Ferrari (BIT:RACE) Valuation Check After New €3.5b Buyback and Post-Guidance Share Price Slide

Reviewed by Simply Wall St

Ferrari (BIT:RACE) just wrapped up its €2 billion buyback a year early and immediately rolled out a new €3.5 billion program through 2030, right after guidance cuts knocked the stock sharply lower.

See our latest analysis for Ferrari.

The sharp October reset in expectations explains why the 1 month share price return is down 12.6 percent and the year to date share price return is off 23.1 percent. At the same time, the 5 year total shareholder return of about 74.5 percent still reflects Ferrari’s long term compounding power. This suggests that momentum has clearly cooled in the short run, while the long term story remains intact.

If this pullback has you rethinking where you hunt for quality auto names, it could be a good moment to explore other performance driven manufacturers via auto manufacturers.

With the stock still trading well below its highs despite resilient growth and fresh buybacks, the key question now is whether Ferrari is finally attractively valued for long term investors or if the market is correctly pricing in slower future gains.

Most Popular Narrative: 22.2% Undervalued

With Ferrari last closing at €314.5 against a narrative fair value of about €404, the latest consensus frames the recent selloff as opportunity, not a broken story.

The ramp up of high margin, recurring revenue streams from brand sponsorships, lifestyle, and personalization fueled by lifestyle activities, racing events, and growing global brand desirability will further enhance margin accretion, drive resilient long term earnings, and reduce reliance on car sales volume alone. Ongoing investments in innovation (e.g., electrification, new manufacturing/paint facilities, and cross sector technology transfers like the Hypersail project) both future proof the business and leverage secular trends towards luxury experiential goods, likely resulting in higher capital efficiency and supporting sustainable earnings growth over the next cycle.

To see what kind of revenue climb and profit expansion are reflected in this view, and why the future earnings multiple is being compared more to a luxury tech name than an automaker, explore the full narrative to understand the assumptions behind that fair value.

Result: Fair Value of €404.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower electrification progress and shifting luxury demand patterns could pressure Ferrari’s margins and pricing power, challenging the bullish long term narrative.

Find out about the key risks to this Ferrari narrative.

Another Way to Look at Value

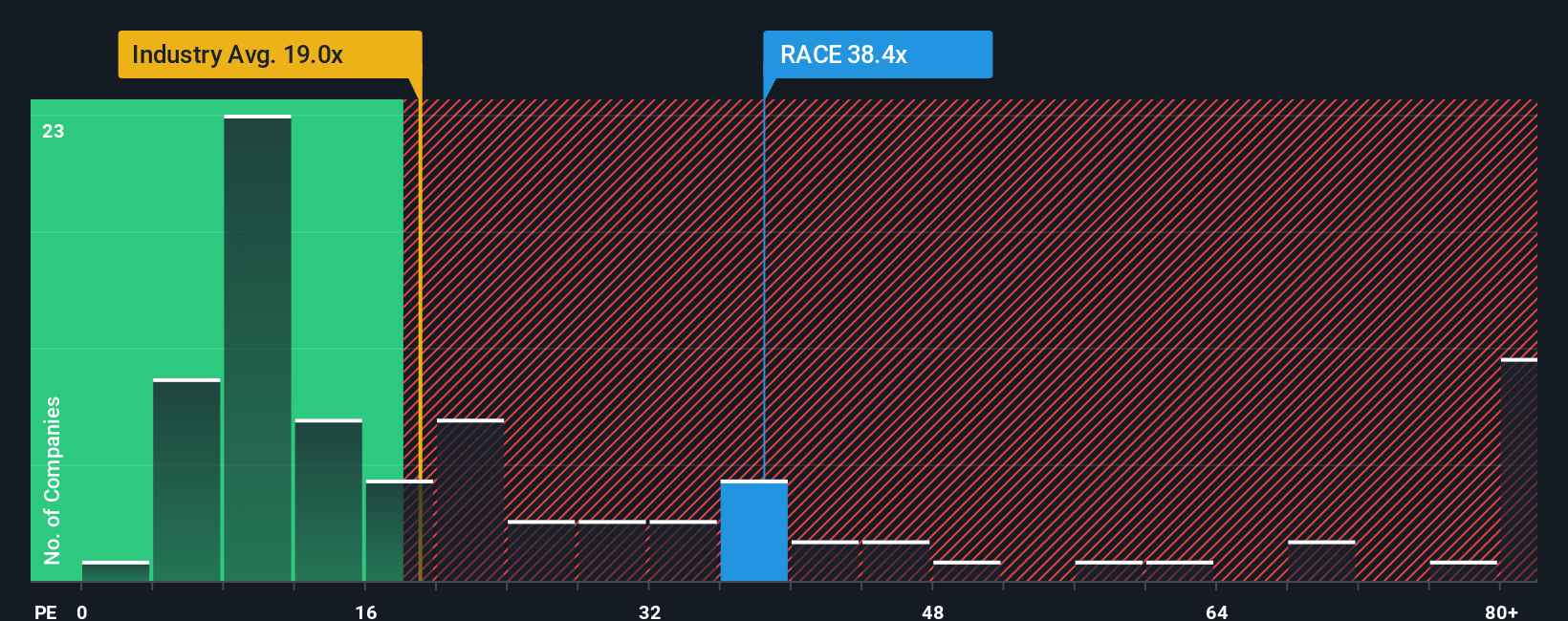

On a simple earnings multiple, Ferrari looks anything but cheap. It trades on a P E of 34.8 times versus 18.4 times for the global Auto industry and 17.6 times for peers, while our fair ratio sits nearer 19.7 times. Is the brand premium worth that valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Ferrari when you can tap into fresh opportunities; use the Simply Wall Street Screener to uncover focused, data driven stock ideas.

- Target income potential by scanning these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow while markets stay volatile.

- Ride powerful innovation trends by evaluating these 25 AI penny stocks that may benefit most as artificial intelligence adoption accelerates worldwide.

- Position yourself ahead of the crowd by reviewing these 80 cryptocurrency and blockchain stocks shaping the next phase of digital finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion