Ferrari Faces Price Drop as Investors Assess Impact of Recent Stock Slump

Reviewed by Bailey Pemberton

Thinking about what to do with Ferrari stock? You’re not alone. This luxury carmaker has long enjoyed a status most companies could only dream of, both in the showroom and on the stock market. Yet lately, investors have started to ask tougher questions. After all, Ferrari’s share price has taken a bit of a detour, down 1.1% over the last week, sliding 14.0% in the past 30 days, and posting a 16.8% drop year to date. Even more striking, Ferrari shares are off 22.6% in the past year, despite still holding a strong 5-year performance of 119.2%. Those numbers make it clear: the market’s perception of Ferrari’s growth potential and risk has been shifting, influenced by sector-wide uncertainty and heavier debate over what counts as reasonable value for a luxury brand in today’s economic environment.

All these moves have many investors wondering: is Ferrari undervalued after the slump, or just finding a new level? When we put Ferrari through six classic valuation tests, such as price-to-earnings ratios, book value checks, and cash flow measures, it only passes 1 out of 6. That’s not exactly screaming bargain, but there’s nuance here, and numbers never tell the whole story. Next, I’ll walk you through the main valuation approaches that analysts, fund managers, and smart individual investors use. Stick around, though, because at the end we’ll go beyond the basics to explore an even more insightful way to look at Ferrari’s true worth.

Ferrari scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ferrari Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company’s true worth by projecting its future cash flows and then discounting those figures back to today’s value. In simple terms, it asks what Ferrari’s expected future profits in euros are, and what they are worth now.

Ferrari’s most recently reported Free Cash Flow stands at €1.30 billion. According to analysts, that number is expected to grow modestly each year, reaching around €1.52 billion in 2026 and climbing to an extrapolated €2.49 billion by 2035. The DCF calculation uses these projections, combined with a longer-term growth assumption, to estimate the total value of all future cash Ferrari is likely to generate.

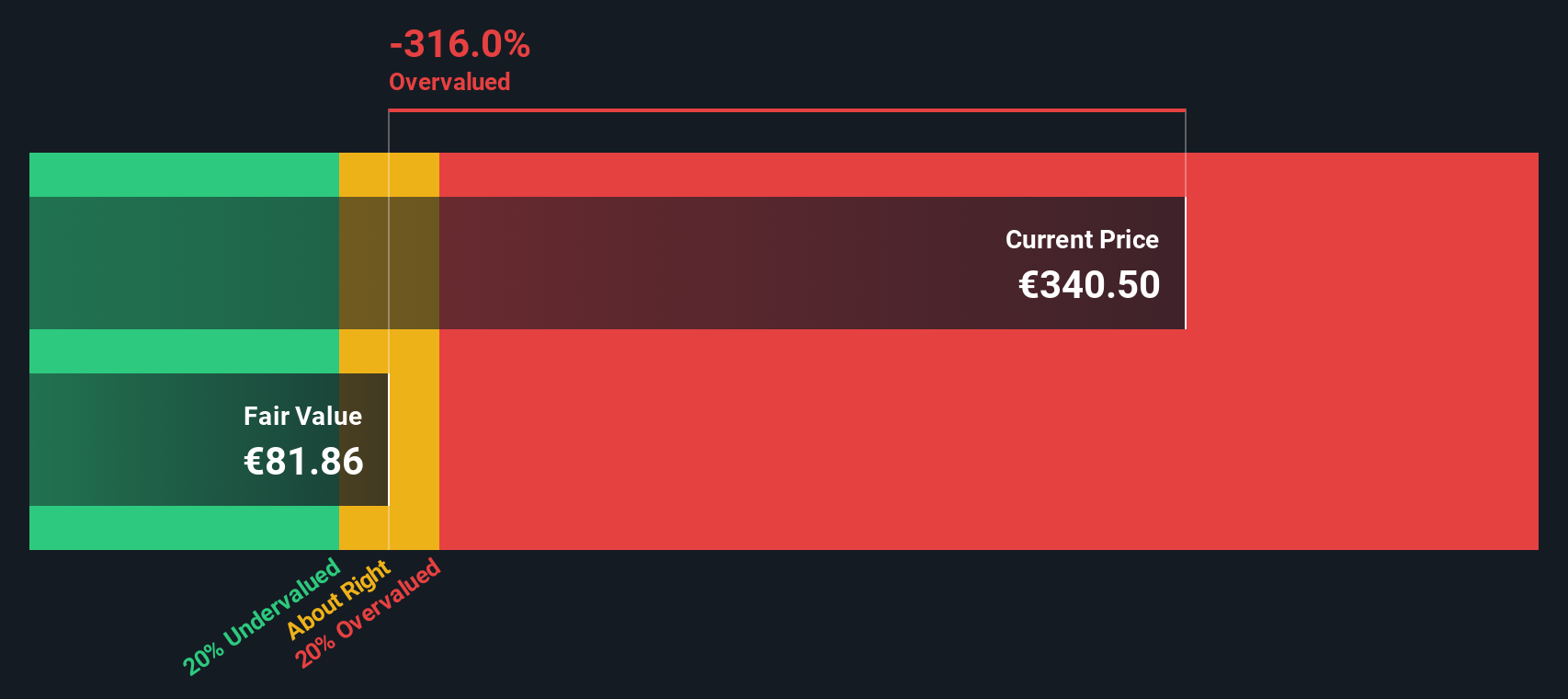

This 2 Stage Free Cash Flow to Equity model points to an intrinsic value for Ferrari of €81.86 per share. However, this figure reflects a 316.0% premium to the DCF estimate, meaning the share price is dramatically higher than what fundamentals suggest is fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ferrari may be overvalued by 316.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ferrari Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like Ferrari because it connects the share price to the company’s bottom-line earnings. Investors use this metric to help determine what they’re paying for each euro of Ferrari’s profits, and it’s a quick reference point for comparing one company to another.

It’s important to note that “normal” or “fair” PE ratios can vary depending on expectations for future growth and perceived risk. Fast-growing, stable businesses tend to command higher PE ratios from the market, while slower or riskier names typically trade with lower multiples.

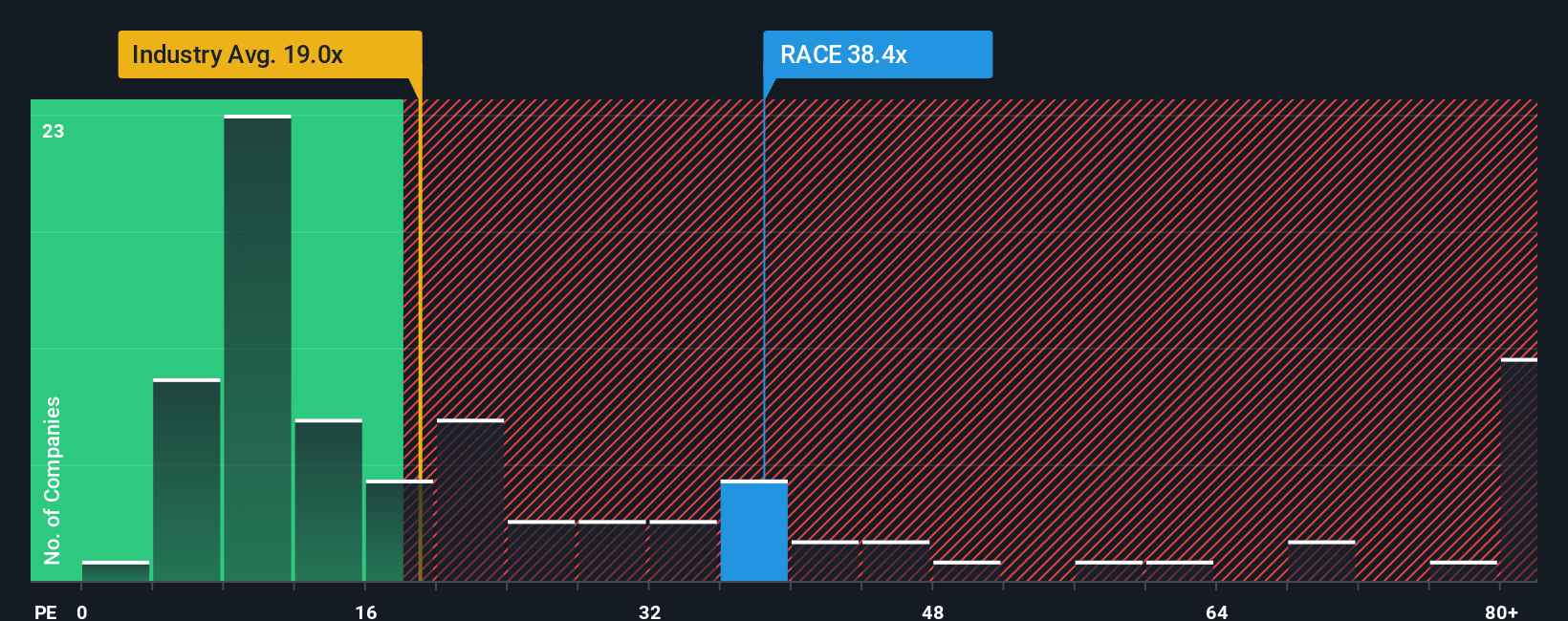

Ferrari currently trades at a PE ratio of 38.0x. Compared to the auto industry average of 18.4x or its peer group’s 14.5x, Ferrari looks considerably expensive on a surface level. However, multiples alone do not tell the complete story. Premium brands often warrant premium pricing due to better growth prospects and stronger profit margins.

Simply Wall St’s proprietary “Fair Ratio” digs deeper by considering Ferrari’s specific earnings growth, profit margins, industry dynamics, and market cap. Unlike raw peer or industry comparisons, the Fair Ratio offers a more tailored benchmark and captures why quality businesses sometimes deserve higher valuations. For Ferrari, the Fair Ratio is 19.6x, which is about half its current PE.

Since Ferrari’s actual PE is nearly double its Fair Ratio, this method also suggests Ferrari shares are running well ahead of their fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ferrari Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized investment story, an approach where you connect your outlook on Ferrari’s business model, growth opportunities, and risks to forecasts for revenue, profit margins, and ultimately, your own fair value estimate.

Unlike traditional models that just focus on static numbers or conventional ratios, Narratives link the company’s unique story directly to a financial forecast and a valuation, making your investment thesis clear and actionable.

With Simply Wall St’s Community Narratives, used by millions of investors, you can explore a range of perspectives on Ferrari, test your assumptions against those of other investors, and see in real time how updated news, earnings, or market developments change fair value estimates. Narratives are easily accessed and created on the Simply Wall St Community page, so anyone can weigh in and build their view, from bullish to bearish, without needing to be a finance expert.

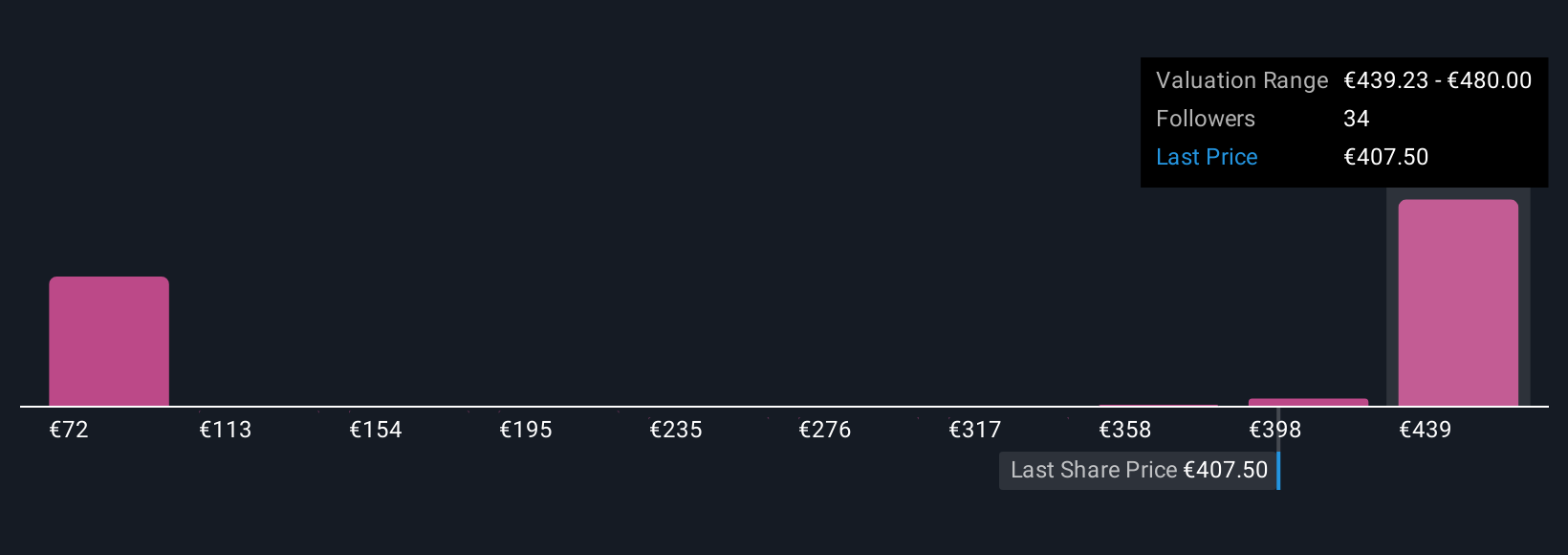

These dynamic Narratives help you decide whether to buy or sell by comparing your Fair Value (based on your forecasts and beliefs) to today’s share price. For example, different investors currently see Ferrari’s fair value anywhere from €380 to €548 per share, showing just how much your story and expectations can change your investment decision.

Do you think there's more to the story for Ferrari? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives