Stellantis’ $13 Billion US Expansion Could Be a Game Changer for Stellantis (BIT:STLAM)

Reviewed by Sasha Jovanovic

- Stellantis recently announced a record US$13 billion investment to expand manufacturing in the United States, including reopening its Belvidere, Illinois plant, launching five new vehicles, and shifting Jeep Compass production from Canada to the U.S., with the creation of 5,000 jobs over four states.

- The move has triggered sharp political and legal responses from Canadian leaders over the relocation of manufacturing jobs, highlighting the complex industry effects of cross-border trade policies and automaker commitments.

- We'll assess how this significant U.S. investment and the Jeep production shift could reshape Stellantis' outlook and long-term earnings potential.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Stellantis Investment Narrative Recap

To be a Stellantis shareholder, you need to believe in the company’s ability to leverage its scale and multinational brand portfolio to capture opportunities in key markets, while overcoming margin pressures from tariffs and electrification headwinds. The recent US$13 billion investment to expand US manufacturing addresses the most important short-term catalyst, increasing North American production to offset tariff headwinds, but does not materially diminish the lingering tariff uncertainty, which remains the biggest risk to margins and earnings visibility.

Of the recent announcements, Stellantis’ partnership with Niron Magnetics stands out as particularly relevant, aiming to develop rare-earth-free magnet technology for electric motors. This collaboration could add further momentum to Stellantis’ electrification push, helping reduce supply chain risk just as it increases its US manufacturing footprint, a move that could contribute to long-term competitiveness, even as margin uncertainty persists.

Yet, in contrast, investors should also be aware of the persistent risk that ever-changing US tariff policies present to Stellantis’ future profitability and capital planning...

Read the full narrative on Stellantis (it's free!)

Stellantis' outlook anticipates €175.3 billion in revenue and €7.6 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 6.3% and an increase in earnings of €10.0 billion from the current earnings of €-2.4 billion.

Uncover how Stellantis' forecasts yield a €9.38 fair value, a 6% upside to its current price.

Exploring Other Perspectives

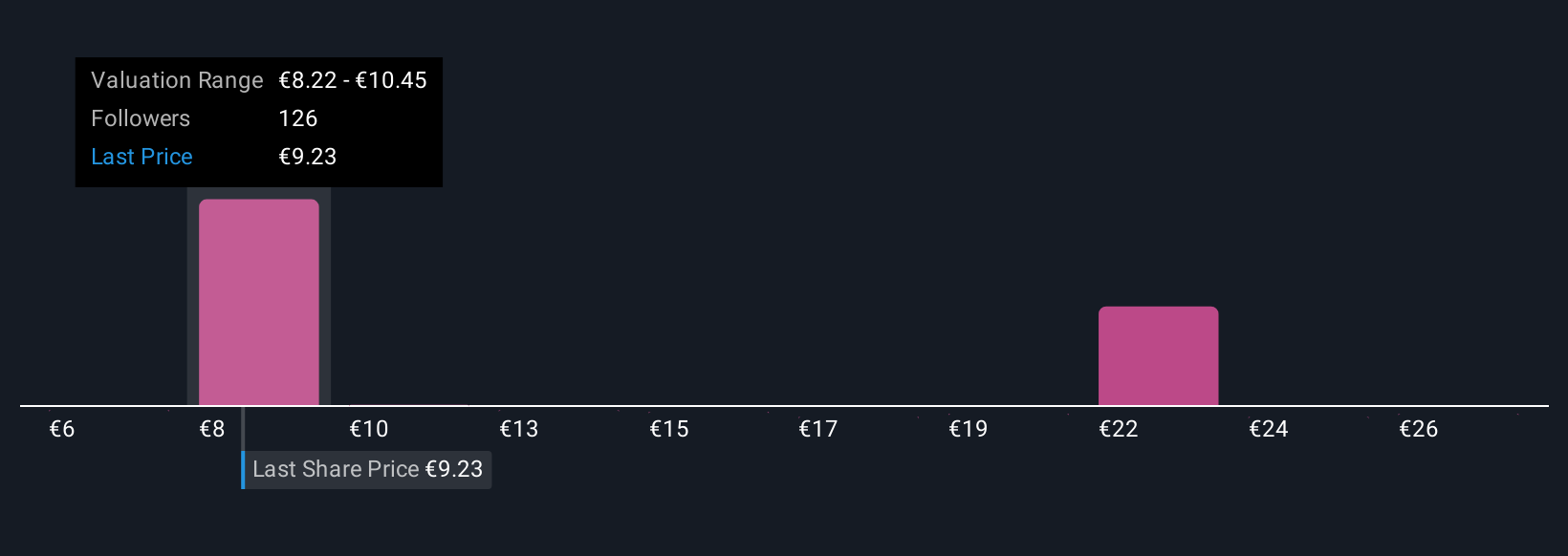

Simply Wall St Community members have mapped out fair value targets for Stellantis ranging from €6 to €28.23, across 30 independent perspectives. Many highlight electrification efforts and US expansion, while others point to tariff volatility as a central factor shaping the company’s performance outlook, explore these alternative viewpoints for broader context.

Explore 30 other fair value estimates on Stellantis - why the stock might be worth 32% less than the current price!

Build Your Own Stellantis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stellantis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Stellantis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stellantis' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:STLAM

Stellantis

Engages in the design, engineering, manufacturing, distribution, and sale of automobiles and light commercial vehicles, engines, transmission systems, metallurgical products, mobility services, and production systems worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives