- Italy

- /

- Auto Components

- /

- BIT:PIRC

Did Aston Martin Deal Just Shift Pirelli & C's (BIT:PIRC) Smart Tire Innovation Narrative?

Reviewed by Simply Wall St

- On September 11, 2025, Aston Martin announced a collaboration with Pirelli to integrate Pirelli's exclusive Cyber Tyre technology – which uses tire-embedded sensors to collect real-time data for enhanced vehicle performance – into its upcoming ultra-luxury sports cars.

- This partnership signals a step forward in connected automotive technology, highlighting Pirelli's growing influence in the ultra-premium vehicle segment through advanced tire integration.

- We'll explore how Pirelli's Cyber Tyre partnership with Aston Martin could shape its position in smart tire innovation and premium markets.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Pirelli & C Investment Narrative Recap

To be a shareholder in Pirelli & C, you need to believe in the company’s ability to maintain leadership in high-value, technologically advanced tires for luxury and premium vehicles, while managing exposure to economic cycles and global supply chain challenges. The new Cyber Tyre partnership with Aston Martin reinforces Pirelli’s smart tire innovation edge, yet the most pressing near-term catalyst, further penetration of the premium EV and connected vehicle market, remains fundamentally unchanged, while risks tied to U.S. tariffs and manufacturing flexibility persist.

Pirelli’s July launch of its >70% bio-based P Zero tire, certified for JLR, stands out as very relevant. This complements the Aston Martin announcement by demonstrating Pirelli’s focus on both sustainability and cutting-edge tire technology, themes crucial to maintaining premium segment demand and supporting margin expansion catalysts.

On the flip side, investors should be aware that tariffs and supply chain constraints could still...

Read the full narrative on Pirelli & C (it's free!)

Pirelli & C's outlook anticipates €7.2 billion in revenue and €646.4 million in earnings by 2028. This is based on a -0.5% annual revenue decline and a €147.5 million increase in earnings from the current €498.9 million.

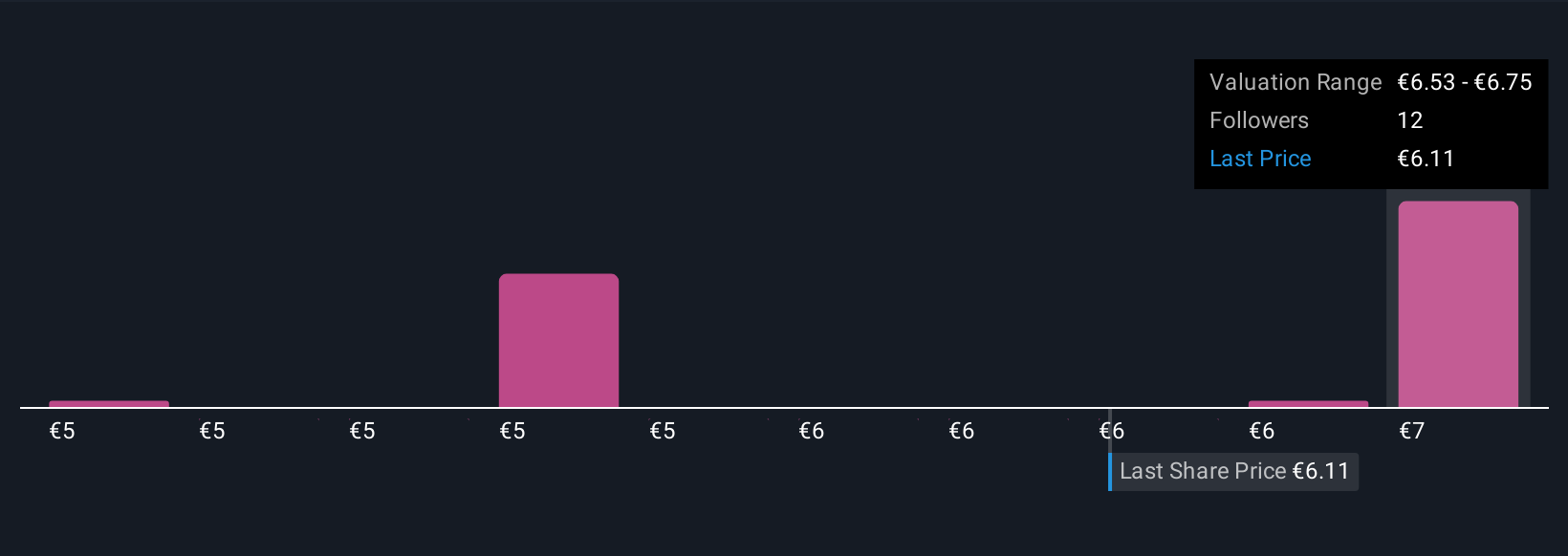

Uncover how Pirelli & C's forecasts yield a €6.75 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Pirelli’s fair value between €4.50 and €6.75, offering a wide spectrum of views. While many see promise in the company’s premium and EV tire innovation, ongoing tariff risks highlight why it’s essential to weigh several perspectives before making decisions.

Explore 5 other fair value estimates on Pirelli & C - why the stock might be worth as much as 11% more than the current price!

Build Your Own Pirelli & C Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pirelli & C research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pirelli & C research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pirelli & C's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PIRC

Pirelli & C

Manufactures and supplies tires for cars, motorcycles, and bicycles in Europe, North America, the Asia-Pacific, South America, Russia, and the MEAI.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives