Banco Desio (BIT:BDB): Evaluating Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Banco di Desio e della Brianza (BIT:BDB) has caught the eye of investors after a recent uptick in its share price. There has not been a headline-grabbing event or major announcement; however, the move has sparked discussion about where the stock could head next. This kind of price shift, even without accompanying news, often leads investors to question whether the current market action is signaling an overlooked growth story or simply adjusting to new information.

Looking back over the past year, Banco di Desio e della Brianza has quietly delivered a total return of 57%, with momentum building further in recent months. The shares have climbed 8% over the past quarter and are now up 10% since January. While there have not been significant corporate announcements or sudden changes in fundamentals, these returns have far outpaced broader market trends for the period. This underscores shifting dynamics or perhaps a change in the market’s perception of risk and reward for the bank.

After such a run, the big question for investors is this: Are Banco di Desio e della Brianza shares still offering value, or is the recent rally already factoring in all the future growth?

Price-to-Earnings of 8.7x: Is it justified?

Banco di Desio e della Brianza is currently valued at a price-to-earnings ratio of 8.7 times, which places it below the Italian market average but above the average of its direct peers. This suggests the market is assigning a moderate premium compared to some Italian banks, while still keeping BDB’s valuation more conservative relative to the broader market.

The price-to-earnings ratio, or PE ratio, is a key indicator used to assess how much investors are willing to pay for each euro of earnings. For banks, it offers insight into expectations about future growth and perceived risks unique to the sector.

While BDB’s PE is attractive versus most Italian stocks, it is above the peer average and points to expectations of either above-average stability or financial performance. Investors will want to consider whether this premium is justified by the bank’s recent growth track record or competitive strengths.

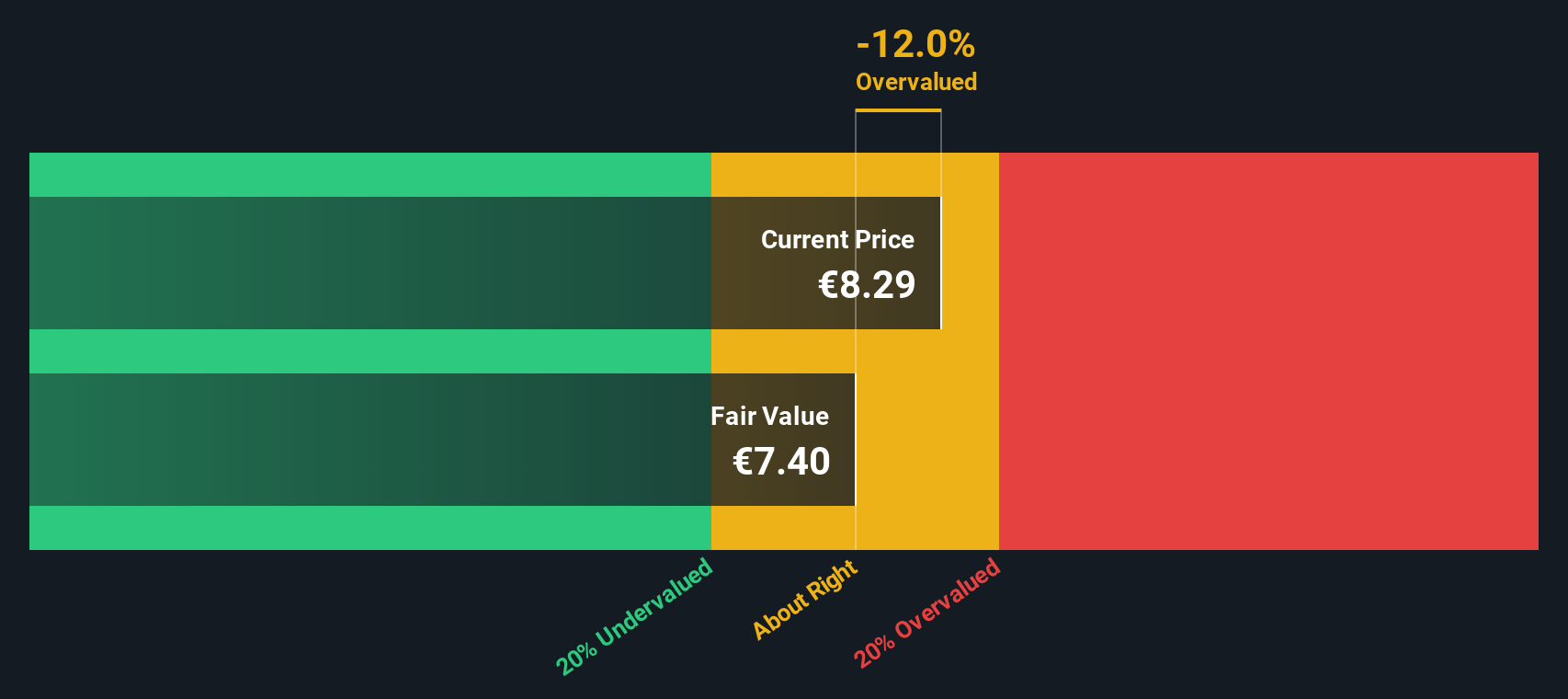

Result: Fair Value of €7.29 (OVERVALUED)

See our latest analysis for Banco di Desio e della Brianza.However, future net income growth remains uncertain. Any negative shifts in the broader Italian banking sector could quickly challenge the current optimism.

Find out about the key risks to this Banco di Desio e della Brianza narrative.Another View: What Does the DCF Model Say?

Looking through the lens of our SWS DCF model offers a different perspective. While the previous ratio points to a premium, this approach suggests Banco di Desio e della Brianza may be trading on the high side as well. Could both methods be overstating the risks, or is caution really needed here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Banco di Desio e della Brianza Narrative

If you are interested in drawing your own conclusions or have a different perspective on Banco di Desio e della Brianza, there is a simple way to build your own analysis in just a few minutes: Do it your way.

A great starting point for your Banco di Desio e della Brianza research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big winner slip through your fingers. With the Simply Wall Street Screener, you can find companies at the forefront of tomorrow’s trends. No matter your strategy, broaden your horizons with powerful data-led insights and act on the opportunities others might miss.

- Tap into market upswings with penny stocks backed by robust financials by checking out penny stocks with strong financials.

- Catch the AI revolution early by targeting up-and-coming innovators in artificial intelligence via AI penny stocks.

- Maximize your investment value by zeroing in on quality stocks trading well below their intrinsic worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco di Desio e della Brianza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BDB

Banco di Desio e della Brianza

Provides banking products and services to individuals and enterprises in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives