Sjóvá-Almennar tryggingar hf. (ICE:SJOVA) Passed Our Checks, And It's About To Pay A Kr3.14 Dividend

Sjóvá-Almennar tryggingar hf. (ICE:SJOVA) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase Sjóvá-Almennar tryggingar hf's shares before the 14th of March in order to be eligible for the dividend, which will be paid on the 30th of March.

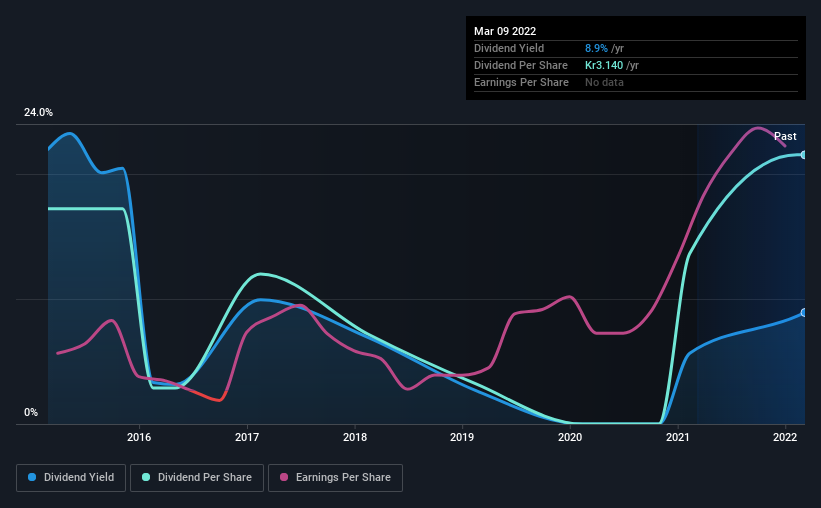

The company's next dividend payment will be Kr3.14 per share. Last year, in total, the company distributed Kr3.14 to shareholders. Calculating the last year's worth of payments shows that Sjóvá-Almennar tryggingar hf has a trailing yield of 8.9% on the current share price of ISK35.2. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Sjóvá-Almennar tryggingar hf has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Sjóvá-Almennar tryggingar hf

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Sjóvá-Almennar tryggingar hf paid out a comfortable 43% of its profit last year.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Sjóvá-Almennar tryggingar hf paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see Sjóvá-Almennar tryggingar hf's earnings have been skyrocketing, up 35% per annum for the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Sjóvá-Almennar tryggingar hf has delivered 3.3% dividend growth per year on average over the past seven years. Earnings per share have been growing much quicker than dividends, potentially because Sjóvá-Almennar tryggingar hf is keeping back more of its profits to grow the business.

Final Takeaway

Should investors buy Sjóvá-Almennar tryggingar hf for the upcoming dividend? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. We think this is a pretty attractive combination, and would be interested in investigating Sjóvá-Almennar tryggingar hf more closely.

While it's tempting to invest in Sjóvá-Almennar tryggingar hf for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 1 warning sign for Sjóvá-Almennar tryggingar hf you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ICSE:SJOVA

Sjóvá-Almennar tryggingar hf

An insurance company, provides property and life insurance in Iceland.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.