Will Mixed Profit Trends at Monte dei Paschi (BIT:BMPS) Influence Analysts' Confidence in 2025?

Reviewed by Sasha Jovanovic

- Banca Monte dei Paschi di Siena S.p.A. reported third quarter 2025 earnings last week, posting net income of €474 million, up from €406.7 million in the same period last year, while nine-month net income reached €1.37 billion compared to €1.57 billion a year earlier.

- Despite the year-over-year improvement in quarterly earnings, the bank's net income for the first nine months showed a decrease, highlighting shifting profitability trends over 2025.

- We'll review how Banca Monte dei Paschi di Siena's quarterly earnings growth shapes analysts’ expectations for its future performance.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Banca Monte dei Paschi di Siena Investment Narrative Recap

To be a shareholder in Banca Monte dei Paschi di Siena is to believe that the bank can deliver stable profitability, execute on cost and risk control, and potentially benefit from sector consolidation or privatization. The Q3 2025 earnings beat showed improved quarterly profitability but did not materially shift the main short-term catalyst, the ongoing privatization and possible stake sale by the Italian government. The biggest risk remains maintaining earnings momentum as macro trends and sector challenges evolve.

Of the bank’s recent announcements, the update regarding Italy’s required reduction of its ownership in MPS below 20% is particularly relevant. The pace and success of this privatization effort directly affect the bank’s flexibility for strategic moves and shareholder payouts, and may influence market confidence as the story unfolds. However, while the quarterly results provide a positive signal, a change in government stake or market appetite could quickly alter the risk-return balance.

In contrast, one persistent area of concern investors should be aware of is the elevated level of bad loans, which...

Read the full narrative on Banca Monte dei Paschi di Siena (it's free!)

Banca Monte dei Paschi di Siena is expected to reach €4.1 billion in revenue and €1.4 billion in earnings by 2028. This outlook assumes a 4.1% annual revenue growth rate, but earnings are projected to decline by €0.3 billion from current earnings of €1.7 billion.

Uncover how Banca Monte dei Paschi di Siena's forecasts yield a €9.52 fair value, a 10% upside to its current price.

Exploring Other Perspectives

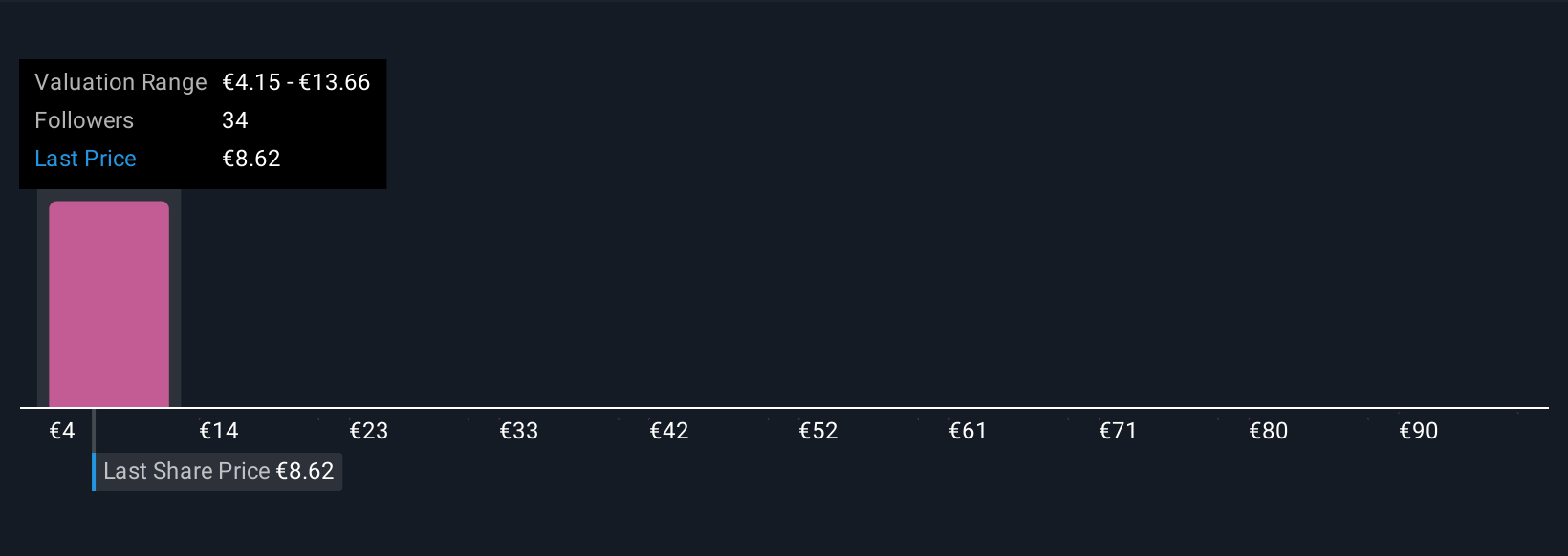

Simply Wall St Community members have published eight fair value estimates for MPS stock, from as low as €4.15 up to €99.27. Strong earnings forecasts are still met by the broader risk that macro trends could slow credit demand and margins, so consider how these varied viewpoints might influence your outlook.

Explore 8 other fair value estimates on Banca Monte dei Paschi di Siena - why the stock might be worth less than half the current price!

Build Your Own Banca Monte dei Paschi di Siena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banca Monte dei Paschi di Siena research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Banca Monte dei Paschi di Siena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banca Monte dei Paschi di Siena's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banca Monte dei Paschi di Siena might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BMPS

Banca Monte dei Paschi di Siena

Provides retail and commercial banking services in Italy.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives