Ferrari (BIT:RACE): Assessing Valuation After Recent Outperformance in Auto Sector

Reviewed by Kshitija Bhandaru

See our latest analysis for Ferrari.

Ferrari’s recent 7-day share price return of 5% stands out in the auto sector, reflecting investor optimism after a year of steady momentum and strong brand-driven performance. The company’s 12-month total shareholder return reinforces a picture of reliable long-term value creation, with momentum building as strategic updates and sector trends catch the market’s attention.

If the recent rally in Ferrari’s stock has you watching the entire auto space, you might want to see which other automakers are making moves via our See the full list for free.

With Ferrari’s stock up and its fundamentals strong, the key question is whether today’s share price reflects all of its growth potential, or if recent gains mean there is still a buying opportunity for investors.

Most Popular Narrative: 4.7% Undervalued

With Ferrari's narrative fair value at €447.87, just above its last close at €426.9, expectations are riding high on future growth drivers that could justify a modest premium.

Expanding the model lineup (for example, Amalfi, 296 Speciale, increased customization and personalization offerings) is successfully attracting new ultra-high-net-worth clients globally, especially in underpenetrated regions like China. This supports future revenue growth, average selling price improvements, and long order backlog visibility.

Curious what makes this valuation tick? The answer lies not just in premium car sales, but in global momentum, deep product customization, and ambitious expansion into new markets. Discover which bold financial targets and luxury trends are driving analysts’ optimism. Only the full narrative reveals the numbers and their impact.

Result: Fair Value of €447.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected progress in electrification and potential demand shifts among luxury buyers could challenge Ferrari’s ambitious growth outlook.

Find out about the key risks to this Ferrari narrative.

Another View: What Do Market Multiples Suggest?

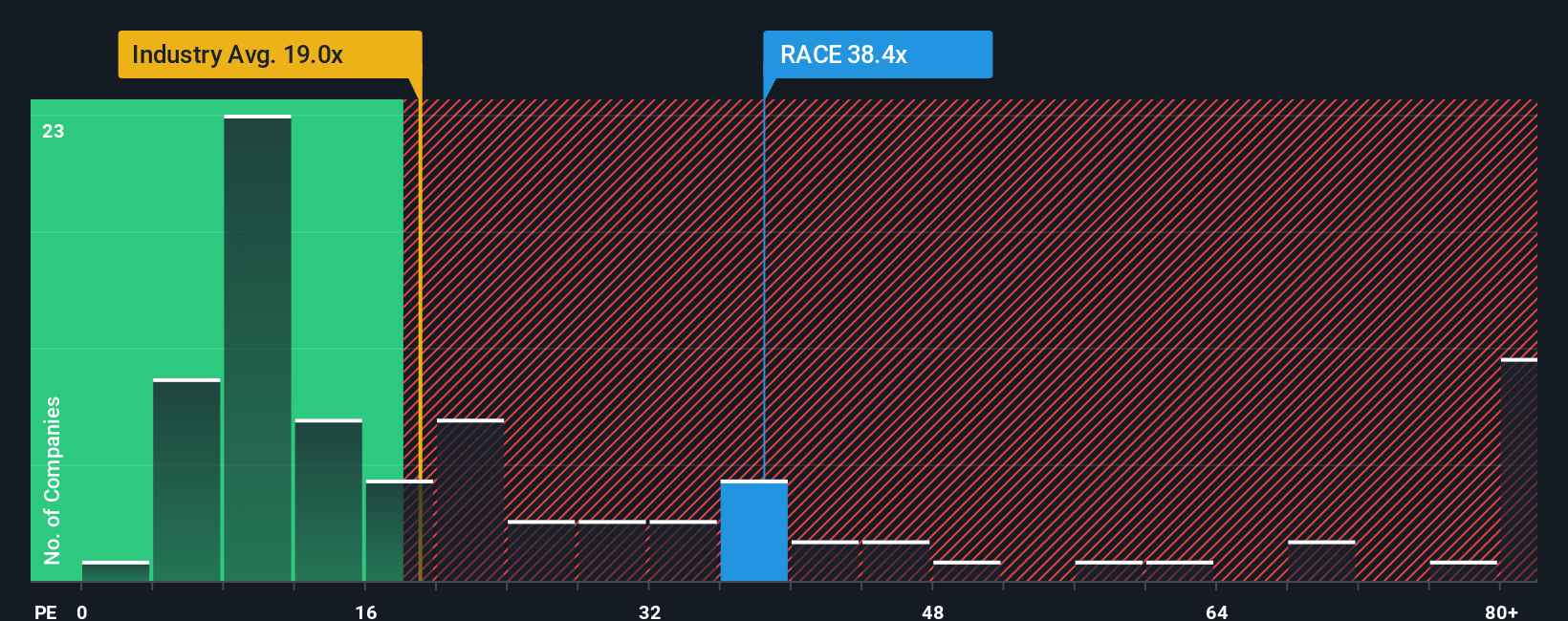

While the narrative perspective sees Ferrari as slightly undervalued, market multiples tell a more cautious story. Ferrari trades at a price-to-earnings ratio of 47.6x, which is far higher than its peers (14.5x), the global auto sector (18x), and above the fair ratio of 20.2x. This sizable premium highlights considerable valuation risk if the market reassesses growth expectations. Are investors overpaying for the Ferrari name, or will future results justify the lofty price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you have a different perspective, or want to dive into the numbers yourself, you can easily build a custom narrative in just a few minutes. Do it your way

A great starting point for your Ferrari research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for new opportunities. Don’t let hidden winners slip past you. Get ahead by tapping into handpicked stock ideas below.

- Unlock big potential gains in the market by jumping into these 896 undervalued stocks based on cash flows that trade below their intrinsic worth and could be ready for a re-rating.

- Capitalize on rapid breakthroughs in healthcare technology by reviewing these 31 healthcare AI stocks making waves in AI-powered medical advancements and diagnostics.

- Boost your portfolio’s income with consistent payouts from these 19 dividend stocks with yields > 3% offering yields above 3%, perfect for balancing growth and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives