- India

- /

- Renewable Energy

- /

- NSEI:RTNPOWER

The 13% return this week takes RattanIndia Power's (NSE:RTNPOWER) shareholders five-year gains to 373%

While RattanIndia Power Limited (NSE:RTNPOWER) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But over five years returns have been remarkably great. In that time, the share price has soared some 373% higher! So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Since it's been a strong week for RattanIndia Power shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for RattanIndia Power

Given that RattanIndia Power didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years RattanIndia Power saw its revenue grow at 20% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 36%(per year) over the same period. It's never too late to start following a top notch stock like RattanIndia Power, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

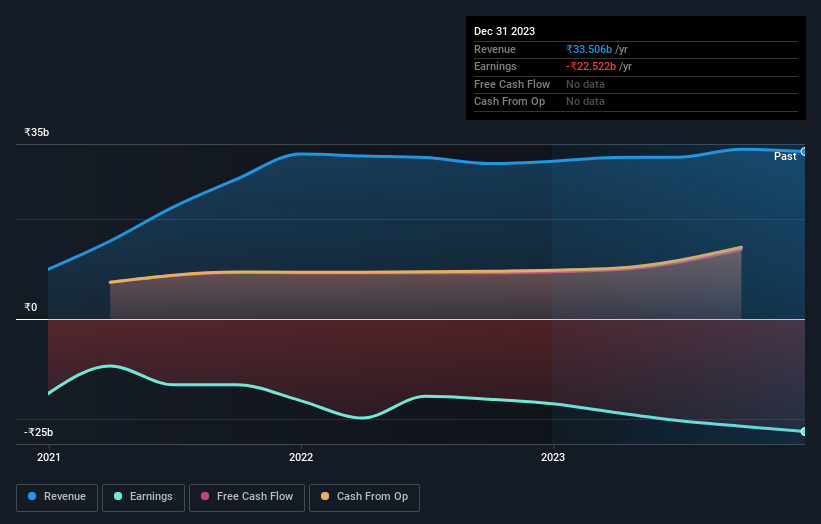

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on RattanIndia Power's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that RattanIndia Power shareholders have received a total shareholder return of 230% over the last year. That's better than the annualised return of 36% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that RattanIndia Power is showing 2 warning signs in our investment analysis , you should know about...

But note: RattanIndia Power may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade RattanIndia Power, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RTNPOWER

RattanIndia Power

Together with its subsidiary, Poena Power Development Limited, engages in power generation, distribution, trading and transmission, and other ancillary and incidental activities in India.

Good value with acceptable track record.

Market Insights

Community Narratives