Ferrari (BIT:RACE) Valuation in Focus After Strategic Reset and Sharply Lower Electric Vehicle Targets

Reviewed by Kshitija Bhandaru

Ferrari (BIT:RACE) made headlines after its Capital Markets Day, revealing new strategic and financial guidance. The company raised its 2025 revenue outlook; however, a softer long-term forecast and lower electric vehicle targets weighed on investor sentiment.

See our latest analysis for Ferrari.

The share price reaction was swift after Ferrari’s cautious long-term outlook and halving of its electric vehicle target. Shares have tumbled nearly 16% in the past month, leaving the year-to-date share price return at -16% and total shareholder return over the past year at -21%. Momentum has sharply reversed recently, even though Ferrari’s three- and five-year total shareholder returns remain strongly positive. This reflects resilience over longer horizons.

If Ferrari’s sudden shift has you thinking about other automakers, this is an ideal moment to discover See the full list for free.

Given the stock’s steep pullback and new, more tempered strategy, investors are left debating: Is Ferrari now trading at an attractive level, or are future growth prospects already fully reflected in its price?

Most Popular Narrative: 23.1% Undervalued

The most closely tracked narrative puts Ferrari’s fair value at €447.87, noticeably above its last closing price of €344.20. This suggests that, in the eyes of those following this consensus, the recent market pullback has left Ferrari undervalued against its projected future earnings, global demand, and strategic positioning.

Expanding the model lineup (for example, Amalfi, 296 Speciale, increased customization and personalization offerings) is successfully attracting new ultra-high-net-worth clients globally, especially in underpenetrated regions like China. This supports future revenue growth, ASP improvements, and long order backlog visibility.

Ferrari’s current valuation rests on more than sheer brand power. This widely followed narrative hints at rising margins, bullish revenue assumptions, and a future profit multiple that breaks away from industry norms. Want to know what bold financial projections drive such a leap in value? The full story is only a click away.

Result: Fair Value of €447.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower electrification progress and shifting luxury demand patterns could present challenges to Ferrari’s future growth and may put pressure on its profit margins.

Find out about the key risks to this Ferrari narrative.

Another View: Price-to-Earnings Ratios Say Ferrari Is Overvalued

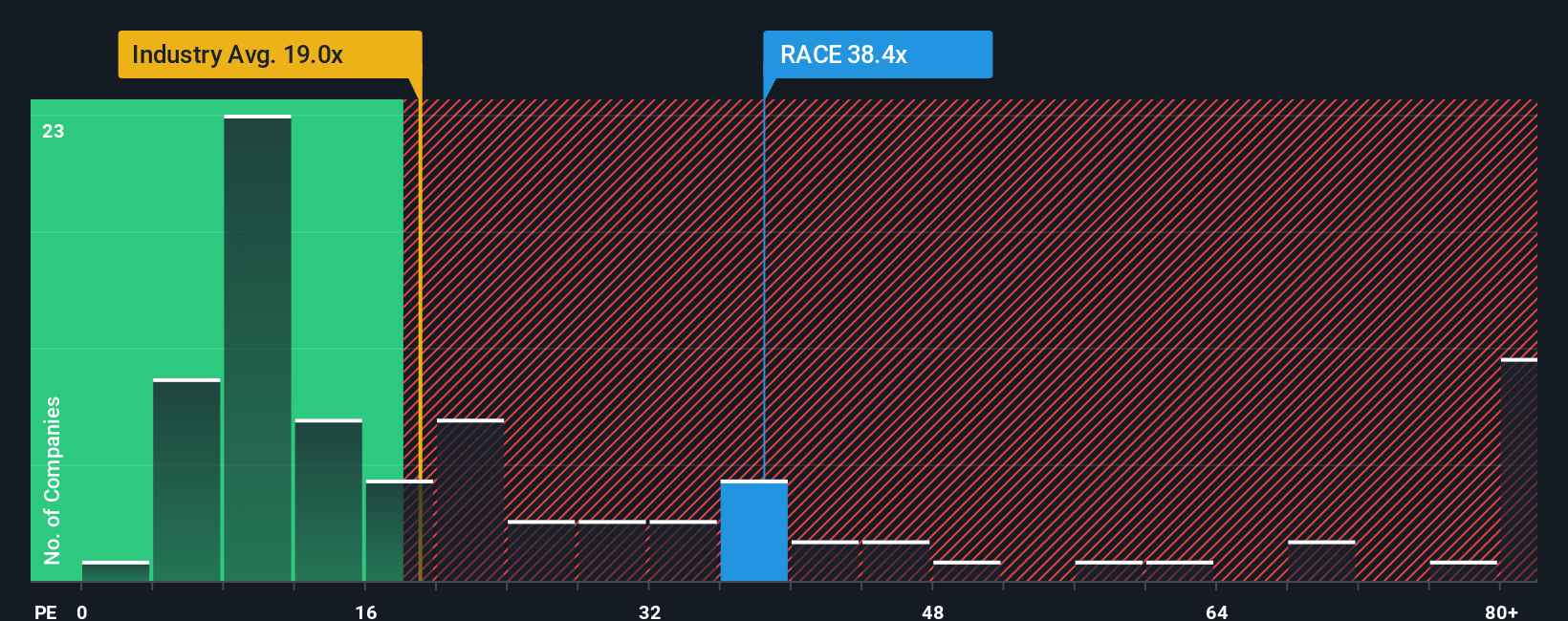

While the consensus sees Ferrari as undervalued, its current price-to-earnings ratio is 38.4x. This figure is much higher than both the global auto industry average of 19x and its peer average of 14.3x, and even exceeds the fair ratio, which stands at 19.9x. Such a large gap signals that Ferrari's shares carry significant valuation risk if expectations stumble, or does this premium simply reflect its exceptional brand strength?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you’d rather form your own conclusions, the tools here let you explore Ferrari’s data directly and craft a personalized outlook in just minutes. Do it your way

A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors rarely stop at one opportunity. Tap into broader market moves and stay ahead by targeting companies that match your strategy before the crowd does.

- Unlock the potential for steady income by reviewing opportunities with these 19 dividend stocks with yields > 3%, focusing on companies delivering 3%+ yields and robust payout histories.

- Seize rapid growth prospects from emerging technologies by exploring these 24 AI penny stocks, which highlights firms leveraging artificial intelligence breakthroughs in tomorrow’s markets.

- Capitalize on hidden value that others might overlook through these 890 undervalued stocks based on cash flows, where selections are made based on strong fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives