The one-year underlying earnings growth at Íslandsbanki hf (ICE:ISB) is promising, but the shareholders are still in the red over that time

It's easy to feel disappointed if you buy a stock that goes down. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. The Íslandsbanki hf. (ICE:ISB) is down 12% over a year, but the total shareholder return is -7.8% once you include the dividend. And that total return actually beats the market decline of 11%. We wouldn't rush to judgement on Íslandsbanki hf because we don't have a long term history to look at.

If the past week is anything to go by, investor sentiment for Íslandsbanki hf isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Íslandsbanki hf

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Íslandsbanki hf share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Íslandsbanki hf's dividend seems healthy to us, so we doubt that the yield is a concern for the market. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

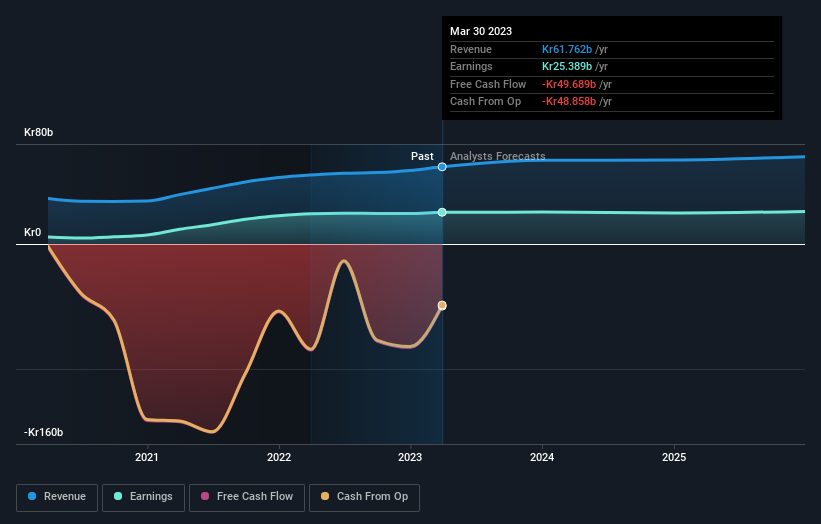

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Íslandsbanki hf will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Íslandsbanki hf's TSR for the last 1 year was -7.8%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's not great that Íslandsbanki hf shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 7.8%, including dividends, wasn't as bad as the broader market loss of about 11%. The falls have continued up until the last quarter, with the share price down 6.4% in that time. This doesn't look great to us, but it is possible that the market is over-reacting to prior disappointment. It's always interesting to track share price performance over the longer term. But to understand Íslandsbanki hf better, we need to consider many other factors. For instance, we've identified 1 warning sign for Íslandsbanki hf that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Icelandic exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ICSE:ISB

Íslandsbanki hf

Provides commercial banking products and services to individuals and businesses in Iceland.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives