- India

- /

- General Merchandise and Department Stores

- /

- NSEI:RTNINDIA

Is RattanIndia Enterprises (NSE:RTNINDIA) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies RattanIndia Enterprises Limited (NSE:RTNINDIA) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for RattanIndia Enterprises

How Much Debt Does RattanIndia Enterprises Carry?

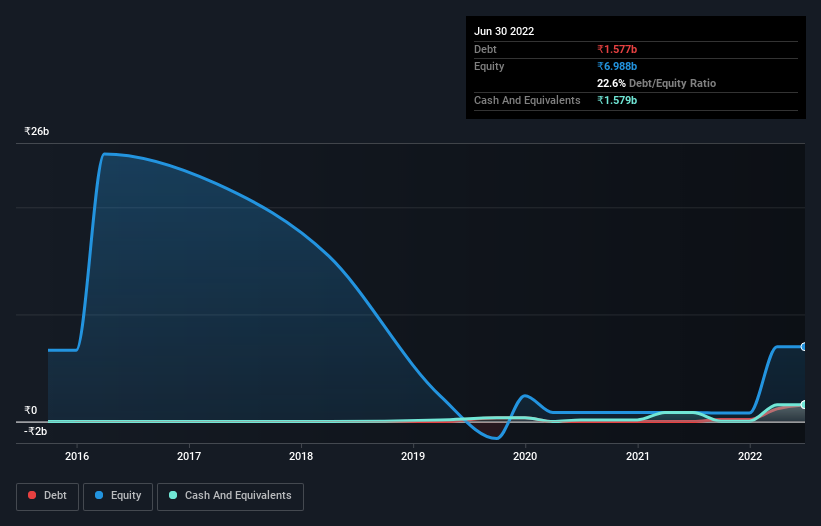

The image below, which you can click on for greater detail, shows that at March 2022 RattanIndia Enterprises had debt of ₹1.58b, up from none in one year. However, its balance sheet shows it holds ₹1.58b in cash, so it actually has ₹2.35m net cash.

How Healthy Is RattanIndia Enterprises' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that RattanIndia Enterprises had liabilities of ₹1.75b due within 12 months and liabilities of ₹346.6m due beyond that. Offsetting this, it had ₹1.58b in cash and ₹50.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹466.8m.

This state of affairs indicates that RattanIndia Enterprises' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹69.9b company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, RattanIndia Enterprises also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is RattanIndia Enterprises's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year RattanIndia Enterprises wasn't profitable at an EBIT level, but managed to grow its revenue by 63,760%, to ₹7.0b. That's virtually the hole-in-one of revenue growth!

So How Risky Is RattanIndia Enterprises?

While RattanIndia Enterprises lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of ₹3.4b. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. The good news for RattanIndia Enterprises shareholders is that its revenue growth is strong, making it easier to raise capital if need be. But that doesn't change our opinion that the stock is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with RattanIndia Enterprises , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RTNINDIA

RattanIndia Enterprises

Engages in the manpower, human resource supply and consultancy, payroll management, technology, and other related services in India.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives