- Italy

- /

- Auto Components

- /

- BIT:PIRC

Pirelli (BIT:PIRC): Assessing Valuation Following New Tyre Launches and Motorsport Wins

Reviewed by Kshitija Bhandaru

Pirelli & C (BIT:PIRC) has been busy, unveiling the Scorpion XC RH mountain bike tyre and the Cinturato Winter 3 for sedans and crossovers. The company also clinched wins in the FIA European Rally Championship for tyre suppliers. These developments highlight ongoing innovation and performance across their core business segments.

See our latest analysis for Pirelli & C.

Even with Pirelli rolling out fresh tyre innovations and clinching major motorsport wins, momentum in its share price has been steady rather than rapid. The stock is up 8.41% so far this year and has delivered a 17.27% total shareholder return over the past twelve months, which underscores enduring value for patient investors as performance compounds over time.

If you’re interested in other players transforming the roads, take your search further and explore See the full list for free.

With steady results and new product launches, investors are left to wonder whether Pirelli’s current share price reflects genuine value, or if the market has already factored in all the growth anticipated in the future.

Most Popular Narrative: 11% Undervalued

The most followed narrative sees Pirelli & C as trading at a noticeable gap to its consensus fair value, with the latest close substantially below analyst forecasts. This shapes a storyline focused on growth drivers that could help the market re-rate the stock.

Accelerating innovation and capacity conversion toward premium and EV-compatible tires, including expanding high-value manufacturing in Brazil and leading homologations with top OEMs and electric carmakers, positions Pirelli to capture growth from increased demand for advanced, durable tires, supporting future revenues and average selling price.

Curious what bold projections back this view? The full narrative peels back the layers on earnings upgrades and margin expansion, revealing the unexpected math that powers Pirelli’s valuation leap. Don’t miss the details market watchers are buzzing about.

Result: Fair Value of €6.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and exposure to global tariffs may undermine margin expansion and challenge the premium growth story if conditions worsen.

Find out about the key risks to this Pirelli & C narrative.

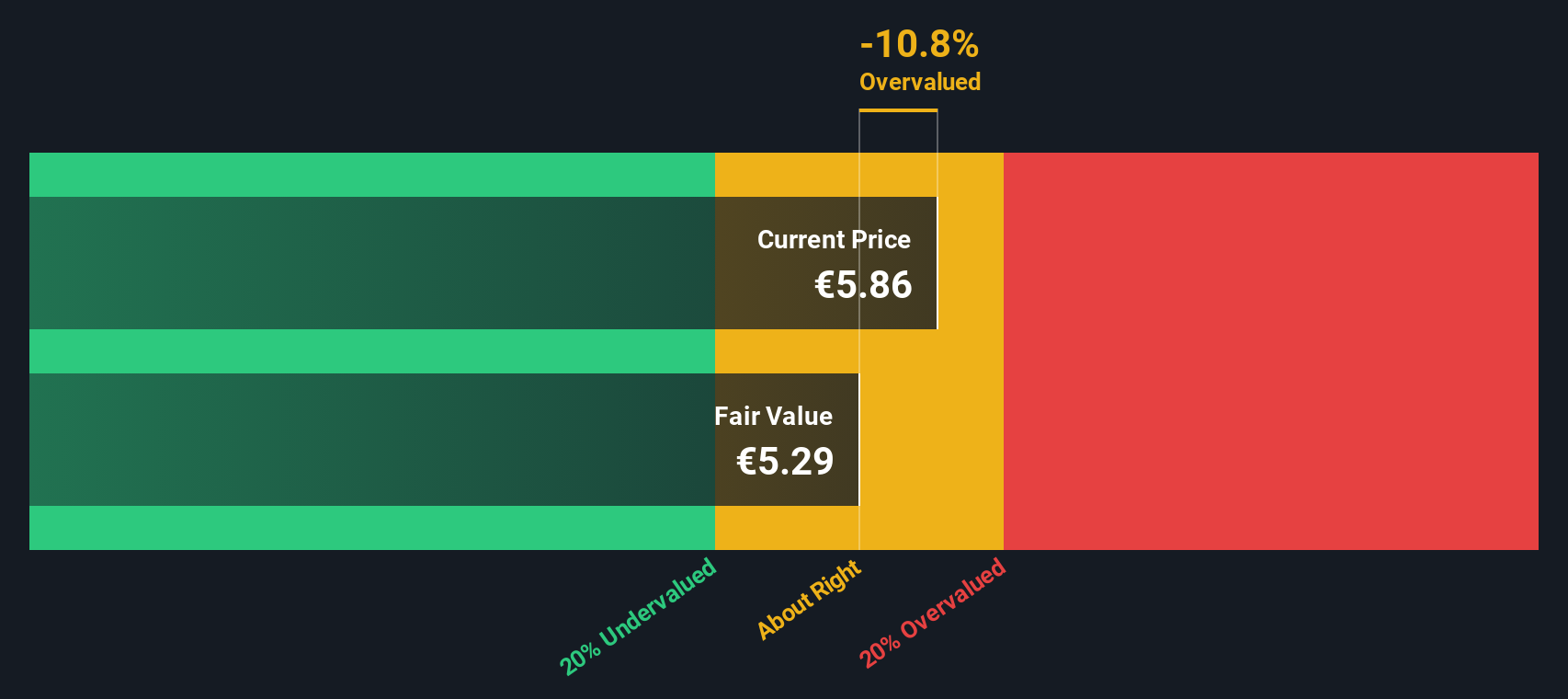

Another Perspective: SWS DCF Model Weighs In

While market watchers see value from one angle, our DCF model presents a different picture. According to this approach, Pirelli is currently trading above its estimated fair value. This could signal less upside than some expect and raises the question of whether short-term optimism might be outpacing fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pirelli & C for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pirelli & C Narrative

If you prefer a hands-on approach or want to reach your own conclusions, you can craft a personal narrative from the latest data in just a few minutes: Do it your way

A great starting point for your Pirelli & C research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know a great opportunity rarely waits. Make your next move count by checking out these proven strategies and unlock hidden winners before the crowd moves in.

- Boost your passive income when you tap into these 18 dividend stocks with yields > 3% that consistently deliver juicy yields above 3%. This can be ideal for building wealth steadily.

- Embrace the frontier of computing and advance your portfolio with these 26 quantum computing stocks, which is set to disrupt industries with breakthrough technologies.

- Ride the momentum in artificial intelligence by targeting these 25 AI penny stocks poised for growth and leadership in tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PIRC

Pirelli & C

Manufactures and supplies tires for cars, motorcycles, and bicycles in Europe, North America, the Asia-Pacific, South America, Russia, and the MEAI.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.