- India

- /

- Electric Utilities

- /

- NSEI:RELINFRA

Reliance Infrastructure (NSE:RELINFRA) delivers shareholders splendid 29% CAGR over 3 years, surging 10% in the last week alone

It hasn't been the best quarter for Reliance Infrastructure Limited (NSE:RELINFRA) shareholders, since the share price has fallen 17% in that time. But that doesn't change the fact that the returns over the last three years have been very strong. The share price marched upwards over that time, and is now 114% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Reliance Infrastructure

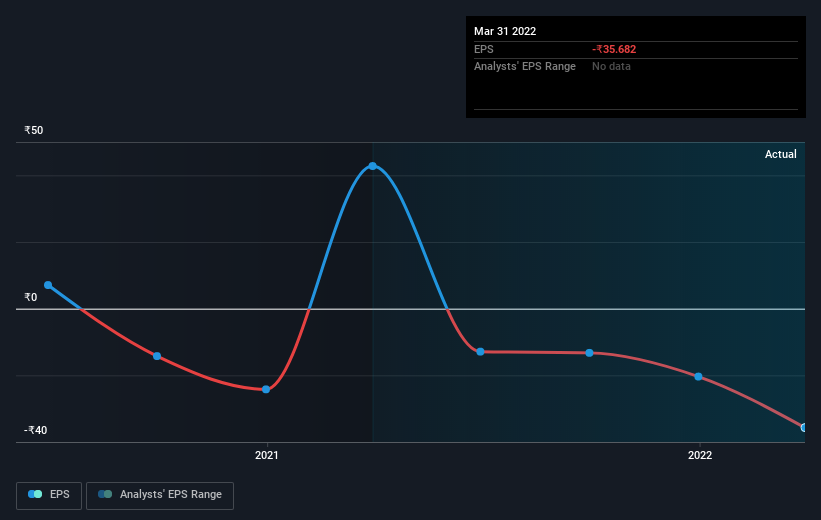

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Reliance Infrastructure moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Reliance Infrastructure's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Reliance Infrastructure shareholders have received a total shareholder return of 25% over the last year. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Reliance Infrastructure better, we need to consider many other factors. Take risks, for example - Reliance Infrastructure has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RELINFRA

Reliance Infrastructure

An infrastructure company, generates, transmits, and distributes electrical power to residential, industrial, commercial, and other consumers in India.

Good value with acceptable track record.

Market Insights

Community Narratives