Intesa Sanpaolo narrative.

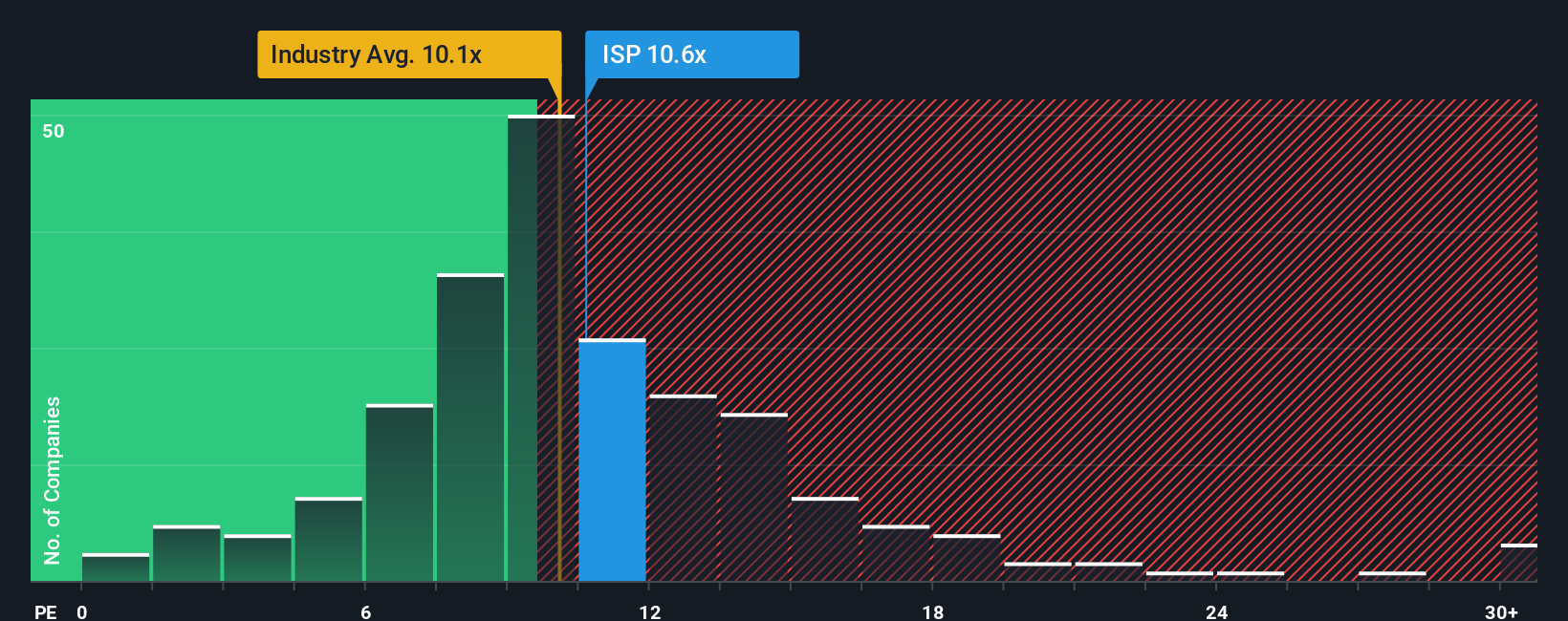

Another View: Market Ratios Tell a Different Story

While the fair value narrative points to Intesa Sanpaolo being undervalued, the market’s price-to-earnings ratio reveals another side. Intesa trades at 10.8x earnings, which is higher than the European banks sector average of 9.8x and its peer average of 10.7x. This suggests the shares are not cheap compared to rivals, and the market may already anticipate its potential. Could that signal caution for value-seeking investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intesa Sanpaolo Narrative

If these insights do not match your view, or you want to dig into the numbers your way, it only takes a few minutes to shape your own perspective with Do it your way.

A great starting point for your Intesa Sanpaolo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Skip the wait and seize your edge right now. These handpicked lists can reveal hidden winners you do not want to overlook.

- Boost your passive income by reviewing these 19 dividend stocks with yields > 3% offering consistently strong yields above 3% and reliable growth potential.

- Tap into game-changing innovation by assessing these 34 healthcare AI stocks powering the future of medicine and health.

- Ride the next big market trend and spot opportunities using these 80 cryptocurrency and blockchain stocks, targeting leaders in cryptocurrency and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ISP

Intesa Sanpaolo

Provides various financial products and services in Italy, Central/Eastern Europe, the Middle East, and North Africa.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives