Those Who Purchased Banca Sistema (BIT:BST) Shares Three Years Ago Have A 48% Loss To Show For It

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Banca Sistema S.p.A. (BIT:BST) shareholders have had that experience, with the share price dropping 48% in three years, versus a market decline of about 15%. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 28% in the same timeframe.

View our latest analysis for Banca Sistema

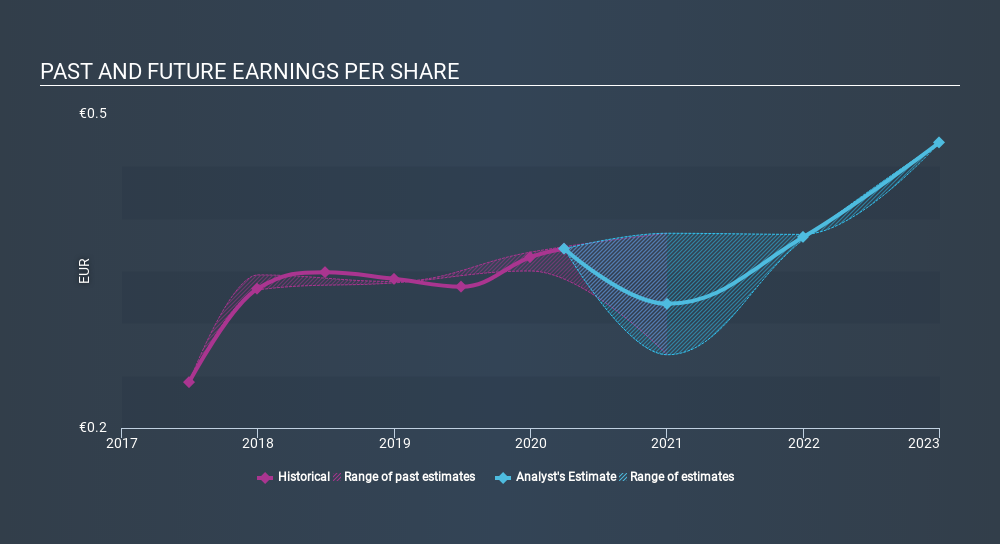

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Banca Sistema the TSR over the last 3 years was -43%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Banca Sistema shareholders may not have made money over the last year, but their total loss of 8.8% ( including dividends) isn't as bad as the market loss of around 8.8%. The one-year return is also not as bad as the 17% per annum loss investors have suffered over the last three years. It is of course not much comfort to know that the losses have slowed. Shareholders will be hoping for a proper turnaround, no doubt. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Banca Sistema that you should be aware of before investing here.

Banca Sistema is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BIT:BST

Banca Sistema

Provides various business and retail banking products and services in Italy.

Very undervalued with proven track record.

Market Insights

Community Narratives