- Italy

- /

- Auto Components

- /

- BIT:PIRC

How Investors May Respond To Pirelli & C (BIT:PIRC) Showcasing Cyber Tyre and Launching New Products

Reviewed by Sasha Jovanovic

- In recent weeks, Pirelli has unveiled several product and technology milestones, including the launch of its fastest mountain bike tire Scorpion XC RH, the debut of the all-weather P Zero Race 4S TLR, and its award-winning Cyber Tyre system that will be integrated with future Aston Martin models.

- The company's advancements in intelligent and sustainable tire solutions, demonstrated by awards and collaborations with leading luxury automakers, highlight its ongoing expansion in innovation and premium mobility markets.

- We'll explore how Pirelli's award-winning Cyber Tyre innovation and new product launches may influence its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Pirelli & C Investment Narrative Recap

For anyone considering Pirelli & C., the central investment premise revolves around sustained leadership in premium and innovation-driven mobility, supported by pioneering products and technology partnerships. While recent product launches and technology awards reinforce brand value and premium positioning, they are unlikely to materially shift the most immediate catalyst, premium tire homologation and EV market penetration, or offset key short-term risks such as exposure to U.S. trade policy and raw material cost pressures.

Among the new announcements, Pirelli's Cyber Tyre technology stands out as especially relevant. Its integration into upcoming Aston Martin models not only strengthens ties with prestige OEMs, a growth catalyst, but also highlights Pirelli's potential to capture new revenue streams from connected vehicle technologies, an area many see as critical for future margin expansion.

However, despite this momentum, investors should be aware that ongoing U.S. tariffs and limited production localization continue to present...

Read the full narrative on Pirelli & C (it's free!)

Pirelli & C's outlook anticipates €7.2 billion in revenue and €646.4 million in earnings by 2028. This implies a 0.5% annual revenue decline and a €147.5 million earnings increase from current earnings of €498.9 million.

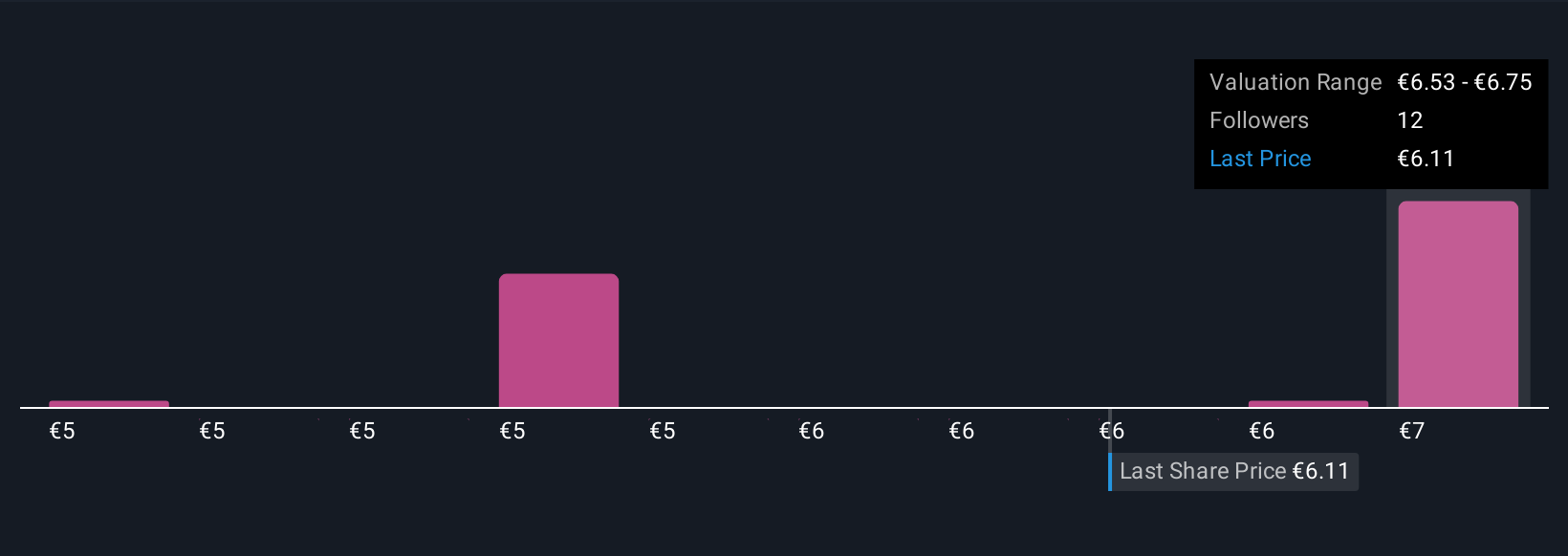

Uncover how Pirelli & C's forecasts yield a €6.75 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed five fair value estimates for Pirelli & C., ranging from €4.50 to €6.75 per share. As many focus on premium tire innovation and the risks in trade policy, these varied perspectives invite you to compare several viewpoints on what could influence Pirelli's performance next.

Explore 5 other fair value estimates on Pirelli & C - why the stock might be worth as much as 12% more than the current price!

Build Your Own Pirelli & C Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pirelli & C research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pirelli & C research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pirelli & C's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PIRC

Pirelli & C

Manufactures and supplies tires for cars, motorcycles, and bicycles in Europe, North America, the Asia-Pacific, South America, Russia, and the MEAI.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives