A Fresh Look at Intesa Sanpaolo (BIT:ISP) Valuation Following Major State Street Partnership Expansion

Reviewed by Simply Wall St

Intesa Sanpaolo (BIT:ISP) has expanded its long-term partnership with State Street Corporation, agreeing to integrate an IT business unit and outsource custody back-office operations. This operational shift aims to improve efficiency and enhance the scale of custodial services.

See our latest analysis for Intesa Sanpaolo.

The recent expansion of Intesa Sanpaolo’s partnership with State Street comes on the heels of several upbeat developments, including consistent earnings growth guidance and a fresh leadership appointment in its Albanian operations. With a 1-year total shareholder return of nearly 66% and a staggering 3-year total return above 250%, momentum is clearly building. This is further highlighted by a robust year-to-date share price return of over 55%.

If major operational moves like these have you wondering where else the action is, this is a great moment to discover fast growing stocks with high insider ownership.

As the stock continues its impressive climb and guidance remains strong, investors are left to wonder if there is still value to be found, or if the market has already priced in future growth potential.

Most Popular Narrative: 2% Undervalued

With the most widely followed narrative setting fair value at €6.08 and Intesa Sanpaolo closing at €5.98, expectations are slightly ahead of the current market price. This sets the stage for a closer look at what is driving this modest undervaluation.

Continued investment in digital transformation, including cloud migration, AI, and technology platforms, should lead to further operational cost reductions and improved customer reach, supporting higher net margins and long-term bottom-line growth.

What is behind this value boost? The fair value rests on ambitious technology upgrades and shifts in recurring revenue, plus a profit forecast that challenges sector norms. Curious how these factors interact and whether the future multiple justifies today's price? The details do not disappoint.

Result: Fair Value of €6.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on the Italian market and rising competition from digital challengers could quickly shift the outlook or limit Intesa Sanpaolo’s growth trajectory.

Find out about the key risks to this Intesa Sanpaolo narrative.

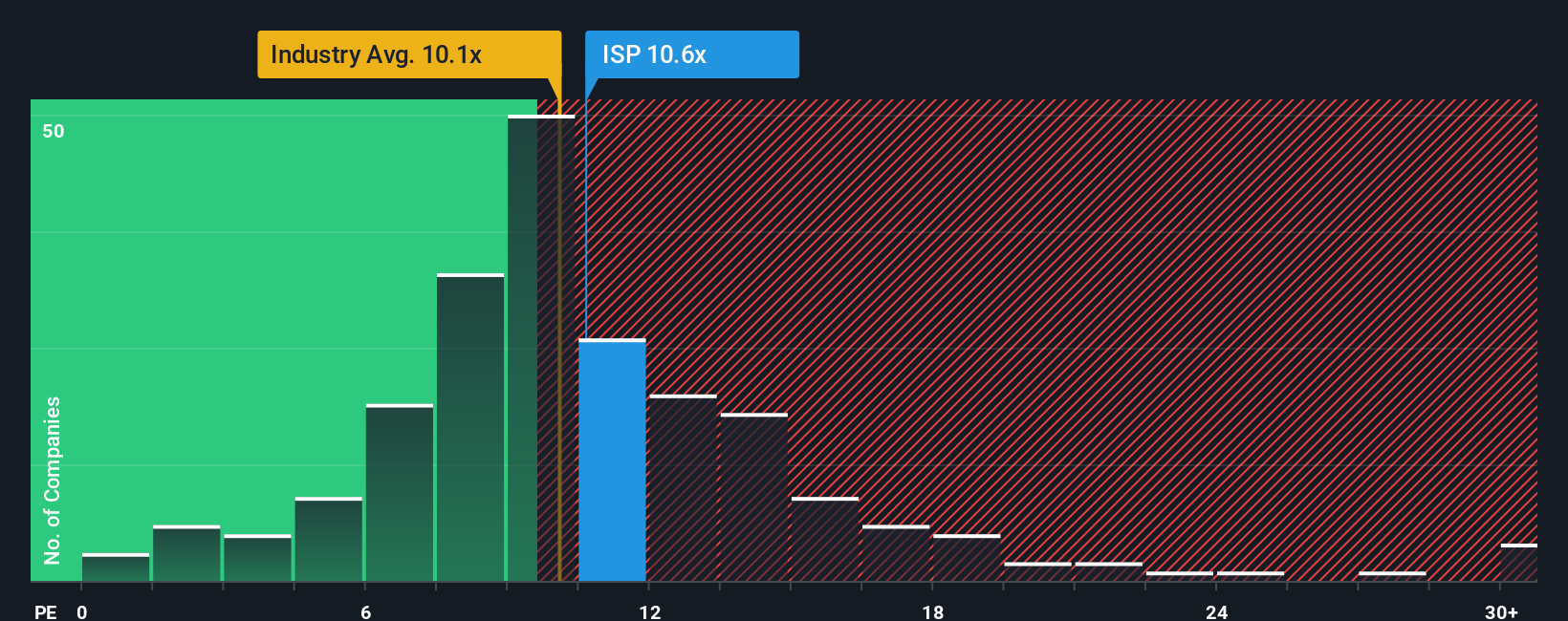

Another View: Multiples Signal Caution

While the fair value analysis paints Intesa Sanpaolo as modestly undervalued, its price-to-earnings ratio sits at 11.6x, which is higher than the European Banks industry average of 10.2x and the fair ratio of 11.1x. This suggests the stock may be a touch expensive compared to peers and industry norms. Could this signal a valuation risk that outweighs the current optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intesa Sanpaolo Narrative

If you are eager to explore the data firsthand or want to develop your own perspective, you can build a personalized narrative in just a few minutes with Do it your way.

A great starting point for your Intesa Sanpaolo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The right opportunities do not wait long. Strengthen your portfolio strategy by acting now. Simply Wall Street’s powerful screener tools help you spot winning trends before the crowd.

- Capture the growth potential of established digital healthcare innovators with these 31 healthcare AI stocks reshaping patient care and medical technology worldwide.

- Unlock powerful passive income possibilities and steady yields by checking out these 15 dividend stocks with yields > 3% that meet rigorous financial criteria.

- Capitalize on rapid sector shifts and market momentum by reviewing these 28 AI penny stocks reshaping global industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ISP

Intesa Sanpaolo

Provides various financial products and services in Italy, Central/Eastern Europe, the Middle East, and North Africa.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives